- SEC could be inching closer to its defeat against Ripple Labs.

- Forbes’ Layton says the SEC realized that they had fallen prey to their own trap.

- If the SEC appeals to the Court, it will establish a precedent that would restrict the relevance of the Howey Test.

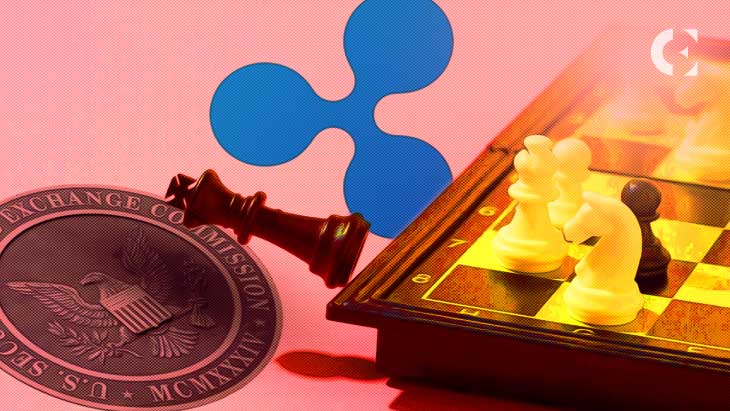

The US Securities and Exchange Commission (SEC) could be inching closer to its defeat against the payment protocol developer Ripple Labs. By all accounts, the ruling could significantly limit the SEC’s ability to regulate crypto in the US.

Roslyn Layton, a Forbes journalist, shared an article on her Twitter handle:

According to Layton, the SEC, soon after filing the case, realized that they had fallen prey to their own trap. She further added that tens of thousands of retail users of XRP were also dragged into the legal battle who had no connection to Ripple other than being co-victims of the government’s behavior.

John E. Deaton’s crypto firm, CryptoLaw, shared on Twitter:

The SEC is facing a bruising defeat against the San Francisco-based enterprise blockchain innovator Ripple. The verdict could drastically limit the SEC’s authority to regulate crypto in the U.S. If that’s how it ends, it will have been a self-inflicted disaster from the start

Earlier this month, Ripple obtained the Hinman documents after fighting for them for over 18 months. The documents, however, remain confidential for now but are tagged as a huge victory for the XRP team.

However, legal experts are skeptical about the decision and if it would increase Ripple’s odds of winning the lawsuit. Additionally, a legal professor who is familiar with the case believes “Ripple got the documents may be that they don’t help their case.”

As the news has it, if the SEC appeals to the Supreme Court, it will not only lose before the court but will also likely establish a broad precedent that would restrict or nullify the relevance of the Howey Test on crypto, which conflicts with the 1946 criteria.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.