- According to Steven Nerayoff, speculations in Changpeng Zhao’s case could damage trust in the crypto industry.

- Zhao played a significant role in exposing and bringing down Sam Bankman-Fried and FTX.

- Nerayoff noted that many suggest SBF’s operation was part of a larger scheme involving influential figures.

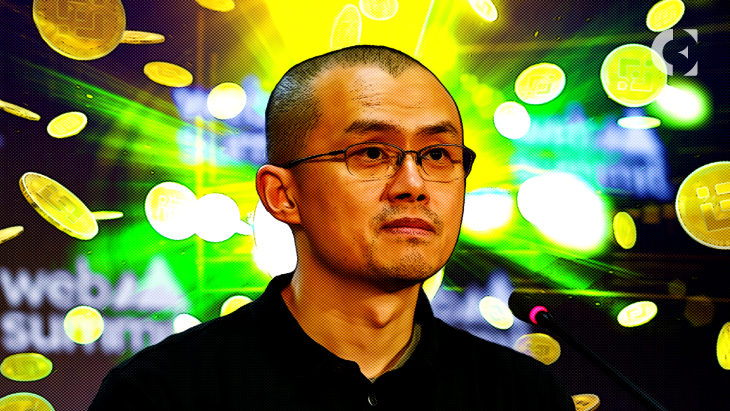

Steven Nerayoff, a renowned crypto attorney, speculated that Changpeng Zhao was going through extended scrutiny by the Department of Justice, and may face imprisonment for playing a major role in exposing Sam Bankman Fried and the FTX exchange.

The attorney thinks that facing such a consequence could be rooted in the fact that “SBF’s operation was part of a larger scheme to funnel money to politicians and other influential figures”. Moreover, the attorney stated, “If true, this could further damage trust in the cryptocurrency industry”.

According to reports, U.S. prosecutors have asked for tighter bond conditions for Zhao before sentencing for breaking a federal anti-money laundering law. The newly proposed bond conditions require the former CEO to submit his Canadian passport to the authorities. Zhao would also be required to provide at least three days’ notice to the prosecutors before traveling anywhere within the U.S.

Last November, Zhao pleaded guilty to a charge of failure to maintain an effective anti-money laundering program in violation of the Bank Secrecy Act. Following the plea, he stepped down as the CEO of Binance. The former Binance CEO is awaiting sentencing, and according to Federal sentencing guidelines, he could face up to 18 months in prison.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.