- FTX crypto exchange called on Binance for help to protect its users.

- Binance agreed and signed a non-binding letter of intent to acquire the exchange.

- Previously, Binance CEO said they would liquidate their entire FTX token portfolio as a post-exit risk management strategy.

FTX crypto exchange has sought the most significant crypto market player, Binance, for help following the exchange’s liquidity crisis.

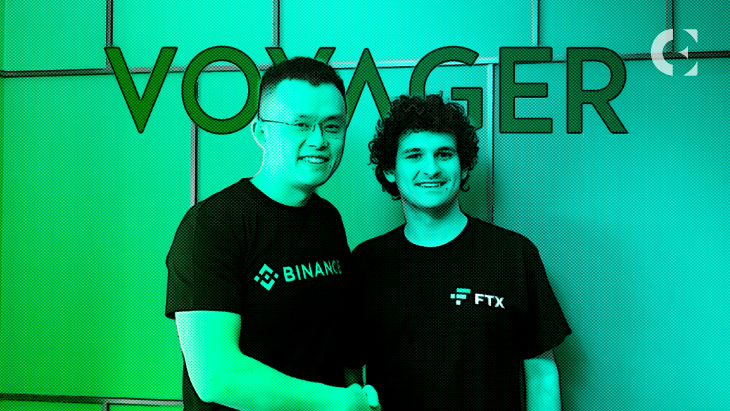

Changpeng Zhao (CZ), the CEO of Binance, posted on Twitter that his team has signed a non-binding letter of intent to acquire FTX to protect users from significant financial losses. The newly signed agreement will help FTX stand firm against its current liquidity crunch and be able to honor users’ withdrawal requests.

Earlier today, the price of FTT, the native token of FTX, plummeted significantly by over 27% as investors rushed to sell the coin over fears of FTX collapsing. Binance coin (BNB), on the other hand, has appreciated by 12% after CEO Zhao announced their intent to acquire the FTX exchange.

Yesterday, CZ announced that his company would liquidate its entire FTT token portfolio as a post-exit risk management strategy. Binance’s CEO took the financial decision after an investigative report by a news outlet revealed that FTX’s balance sheet primarily contains FTT tokens rather than independent assets like a fiat currency or other cryptocurrency.

Analysts claim that the major problem with the FTT token is that it has no use and hardly any demand. As a result, the coin can become an illiquid asset, endangering investors’ financial security akin to that of Terra LUNA.

Furthermore, after deciding to withdraw from FTX equity last year, Binance got around $2.1 billion in compensation in the form of a stablecoin and FTT rather than a stablecoin alone. The CEO of FTX, Sam Bankman-Fried, allegedly desperately needs to maintain the value of FTT inflated to continue luring outside investors with increased values.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.