- Charles Hoskinson rebuffs an interview with BitBoy Crypto amid the dispute.

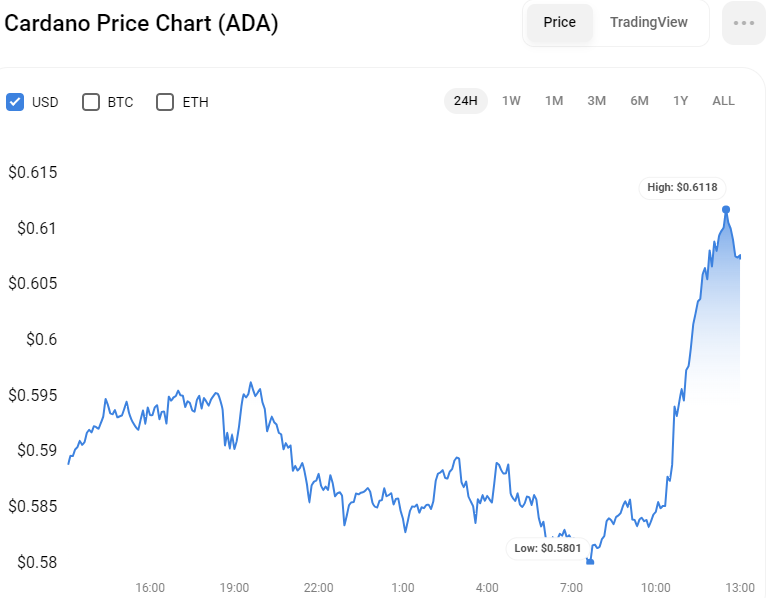

- ADA shows bullish momentum, trading between $0.6118 and $0.5801.

- Technical analysis suggests a potential bullish continuation for ADA.

In a recent turn of events, Cardano founder Charles Hoskinson declined an interview invitation from crypto influencer Ben Armstrong following a contentious dispute.

Armstrong, also known as BitBoy Crypto, sparked controversy by claiming “ADA is dead” in a video, raising concerns about Cardano’s progress relative to other blockchain projects. Hoskinson’s rebuttal came swiftly on social media platform X (formerly Twitter), expressing disappointment in Armstrong’s negative stance but wishing him well.

The clash between Hoskinson and Armstrong ignited after Armstrong’s video critique, prompting an exchange of viewpoints on social media. Despite Armstrong’s attempt to reconcile by highlighting “some good points” made in the video and extending an olive branch for an interview, Hoskinson remained firm.

He stated that engaging in dialogue with someone who believes ADA will fail serves no purpose, effectively closing the door on any potential debate on the matter.

ADA Shows Strength with Over 3% Increase in Value

In the last 24 hours, the Cardano token (ADA) has demonstrated bullish momentum, trading within a price range of $0.6118 and $0.5801. According to the latest data from CoinStats, ADA opened the day at $0.5894. Later, it briefly dipped to its intraday low of $0.5801, which currently serves as the immediate support level.

However, ADA bulls quickly took control, pushing the price to an intraday high of $0.6118, now acting as its immediate resistance level. Despite this positive 24-hour performance, it’s worth noting that ADA has seen a weekly decline of 3.52%, adding a complex layer to its market dynamics.

As of press time, ADA is trading at $0.6082, marking a 3.18% increase within the last day. This upward movement has also been reflected in its market capitalization, which has grown by 3.15% to reach $21,649,444,692, securing ADA’s position as the 9th largest crypto by market cap. Notably, its trading volume has surged by 52.27% to $393,834,250, with a Volume/Market Cap (24h) ratio of 1.78%, indicating heightened trading activity around ADA.

The Critical Bulls Target Zone: ADA’s Next Move

Turning to the technical analysis, the one-day chart for ADA/USD reveals a promising uptrend, supported by its bounce off the previous support level of $0.58. This momentum is directing ADA toward a critical ‘bulls target’ zone. A successful breach of this zone could signal a robust upward trajectory toward a key resistance level at $0.67, potentially catalyzing further gains. Conversely, should ADA falter at this ‘bulls target,’ it might consolidate or slightly pull back, offering traders an opportunity to enter the market at a more attractive price.

The Moving Average Convergence Divergence (MACD) indicator suggests an impending bullish breakout, with the MACD line (-0.020 in the negative region) trending upwards toward the signal line. This movement indicates a weakening bearish grip and a potential shift in market dominance to the bulls. The histogram’s movement towards the zero line further corroborates this potential bullish reversal, hinting at a long-term uptrend for ADA.

Additionally, the Stochastic Relative Strength Index (RSI) stands at 43.28, implying that ADA is neither in overbought nor oversold territory. Originating from an oversold region, this indicator suggests a strengthening bullish sentiment that could propel ADA’s price further in the near term. A decisive break above the ‘bulls target’ could affirm this uptrend.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.