- FUD caused XRP to lose about 3.78% of its value but it has held on tight to $0.48.

- Bulls have not been able to take full control but XRP may rise above $0.50 soon.

- With increasing volatility, traders are optimistic about the XRP price action.

Since its impressive run to $0.88, Ripple (XRP) has been hovering between $0.45 and the psychological $0.5 zone. One reason for this is the tightening liquidity, caused by the Fear, Uncertainty, and Doubt (FUD) currently in the market.

Another ground for XRP’s consolidation and decline could be the unpredictability around Ripple’s lawsuit with the U.S. SEC. XRP has lost 3.78% of its value in the last seven days. However, the token ranked as the sixth most valuable asset in terms of market cap, and was able to hold on to $0.48 at press time.

Indicators Join Hands to Boost XRP

According to the XRP/USD 4-hour chart, bulls were able to push XRP upwards to $0.46 on September 11. While the market is not yet out of bears’ reach, hitting the $0.48 ceiling has served as a massive boost for XRP.

Furthermore, the Relative Strength Index (RSI) has also exited the 18.11 point it was on September 11. At the time of writing, the RSI was 44.93. The increase is a sign of a significant rise in buying pressure.

If the RSI continues to rise and probably crosses the 50.00 mid-point, then XRP could have a chance at moving above the $0.50 psychological level. But to achieve this, bulls must ensure that bears do not neutralize their presence in the market.

Another positive outlook XRP enthusiasts can look to is the Bollinger Bands (BB). For a while, XRP’s volatility was very low as the bands contracted. However, as of this writing, the BB indicated a high level of volatility.

This means that there could be significant price fluctuations either to the upside or downside. If XRP’s buyers outweigh sellers consistently, then, a push in the direction of $0.60 should not be written off.

Traders’ Target Is Lower than $0.60

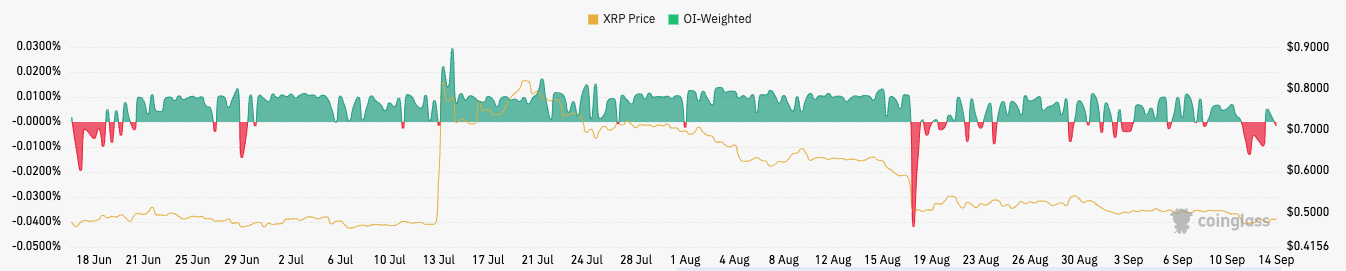

Meanwhile, traders seemed to have changed their sentiment towards the token, as indicated by the funding rate. According to Coinglass, XRP’s funding rate had moved into the positive region. For context, funding rates are payments made between longs and shorts to keep their contracts open.

A negative funding rate suggests that traders are bearish on the price action. Conversely, a positive funding rate means traders are bullish on the price action. But from Coinglass’ data, traders’ target of the next XRP price is well below $0.60

In conclusion, XRP’s next direction could well depend on market sentiment, and buying or selling pressure. However, traders should not ignore the external factors like developments surrounding Ripple’s case with the SEC. Currently, XRP has a chance of rising above $0.50.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.