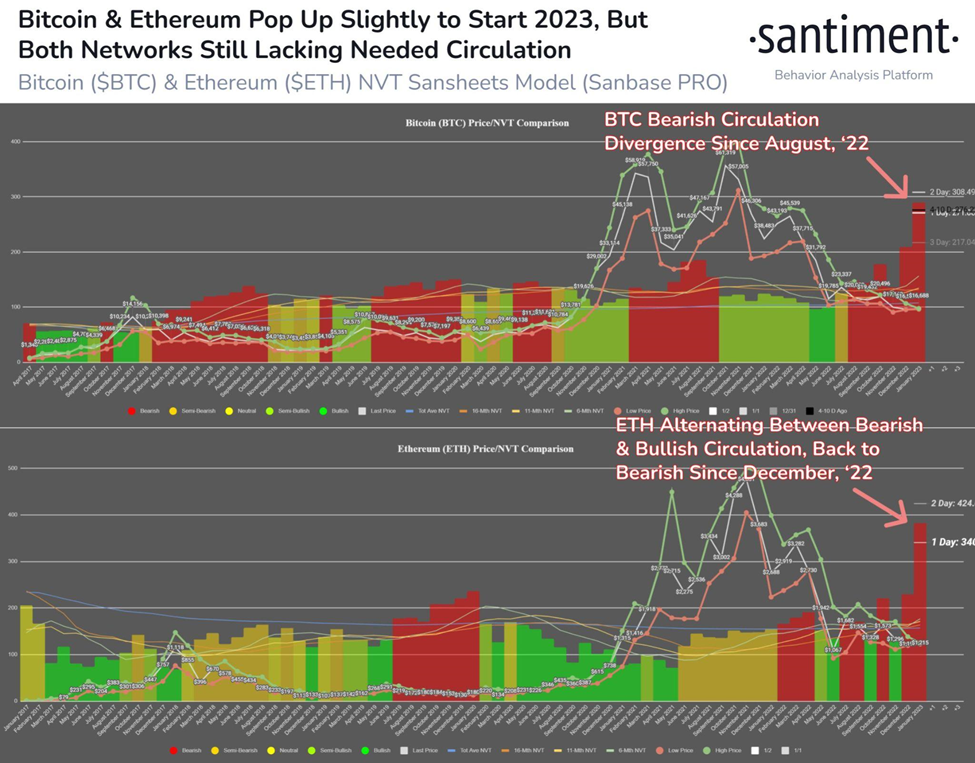

- Santiment tweeted today that the market caps of BTC and ETH are too high given their utility levels.

- The data showed that BTC had a bearish circulation divergence since August last year.

- BTC’s price has broken above the 9-day EMA line.

The blockchain analysis firm, Santiment, posted a tweet today regarding the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH). According to the tweet, Santiment Feed’s NVT price prediction model showed that the two market leaders required some increased network utility to justify their current market caps.

The tweet concluded that the circulation of both networks needs to pick up in 2023 and that this week will be telling, as the new year kicks off and the holidays end.

The snapshot shared in Santiment’s tweet shows that BTC has had a bearish circulation divergence since August last year. Meanwhile, ETH has been alternating between bearish and bullish circulation since December 2022.

CoinMarketCap shows that the prices of both ETH and BTC have risen over the last 24 hours. At press time, the price of BTC is trading at $16,710.46 following a 0.39% rise, while ETH is trading at $1,216.47 after its price rose 1.20%.

BTC’s market cap is now estimated to be $321,721,819,987, and ETH’s market cap stands at approximately $148,876,533,160 at press time.

BTC’s price has broken above the 9-day EMA, but is now being held down by the 20-day EMA line. The daily RSI suggests that BTC’s price will break above this level as well as the RSI line is sloped positively towards the overbought territory and the RSI line is positioned above the RSI SMA line.

This bullish thesis will be confirmed if the 9-day EMA line crosses above the 10-day EMA line within the next 48 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.