- Ark Invest stated that the crypto assets would rival and redefine traditional assets by 2030.

- Lark Davis tweeted mentioning Ark Invest’s assumption that the crypto assets would be a $25 trillion asset class in 2030.

- The investment management fund also stated that DeFi is a promising alternative to centralized intermediaries.

Ark Invest, the American-based investment management firm, recently released the 2023 edition of the annual research report entitled “Big Ideas”, in which the firm reiterated that the crypto assets could rival and redefine traditional asset classes by estimating the possible position of cryptocurrencies in 2030.

Notably, earlier today, the crypto investor and reporter Lark Davis shared a Twitter thread regarding Ark Invest’s assumption that crypto could become a “25 trillion dollar asset class by 2030.”

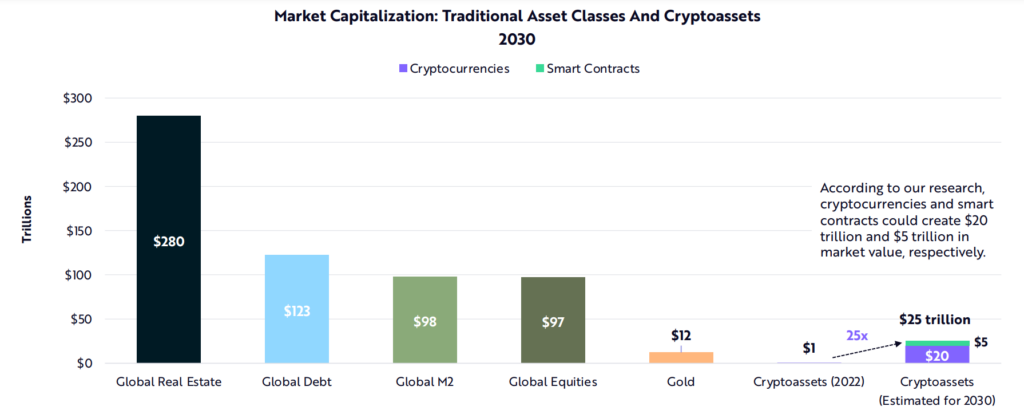

Davis discussed the graph released by Ark Invest citing the estimated market capitalization of both crypto assets and other traditional assets in 2030, assuring that “cryptocurrencies and smart contracts could create $20 trillion and $5 trillion in market value, respectively”.

In addition, while expounding the utility of smart contract networks, Ark Invest commented that decentralization is proving more critical to maintaining the original value proposition of public blockchain infrastructure, stating:

According to ARK’s research, as the value of tokenized financial assets, grows on-chain, decentralized applications and the smart contract networks that power them could generate $450 billion in annual revenue and reach $5.3 trillion in market value by 2030.

Interestingly, the platform stated that decentralized finance [DeFi] is a promising alternative to centralized intermediaries, pointing out the transparency of the former.

Corroborating the previous claims, Ark Invest added that smart contracts could facilitate $450 billion in annual fees by 2030, quoting:

If financial assets were to migrate to blockchain infrastructure at a rate similar to the adoption of the early internet, and decentralized financial services charged a third of traditional financial services take rates, smart contracts could generate $450 billion in annual fees and create $5.3 trillion in market value by 2030.

Nonetheless, Ark Invest added that true decentralization is difficult for the new networks and they could barely claim that they are sufficiently decentralized.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.