- STX outperformed other assets in the top 50 except for BCH following the Grayscale announcement.

- STX hit an overbought point but still has a better performance than BTC.

- If the MFI reaches 80, then STX may plunge, and the target could be between $0.44 and $0.47.

After Grayscale’s partial win over the U.S. SEC, with regard to the Bitcoin (BTC) ETF application, the price of Stacks (STX) surged. According to CoinMarketCap, STX performed much better than other coins in the top 50, except for Bitcoin Cash (BCH).

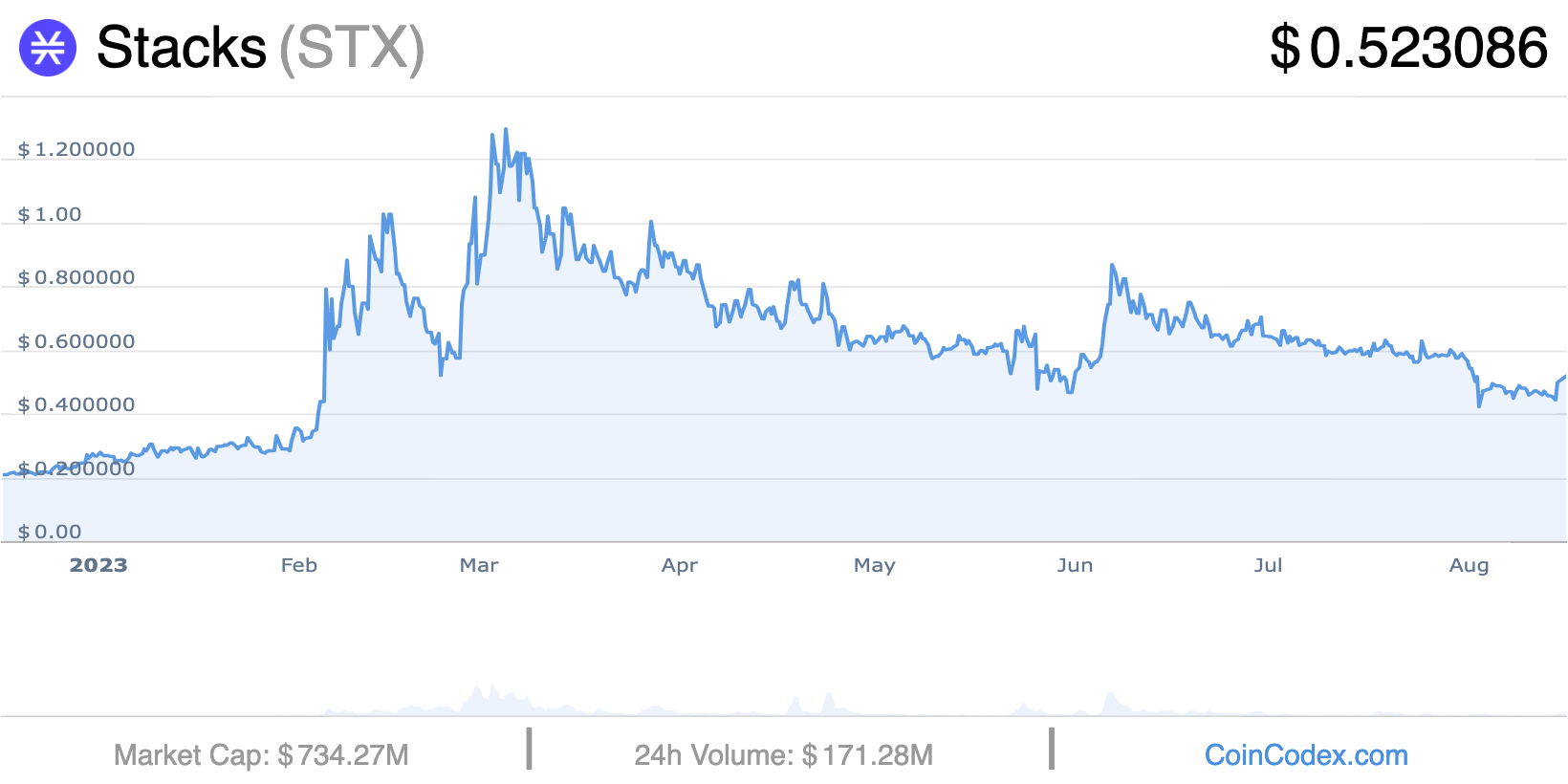

At press time, STX’s value is $0.52— an 8.28% hike in the last seven days. Although Stacks enjoys a surge in price when Bitcoin has a positive outlook, it also has its own fundamentals backing it.

STX and BTC: One of a Kind

For the unfamiliar, Stacks is Bitcoin Layer Two (L2) for smart contracts. As an L2, Stacks enables settlement and faster transactions on the Bitcoin blockchain using the Proof-of-Transfer consensus mechanism.

Proof of Transfer regulates the interaction between two actors in Stacks, namely the miners and stackers. For miners, on the Stack network, their function is to lock Bitcoin in a smart contract to participate in validating Stacks transactions and, in turn, get rewarded in STX.

On the other hand, Stackers hold STX tokens and temporarily lock their tokens in the network in exchange for the BTC locked by miners as rewards

This year, STX has not had only the backing of Bitcoin. However, the introduction of Bitcoin Ordinals and its adoption also ensured that the token gained more traction. On a Year-To-Date (YTD) basis, STX has increased by 143% against the U.S. Dollar (USD), and it’s also up 47.68% against BTC.

Stacking for the Future

At the time of writing, STX’s volatility was at a very extreme level, the Bollinger Bands (BB) indicated. Also, after the price hike during the week, STX hit the upper band of the BB, which means it was overbought.

As a result, the price dropped from $0.54 to $0.52. With the increasing volatility, it is likely that STX trades in a wider range in the short term. If selling pressure overtakes demand, STX may fall between $0.44 and $0.47.

However, if buying momentum outweighs sell-offs, the price may reach as high as $0.56. According to indications from the Money Flow Index (MFI), STX currently has a good buying momentum at 77.31.

Typically, an MFI reading above 80 is considered overbought. But when the MFI is 20 or below, it is considered oversold. To avoid a significant plunge, STX may need to avoid touching the overbought level threshold.

Although STX may not rally anytime soon, it has the tendency to follow in Bitcoin’s direction whenever BTC’s price increases. In the long term, STX may possibly beat its All-Time High (ATH) if Bitcoin does the same.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.