- Crypto analyst tweeted that BTC was attempting to break out after several rejections.

- BTC loses momentum gained during the beginning of 2023 as bulls settle in.

- If Bollinger bands widen like in June 2023, BTC could spike.

Crypto Analyst Captain Faibik tweeted that BTC was once again attempting to break out from the rising triangle pattern after multiple unsuccessful attempts. The analyst further stated that in the event of BTC breakouts, then, there could be a spike of 15-20% in price. However, if this is yet another rejection, BTC’s support would be $25.6K.

When looking at the 1-month chart for BTC, it could be noted that it was trading at $26.5K, when the markets opened for trading. The bulls have been successful in keeping the prices above the opening market price, though at times BTC fell below the opening market price.

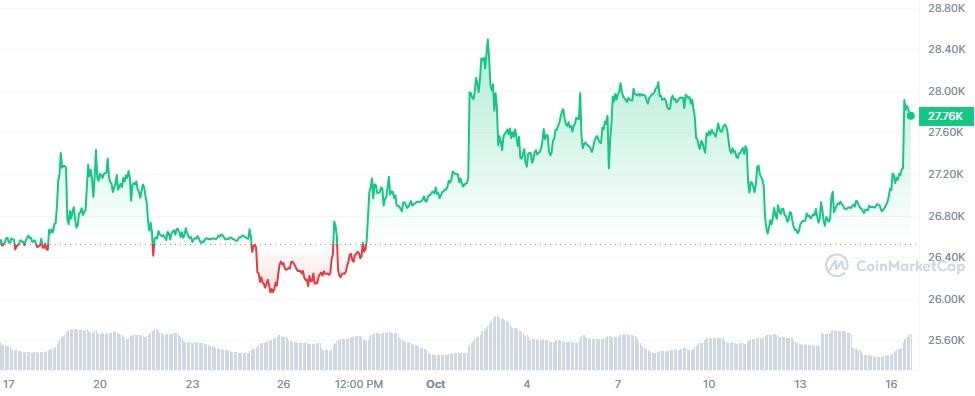

BTC printed its highest price of $28,494 on October 2 and its lowest price of $26,064 on September 25. Currently, BTC is trading at $27,725 after increasing by 4.4% during the month.

When considering the chart above, it can be seen that BTC was gaining value with a higher gradient from the beginning of 2023 until mid-August. After the midweek of August, BTC lost momentum and currently, it is gaining value along a lesser gradient. This shows that the sellers have taken some part of the market and are influencing the price increment.

If BTC keeps this momentum increasing, it could reach $30,000, and with more momentum from the bulls, it could even touch $31,500. However, BTC may test the $25,300 support level, if there is retracement.

Moreover, if BTC reciprocates its behavior in June 2023, there is a high chance that the Bollinger bands could widen and the above-stated resistance level could be achieved.

The RSI currently reads a value of 59 and it is rising above. Hence, if more and more buyers keep entering the market, the RSI could move into the overbought region. In contrast, if BTC’s current uptrend is not supported by volume, then, it may crash to $19,000, which is a stronghold for the bears.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.