- BitMEX founder Arthur Hayes speaks of the ETH Merge and its price.

- He specifies that there is a reflexive relation between ETH Merge and search trend.

- Also, he indicates that the Merge is not affected by ETH price.

Arthur Hayes, founder and former CEO of BitMEX, shared his opinions regarding Ethereum price in the wake of the soon-to-be-launched Merge. Hayes opined that crypto traders should look for ETH trading in the dip and not reduce their position heading into or right after the merge.

The fintech pioneer threw a slew of opinions about ETH merge and the coin price after he extracted some crypto market-related pitches from the book “Alchemy of Finance” by George Soros.

In the BitMEX blog post, he opined that whether or not the ETH Merge happens, this is the future event for trading. And as the Merge itself is unaffected by the ETH price, its success or failure is based on the skills of the core developers.

Hayes relates the “theory of reflexivity” that is mentioned in Soros’ book and said:

The basic idea is that market participants’ perception of a given market situation will influence and shape how that situation plays out. The expectations of market participants influence market facts (or so-called “fundamentals”), which, in turn, shape participants’ expectations, and so on and so forth.

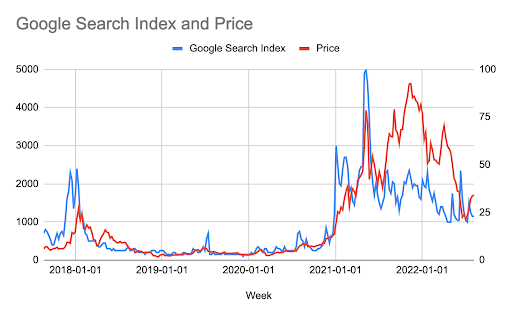

With that said, the crypto leader pointed out a chart of Google search trends for ETH and the price of ETH and signaled that they are closely correlated. Evidently, Hayes indicates that mindshare (awareness) and the price of ETH have a reflexive relationship.

Furthermore, he added that if the merge is successful, there will be a positive reflexive relationship between the price and the amount of currency deflation. This is because traders may buy ETH now, acknowledging that its price would go higher due to increased usage on the network and currency deflation.

More importantly, Hayes specifically tells the traders who believe ETH would become a deflationary currency, that they must also believe the network usage will be high enough to “nullify the amount of the coin emitted by every block” as a reward for validators.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.