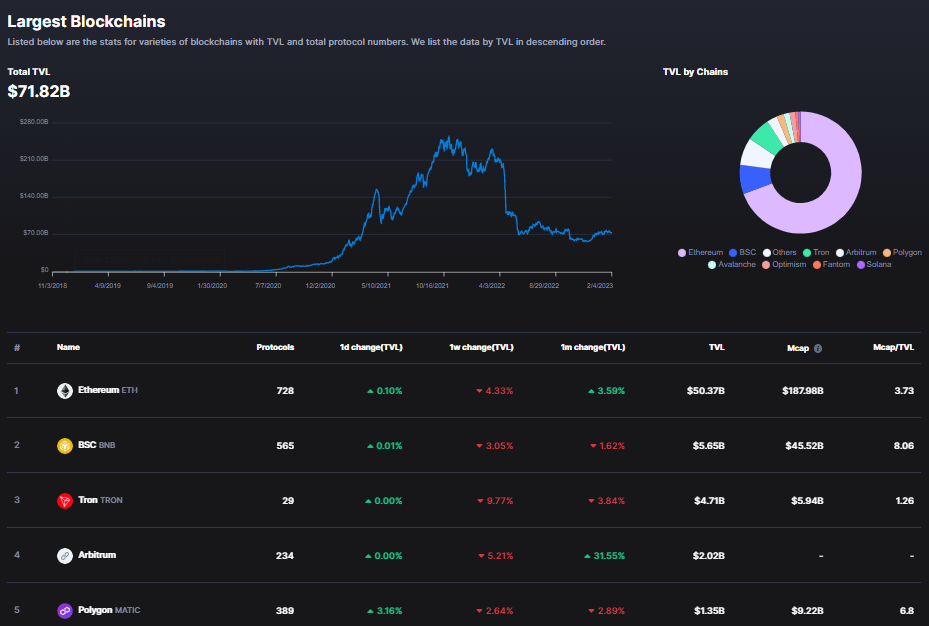

- CoinMarketCap has categorized the top five blockchains by total value locked (TVL).

- The total TVL of the largest blockchains currently stands ta $71.82 billion.

- Ethereum stands at the top, followed by BSC, Tron, Arbitrum, and Polygon.

CoinMarketCap categorizes the largest blockchains on the basis of total value locked (TVL) and total protocol numbers. CMC has also listed various figures for these blockchains. At press time, the total value locked of all the blockchains was $71.82 billion.

First on the list is Ethereum, which has a total of 728 protocols. Ethereum has a TVL of $50.37 billion with a market cap of $187.98 billion. The Mcap/TVL value of Ethereum is 3.73, and there has been a 0.1% spike in the TVL in the last 24 hours. The TVL has also spiked by 3.59% in the last month.

BSC (BNB) is second on the list with a TVL of $5.65 billion. BNB has a market cap of $45.52 billion, and Mcap/TVL stands at 8.06. The number of protocols on the BSC chain is currently 565.

Third on the list is TRON, with 29 protocols at press time. TRON has a TVL of $4.71 billion and a market cap of $5.94 billion. The Mcap/TVL was 1.26 at press time.

Arbitrum is fourth on the list, with 234 protocols, according to CMC data. At the time of publication, the total value locked in Arbitrum was $2.02 billion. However, Arbitrum has had a 31.55% spike in TVL in the last month.

Polygon (MATIC) has bagged fifth place with over 389 protocols on the blockchain at press time. Polygon has a TVL of $1.35 billion and a market cap of $9.22 billion. The Mcap/TVL value stands at 6.8. The TVL has dropped by 2.89% in the last month and spiked by 3.16% in the last 24 hours.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.