- 50,000 BTC sold by whales, sparking market reaction and impacting Bitcoin’s value.

- Bitcoin’s price remains stable despite the sell-off, with mixed market indicators: neutral RSI and bullish MACD.

- Bitcoin’s future growth may hinge on SEC’s ETF decision and user adoption, with historical patterns showing seasonal trends.

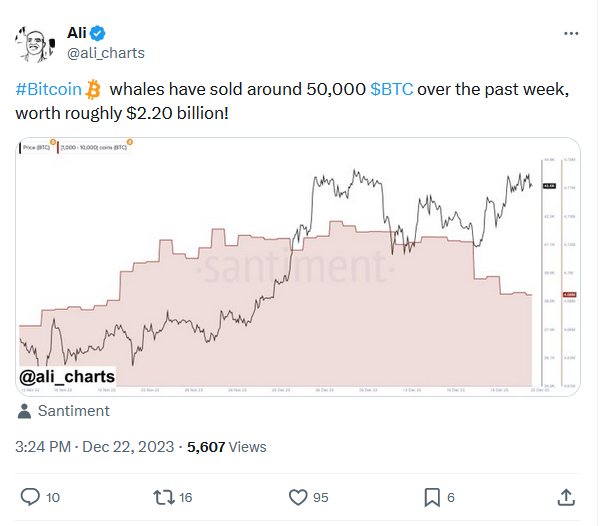

In a notable development in the cryptocurrency market, Bitcoin whales have reportedly sold about 50,000 BTC in the past week, a transaction valued at approximately $2.20 billion. This movement, as reported by Ali on X (formerly known as Twitter), marks a significant shift in the holdings of major Bitcoin investors.

At press time, Bitcoin traded at $43,579.89, with a 24-hour trading volume of $24,473,483,047. Despite a slight decrease of 0.32% in the last 24 hours, the cryptocurrency maintains its position at the top of CoinMarketCap’s ranking, boasting a live market cap of $853,174,469,414.

Bitcoin recently surpassed the milestone of 50 million non-zero-balance addresses, a clear indicator of its growing user adoption. Furthermore, the average holding per Bitcoin user is now around $16,000, indicating a substantial implication for future price performance. This landmark achievement reflects increased users and underscores the growing acceptance of Bitcoin as a legitimate asset class.

Analyzing the market indicators, the Relative Strength Index (RSI) is currently near a neutral point at 57.28. In contrast, the Moving Average Convergence Divergence (MACD) presents a more bullish momentum, with the MACD line crossing above the signal line and the histogram shifting from negative to positive values, suggesting an increase in upward momentum.

Moreover, research conducted by Matrixport projects that Bitcoin’s price might surpass the $50,000 mark by January 2024, contingent on the U.S. Securities and Exchange Commission (SEC) approving spot Bitcoin ETFs. The firm assigns a 95% probability to the SEC’s approval of these ETFs in January 2024.

Historical data supports this projection, as seen in the significant price increase following the launch of Bitcoin Futures by the CME Group in 2017. Furthermore, Matrixport anticipates a potential price breakout for Bitcoin during Christmas, historically a period of modest gains for the cryptocurrency.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.