- BTC’s price has dropped 3.83% over the last 24 hours.

- The market leader has entered into a short-term bearish cycle.

- Bulls have stepped in today to rescue BTC’s price.

The crypto market leader experienced a 24-hour drop in price as the crypto market shed 3.54% of its collective market cap. According to CoinMarketCap, the price of Bitcoin (BTC) is down 3.83% over the last 24 hours. This negative 24-hour price performance has flipped BTC’s weekly performance into the red, as it now stands at -1.36%.

BTC’s price has entered into a short-term bearish cycle as the 9 EMA line has crossed below the 20 EMA line on BTC’s 4-hour chart. As a result, BTC’s price dropped to the major support level at $22,524.29. BTC’s price is now also trading below the 4-hour 9 and 20 EMA lines.

Bulls seem to be trying to elevate BTC’s price as the trading volume for the last 12-16 hours has been mainly buy volume. The RSI indicator on the 4-hour chart is also showing some early bullish signs, with the RSI line sloping positively toward the overbought territory.

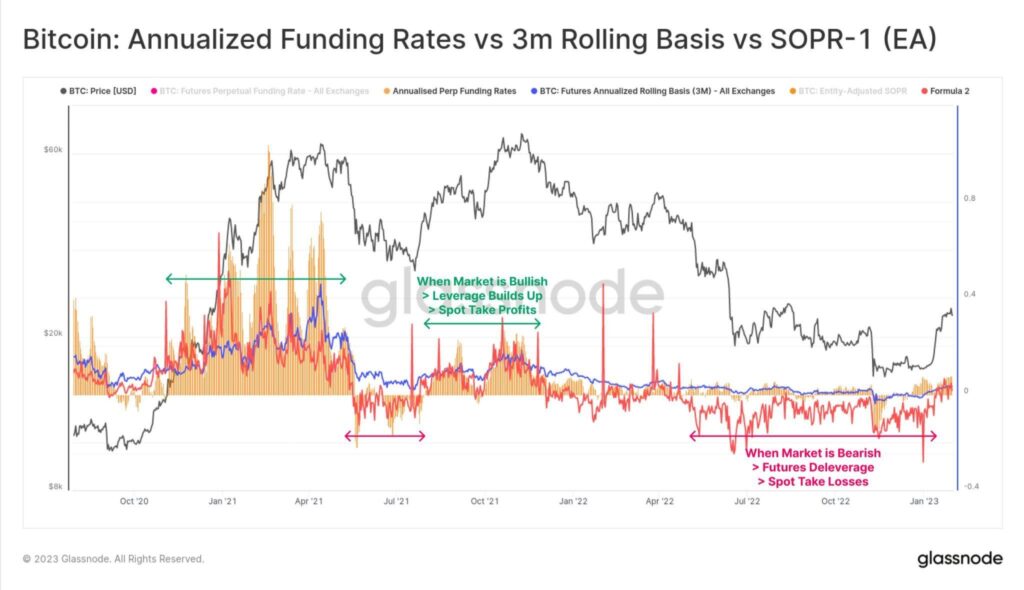

Crypto analyst _Checkmate (@_Checkmatey_) tweeted a thread regarding the relationship between Bitcoin derivatives markets and spot/on-chain. In the tweet, the Twitter user stated that the two “speak the very same language.” He also went on to state that “critics of on-chain data are just plain wrong.”

The tweet included a chart from the blockchain analysis firm, Glassnode. According to the tweet, there is an obvious visual relationship present in the chart, and that is that when futures lever-up, spot is usually realizing profits. Conversely, spot is usually realizing losses when futures de-lever.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.