- Korean traders seem to pump and dump tokens when withdrawals are suspended.

- The CryptoQuant CEO added that Korean traders now favor pumping and dumping altcoins.

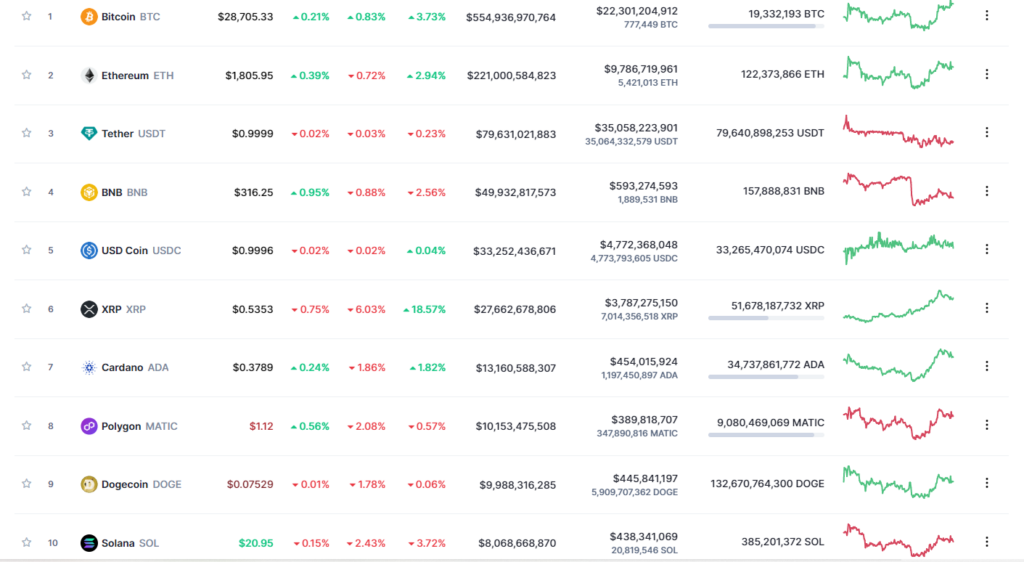

- The global crypto market cap saw a 0.83% increase over the last day.

The CEO of CryptoQuant, Ki Young Ju, took to Twitter this morning to add to an old thread from 2021 about the habits of Korean traders when withdrawals are suspended. Back then, the CEO mentioned that Korean traders seemed to pump and dump tokens when withdrawals were suspended. He mentioned that market manipulators also emerge when this is the case.

In addition to this, Ki Young Ju stated that this likely happens because Korea has very strict capital controls, which subsequently block arbitrage opportunities between global exchanges. Adding to this problem, the CEO explained that the Korean government would make things even worse with the travel rule solution. He believed that this would only succeed in making Korean exchanges even more isolated.

This morning, the CryptoQuant CEO added to this thread. He stated that Korean traders now favor pumping and dumping altcoins specifically. In the post, various videos were added to demonstrate how this is the case.

CoinMarketCap indicates that the global crypto market cap saw a 0.42% increase over the last day and now stands at about $1.19 trillion. The volume of all stablecoins is now $45.98B, which is 86.90% of the total crypto market 24-hour volume. Bitcoin’s (BTC) dominance is currently 46.62%, an increase of 0.51% over the day.

Out of all of the top 10 cryptocurrencies by market cap, BTC is the only one trading in the green today. The crypto king saw a 1.02% increase in price over the last 24 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.