- BNB futures spiked to a five-month high despite a price dip, hinting at a market reversal.

- Resilient BNB rebounded from a 90-day low and sparked renewed interest.

- The increased trading volume has fueled optimism for BNB’s future.

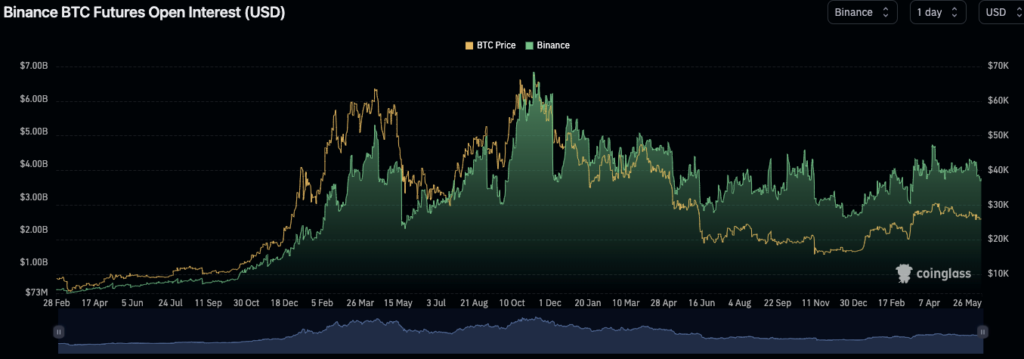

Earlier today, Binance’s (BNB) token witnessed an unexpected twist in its financial saga. Despite a drop in its price, the open interest in its futures soared to a five-month high. This rise in open interest, the tally of active and unsettled futures contracts, was tracked by Coinglass, revealing a staggering increase of 27% within a week and an 8% rise in the past day alone.

Binance’s native token, BNB, took a significant hit early on Monday, with its market price plummeting to $221. This near mirrors the token’s low point on July 13, 2022, marking a steep 25% decline since the U.S. SEC announced a lawsuit against Binance on June 5, 2023.

Yet, amid the downward spiral, BNB managed to bounce back from a 90-day low of $222.07 after falling from a 24-hour high of $238.49. The market saw the bulls take control as the token found support at this level and rebounded to $236.74 at the time of writing. This swift recovery echoes the resilience of BNB in the face of strong bearish sentiment.

The market capitalization of BNB dipped by 0.38% to $36,795,635,711. Meanwhile, the 24-hour trading volume surged significantly by 78.87% to $847,447,451, pointing to a renewed interest from investors. This upsurge in trading volume may indicate that many see the recent dip as an opportune moment to invest, especially those with a long-term belief in Binance and its ecosystem.

BNB/USD Technical Analysis

The Relative Strength Index rating of 37.89 and upward pointing indicate that the market is now in a modest uptrend.

This movement shows that the negative momentum in BNB is fading and that a reversal is possible shortly.

Adding to the optimistic outlook, the Chaikin Money Flow (CMF) has begun to rise, attempting to enter the positive sector with a reading of -0.20. This movement indicates that purchasing pressure is building, which might change the market mood.

In conclusion, despite a recent price drop, BNB’s futures open interest surged to a five-month high, signaling increased investor interest and a potential reversal in the market’s sentiment.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.