- Bitcoin’s price corrected but market participants are moving their assets into self-custody.

- BTC formed a golden cross, indicating that traders are bullish on the price action.

- Maintaining the $27,000 psychological support could propel Bitcoin to $30,000.

Since Bitcoin (BTC) rose above $28,000 for the first time since August, traders have been displaying confidence that a return to $30,000 may soon occur. However, the Bitcoin breakout only lasted a while as the cryptocurrency was back trading at $27,667 at press time.

Despite the correction, market participants are not giving up hope on the possible BTC upward trajectory, and on-chain analytic platform Santiment’s monthly report highlighted this stance. Using the social volume metric, which is a measure of the commentary about an asset, Santiment noted that the market is extremely bullish on Bitcoin.

Bitcoin Is Not Alone

The market was also bullish on altcoins including Chainlink (LINK), Aave (AAVE), and Ethereum (ETH). But there was one part about Bitcoin that made it seem like $30,000 was the next stop.

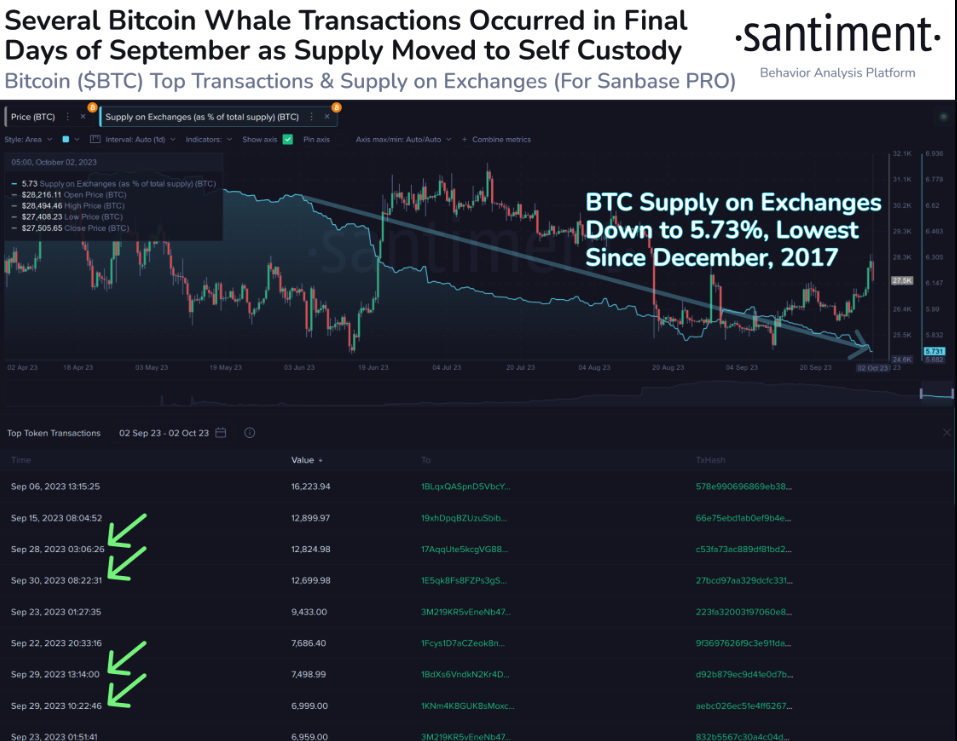

According to Santiment, Bitcoin’s supply on exchanges hit its lowest point since December 2017. This decrease is a testament to whales’ movement of their asset to self-custody. In most cases, the transfer is a sign that selling pressure may not be rampant, and Bitcoin could be ready for another upward movement.

To buttress its point, the on-chain data provider explained, “And when we look at these in contrast to the supply of Bitcoin on exchanges, we see that most of the largest token transactions contributed to coins moving more and more to self-custody. This is generally a very positive sign, and it was unsurprising that October opened with a 6-week price high.”

Retracement May Not Stop the Bulls

From the 4-hour BTC/USD chart, the drop below $28,000 was a result of profit-taking in the market. As Santiment rightly pointed out, the surge in price caused one of the highest on-chain transactions in profit in the last three months.

Therefore, BTC’s initial rise to $28,432 could be termed a short-term local top. The technical outlook also showed how buyers attempted to push up the price. But the endeavor ended with rejection at $27,680.

However, there is a chance that the retracement might only last a short period. This was because of the Exponential Moving Average (EMA) condition. At the time of writing, the 20 EMA (blue) had crossed over the 50 EMA (yellow), meaning BTC had formed a golden cross, and traders were bullish on the price action.

If the EMA holds the same stance, then it’s only a matter of time before Bitcoin reclaims $28,000. It is also possible that the coin blasts toward $30,000 if accumulation and the volume rises.

Notwithstanding, Bitcoin’s bullish sentiment remains very present despite the drawdown. If the coin is able to maintain its value above the $27,000 psychological support, then there is room for an increase. Altcoin may also benefit from the hike but traders may need to be cautious.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.