- Stockmoney Lizards tweeted that BTC is in a bullish position in its current market cycle.

- BTC is currently trading at $16,591 according to CoinMarketCap.

- The market leader’s daily trading volume has also dipped 4.9% over the last 24 hours.

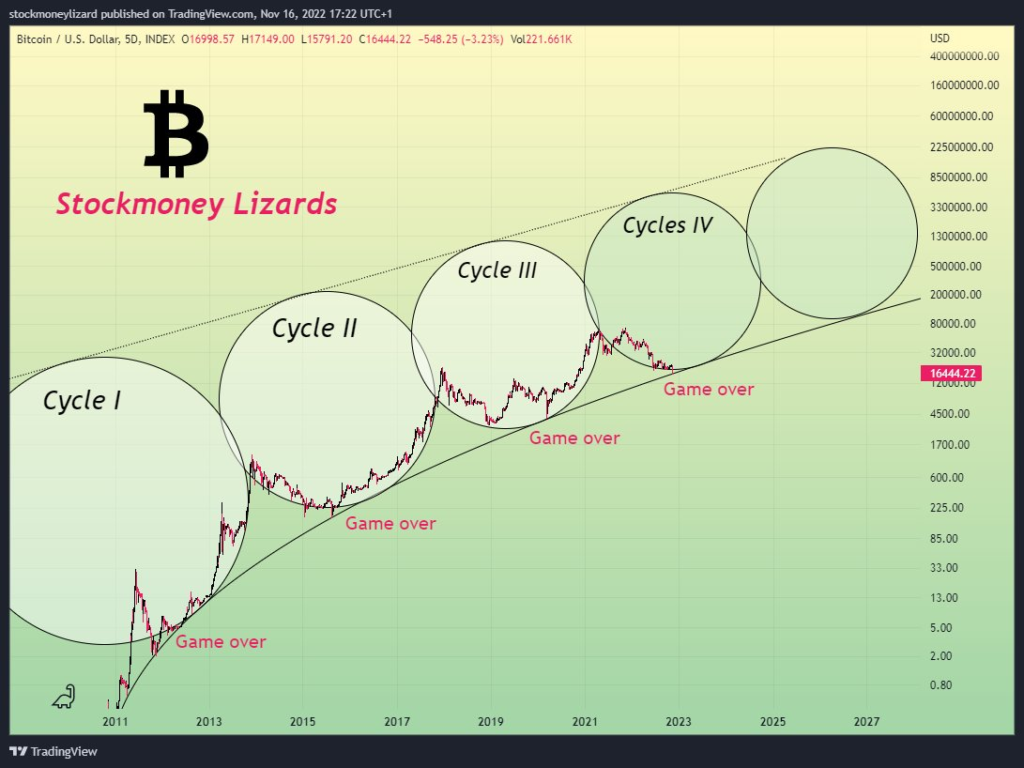

A tweet made by the Twitter user, Stockmoney Lizards (StockmoneyL), yesterday morning shows that the market leader is at a point in its market cycle that has historically led to a bull run.

As can be seen from the chart above, BTC is currently at a point in its 4th cycle that historically has been an onramp into a bull market. Of course, being a 5-day chart, this does not necessarily suggest that the bull market will happen any time soon.

A strong bull run may be on the cards for BTC if it breaks out of its current cycle as depicted on the chart. Should this happen, BTC’s price will most likely enter into a positively sloped price channel with a gradual slope. The only reason that BTC will not enter into a more steep price channel is that the global financial markets are in a recession presently.

On the other hand, if BTC does not break out of its current cycle, it will consolidate at its current level, which is between $16,200 and $17,500 until the next bull run.

Currently, BTC’s price stands at $16,591, according to the crypto market tracking website CoinMarketCap. This is after its price dropped 1.26% over the last 24 hours and 0.94% over the last 7 days.

BTC’s trading volume has also dipped over the last day. At press time, the total 24-hour trading volume stands at $32,640,382,107 – a 4.91% drop over the last 24 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.