- Bullish sentiment struggles against solid bear resistance in Moonbeam’s GLMR market.

- Traders’ pessimistic sentiment drives a decline in Moonbeam’s market capitalization and trading volume.

- Positive momentum indicators suggest a potential for an upside reversal in the GLMR market.

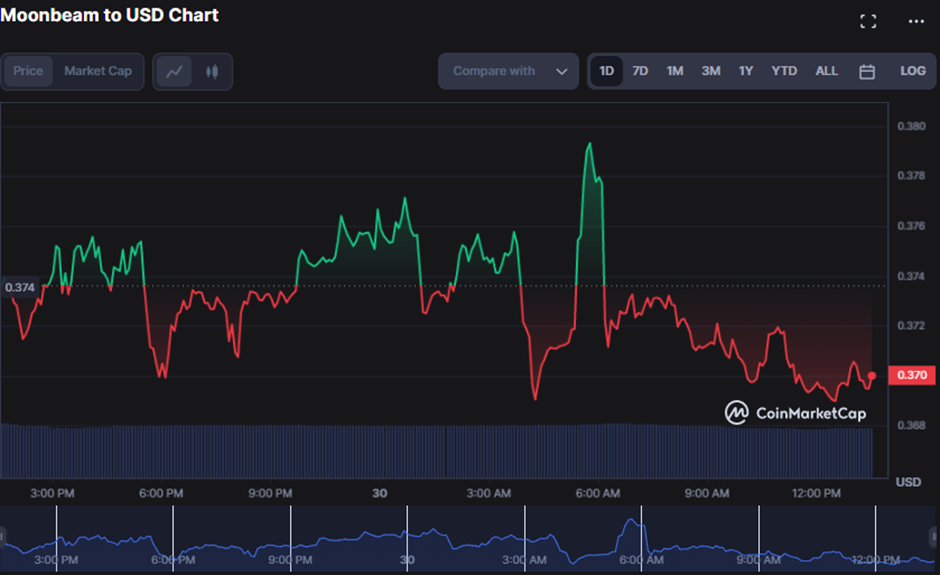

Bullish attempts to topple the bear reign in the Moonbeam (GLMR) market have been thwarted by solid resistance at the intraday high of $0.3795. After the bulls failed to invalidate the bearish hand in GLMR, the price fell to a 24-hour low of $0.3686 before regaining support.

When writing, bears in Moonbeam were still dominant, driving the price down to $0.3686 (a drop of 1.09%). If this trend continues and the $0.3686 support level is broken, the following levels to monitor are $0.3558 and $0.3429, respectively. If the bears lose steam and the bulls regain control, the price may recover toward the resistance levels of $0.3825 and $0.3962.

During the downturn, market capitalization and 24-hour trading volume fell by 0.88% and 13.52%, respectively, to $224,101,074 and $7,426,918. This drop shows traders’ pessimistic sentiment toward the market as they sell off their assets, resulting in a decline in market capitalization and trading volume.

Since the Vortex Indicator recently crossed above its signal line with a reading of 1.0939, the bearish momentum in GLMR may be fading, and a potential trend reversal to the upside may be on the horizon. This action increases traders’ confidence in the Moonbeams’ upside potential and may entice more buyers to enter the market, further driving up the price.

The positive movement of the Rate of Change with a reading of 1.86 indicates that Moonbeams’ momentum is strong and may continue to rise in the near future, making it an appealing investment option for traders looking for potential gains.

This expectation is based on the belief that if the ROC trend is positive, the asset’s price is rising, and, as a result, long-term investors may see a positive rate of return if they buy low and hold until the price rises.

The Aroon up reading of 71.43 and the Aroon down reading of 21.43% indicate that the current bearish momentum in GLMR may last a while longer, but it is not yet strong enough to indicate a long-term downtrend.

This expectation stems from the Aroon up, indicating that the uptrend that preceded the current bearish momentum is still strong. In contrast, the Aroon down indicates that the bearish trend is relatively weak and may soon reverse.

The stochastic RSI’s recent drop below its signal line, with a reading of 75.50, suggests that the bear reign may be extended. This move dims the short-term outlook, and traders may want to reconsider their positions.

This expectation of a continued bear rule is based on the stochastic RSI moving below its signal line, indicating that buying pressure is low and the market may keep plunging.

Despite recent bearish pressure, positive momentum indicators suggest Moonbeam’s potential for an upside reversal, making it an enticing investment option.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.