- Bitcoin wavers amid key liquidation points at $44,300 and $46,250, influencing short-term market moves.

- SEC’s uncertain stance on Bitcoin ETFs triggers market volatility, leading to significant investment shifts.

- Despite a brief surge, Bitcoin struggles, with market rumors and regulatory speculation driving rapid price changes.

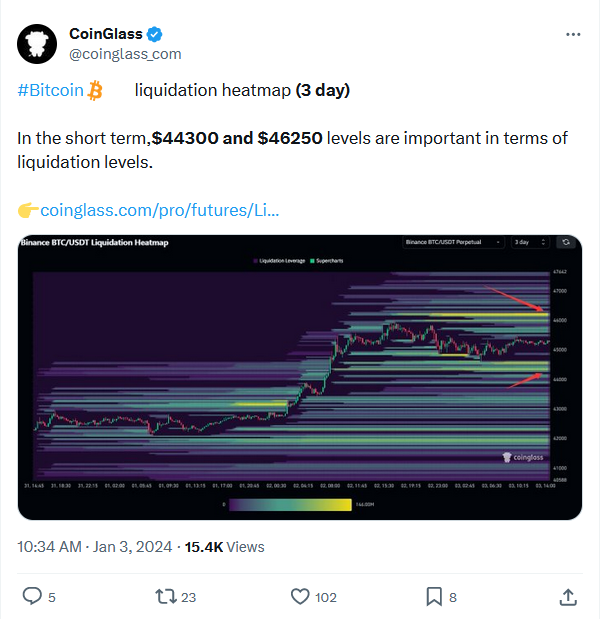

Bitcoin‘s market dynamics are in flux, with key liquidation thresholds at $44,300 and $46,250 looming large, as per a recent CoinGlass tweet. These figures represent pivotal points in the cryptocurrency’s short-term trajectory, potentially shaping its immediate financial landscape.

In a related development, speculation about the U.S. Securities and Exchange Commission’s (SEC) stance on Bitcoin exchange-traded funds (ETFs) has been rife. Financial services firm Matrixport anticipates a blanket rejection of all ETF applications this month. This skepticism aligns with recent market trends, where Bitcoin witnessed an 8% drop on Wednesday. This decline erased gains from January 1, leading to the liquidation of $500 million in derivatives exchanges.

Analyst GreeksLive on X highlights, “The market hit a stalemate as the likelihood of the ETF’s passage dwindled.” He adds that the downturn in crypto mining stocks and related U.S. equities further fueled market doubts.

Despite these challenges, Bitcoin experienced a brief surge, reaching multi-year highs above $45,900 on January 2. This short squeeze was short-lived, however. The cryptocurrency is trading at around $45,525 at press time, reflecting a mixed sentiment in the market, per CoinStats.

Last week, Reuters stirred the market with reports of a potential Bitcoin ETF approval. These expectations were tempered by Matrixport’s analysis, suggesting that the SEC’s stringent requirements might delay any approval until at least Q2 2024. Matrixport stated,

We believe all applications fall short of a critical SEC requirement

Following a peak of $45,500, Bitcoin took a sharp turn, plunging to a low of $40,550 before stabilizing at $42,525. The tumultuous market conditions saw a $2 billion reduction in open interest due to liquidations and traders scaling back on long and short positions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.