- Bitcoin re-enters the $50K level for the first time after losing it in 2021.

- Analysts have spotted bearish signals amid the market’s bullish frenzy.

- BTC’s current price is reportedly not an ideal entry, targeting $45,500.

In the last 24 hours, Bitcoin (BTC) hit a significant milestone for the crypto market, reclaiming the $50,000 mark. This return to the $50K level marks the first instance of BTC re-entering the range after losing it in 2021.

Moreover, the surge represents a noteworthy recovery from its recent low point of approximately $38,700 recorded last month. Expectedly, Bitcoin’s trajectory has bolstered the broader crypto market, with other prominent projects like Solana (SOL) and Ethereum (ETH) registering notable 9.4% and 7.62% weekly gains at press time, respectively.

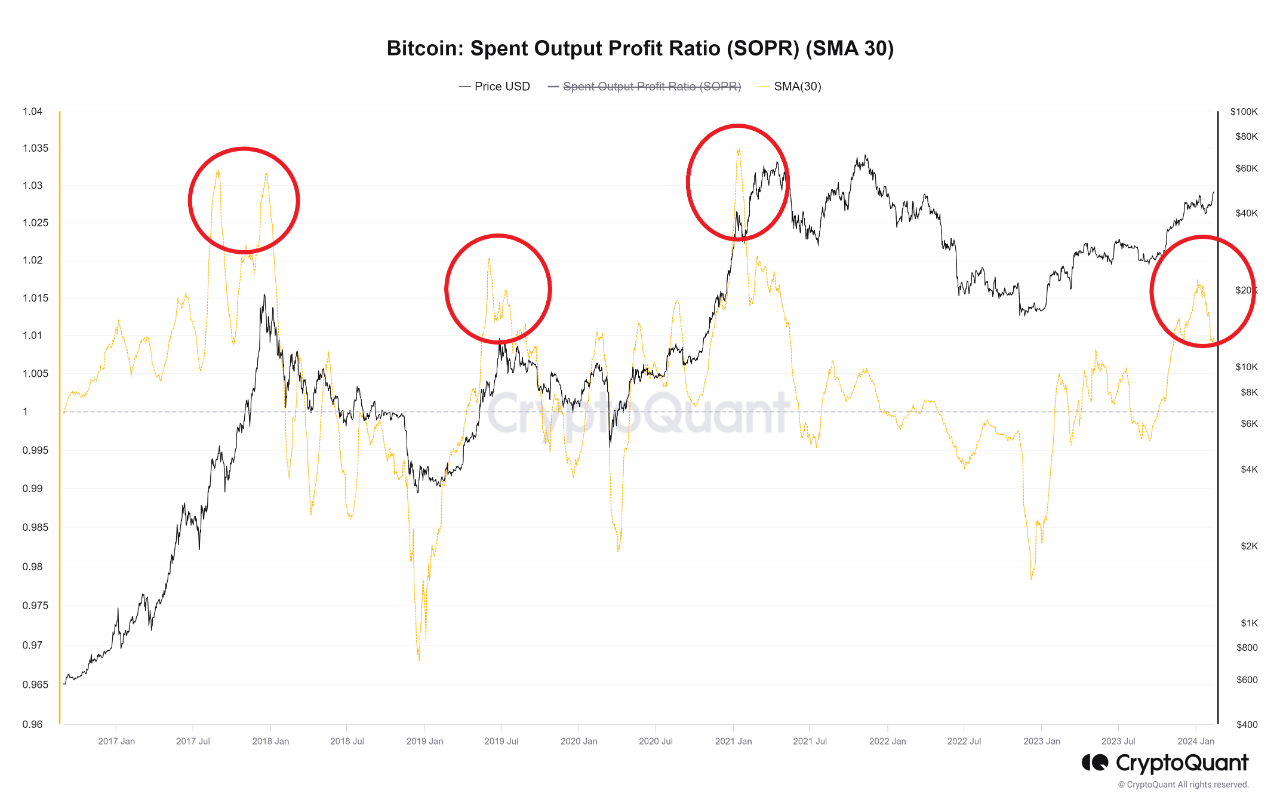

Meanwhile, analysts have spotted bearish signals amid the Bitcoin-led bullish frenzy rocking the market. Woominkyu, a verified author and community manager at the on-chain analytics platform CryptoQuant, recently highlighted the potential direction of the market.

Woominkyu pointed out that the Spend Output Profit Ratio (SOPR) on the 30-day moving average for Bitcoin is above one. Per the disclosure, the metric indicates that BTC holders are predominantly profitable.

According to the analyst, these holders, dubbed “Smart Money,” are not overlooking recent gains. Specifically, Woominkyu argued that the SOPR metric suggests these BTC holders are opting to realize their gains by selling, essentially taking profits.

Furthermore, the analyst argued that, based on historical data, the current position of Bitcoin is not an optimal entry point. Woominkyu stated that suspicion exists concerning an impending price correction “any moment” from BTC’s current price point, given the high probability indicated by the SOPR ratio.

As a result, the analyst urged monitoring for a decline in the SOPR ratio. He suggested a decline below one would signal a transition to FOMO-driven purchases, followed by subsequent sales at a loss. Woominkyu believes an opportunity to enter the market would emerge at that point.

While Woominkyu failed to mention how low Bitcoin could reach should a correction occur, another analyst has issued a target of $45,500. At press time, Bitcoin trades at $49,981, with a 16.65% gain over the past week.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.