- The key resistance for BTC/USD pair is currently at 19,030.09.

- BTC found support at $1,7995.20 and breaking below this level can result in a sell-off to the $18,700 level.

- Bitcoin fluctuates around $18,827.75 after a bullish run and has surged up by over 3.83%.

Bitcoin is bullish today as the market is expecting more positive news to come out on the digital currency. The BTC/USD pair is currently trading at $18,827.75 and is facing a resistance level of $19,030.09. If the bulls manage to break this resistance, we can expect a further surge in Bitcoin’s value.

The daily Bitcoin price analysis reveals that the digital currency is in a strong uptrend and looks set to continue its positive momentum. The 24-hour trading volume for the digital asset stands at $31 billion, and the total market capitalization for BTC is currently at $362 billion. The bears are trying to push the prices lower, but the $17,995.20 support level is proving to be a tough nut to crack.

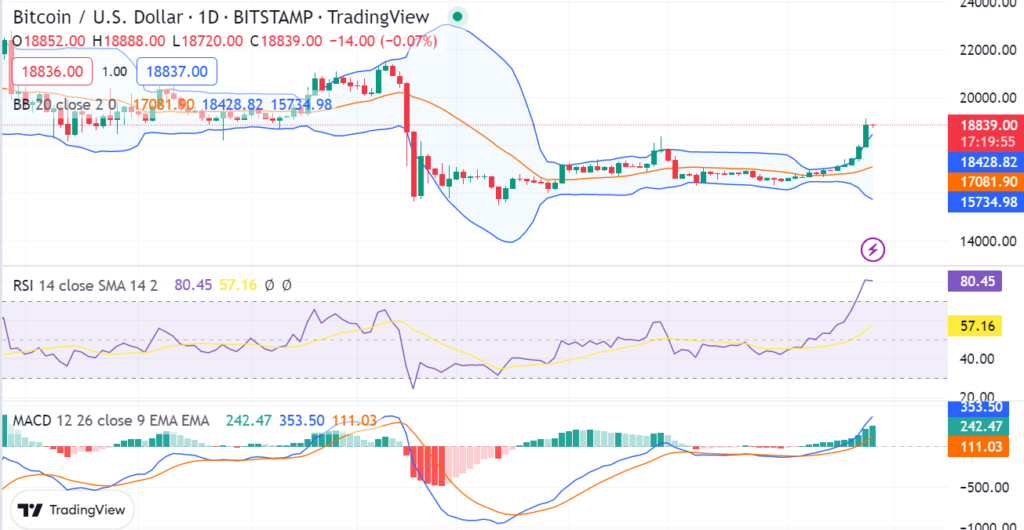

The Relative Strength Index (RSI) is currently at 80.45 indicating that the cryptocurrency is in the overbought zone. The Moving Average Convergence Divergence (MACD) indicator is also showing a bullish crossover, which could indicate that the bulls have the upper hand in the market. The Bollinger Bands are also expanding, which is indicative of increased market volatility.

The 4-hour chart for BTC/USD shows that the digital asset is trading in a range-bound pattern. The cryptocurrency market has been seeing a lot of positive momentum in the last 24 hours, with most major assets seeing significant gains, the price for the coin has increased by 3.08% in the last day.

Overall, the sentiment in the market is still bullish, and investors should look for buying opportunities if the prices move higher. With more positive news coming out on the digital currency, we could see a further surge in the value of the Bitcoin.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.