- According to Swiss investment adviser 21e6 Capital, 97 of 700 global crypto funds closed in 2023.

- Bitcoin outperformed crypto funds as part of a significant January gain, followed by a March surge.

- Directional funds struggled with uncertain markets, operational hurdles, and FTX collapse recovery.

The crypto winter, while still in recovery, has hit the industry hard, which is reflected in Swiss investment adviser 21e6 Capital AG’s latest report. According to the blog, Of the over 700 cryptocurrency funds present globally, 97 have shut down within the current year.

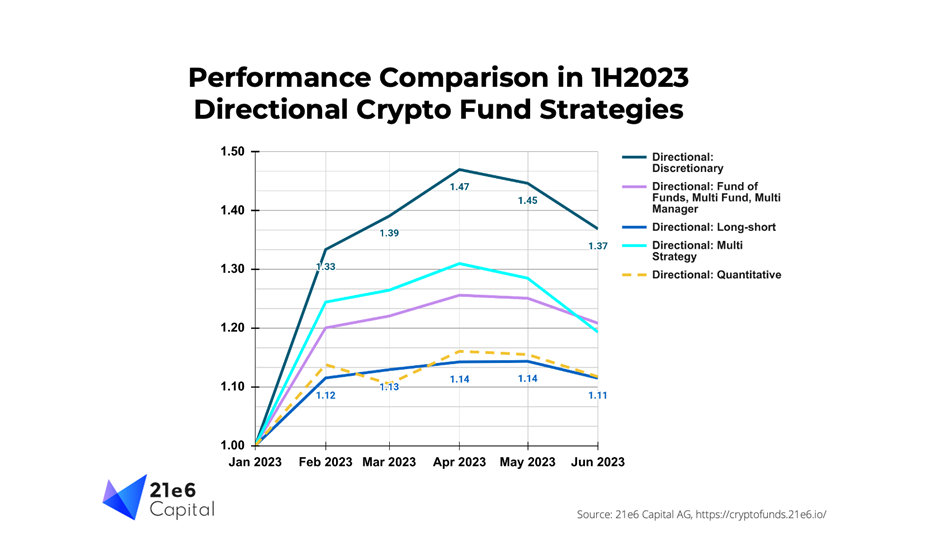

According to data from bitcoinmonthlyreturn.com, Bitcoin saw an impressive gain of around 40%, nearly twice the performance of crypto funds, in January. While funds showed approximately similar results to Bitcoin in February (0% change), they failed to capitalize on the upward movement in March, with Bitcoin surging by 23%, while directional crypto funds only managed a 4% increase.

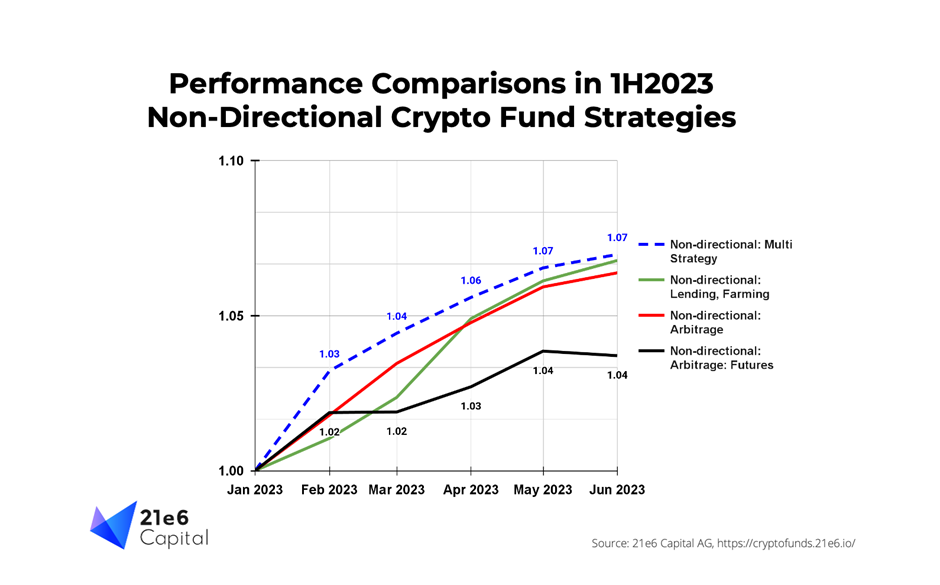

21e6 Capital acknowledged that this trend occurred due to the prevailing positive trajectory of the crypto market until the end of June, with regulatory uncertainties impacting various funds’ operational pace while discretionary crypto funds remained relatively unaffected.

The company noted directional crypto funds underperformed Bitcoin in 2023 because they were in “defensive mode after the devastating events of 2022, most notably FTX.” In fact, a number of funds 21e6 Capital communicated with disclosed an increased allocation to cash holdings.

Meanwhile, the investment adviser attributed the underperformance of quantitative funds to unstable momentum in “choppy” markets led to inaccurate signals for trading algorithms employed by systematic crypto quant funds.

Additionally, a challenging landscape, marked by regulatory uncertainty, the quest for secure exchanges, and the loss of banking partnerships at the year’s outset, posed significant obstacles for these funds.

The report adds that a straightforward buy-and-hold approach with Bitcoin would have surpassed the performance of all the fund assortments. By the midpoint of the year, Bitcoin had accrued approximately 80% in value. Expert crypto trader Alex Kruger when asked if it is better to trade Bitcoin or hold it, he answered,

Both – trading dominates mental space due to its higher frequency.

Lastly, the report underscored a slight improvement in investor sentiment during the first half of 2023, hinting at the possibility of certain funds increasing their investments in the crypto sector.

Nevertheless, the report did mention that the existing data concerning capital inflows and outflows indicate that a complete rebound in sentiment has yet to be achieved.

At present, BTC is trading at approximately $29,000, and it is facing challenges in maintaining a position above the $30,000 threshold, which has only been transiently surpassed a few times in 2023. Nonetheless, the current prices signify a remarkable 75% increase in the asset’s value since the beginning of the year, as per data from CoinGecko.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.