- Curve Finance founder, Michael Egorov is facing huge debt risks as he has a $100M loan backed by 427.5m $CRV.

- Egorov’s attempt to lower the utilization rate by launching a new liquidity pool worked.

- The DeFi ecosystem could be impacted by a decline in CRV prices brought on by the possible liquidation.

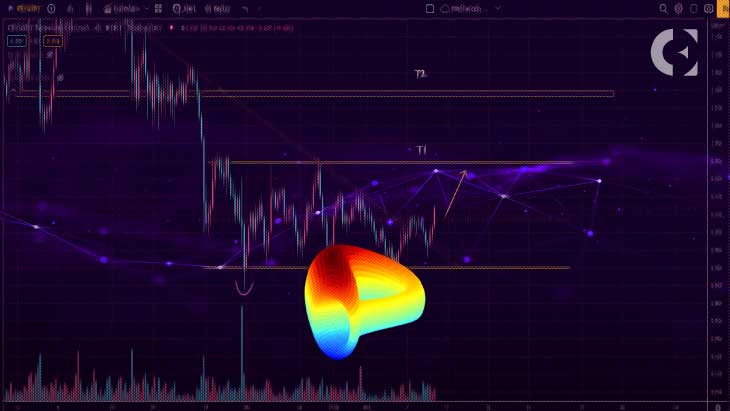

Curve Finance’s founder, Michael Egorov, is facing a lot of debt risks. Due to his 15.8 million FRAX debt and 59 million Curve DAO (CRV) collaterals, Egorov is in a risky position, according to Delphi Digital, a company that conducts market research on digital assets.

Egorov has a $305 million CRV backing a 63.2 million USDT loan on Aave. His current position is eligible for liquidation at 0.37 CRV/USDT which would require approximately 33% drop in CRV price. Delphi Digital added that he should also pay nearly 4% annual percentage yield (APY) for this loan.

Delphi Digital also mentioned that currently at 100% utilization, the interest rate would double every 12 hours. The interest rate was 81.2% but is expected to increase to reach a 10,000% APY after 3.5 days, which could lead to Egorov’s liquidation. His position’s liquidation price could reach 0.517 CRV/FRAX in 5 days, less than a 10% decrease from current prices.

Egorov had attempted to lower his debt and the utilization rate twice. He repaid a total of 4 million FRAX over the past 24 hours, however, the market’s utilization rate remained at 100%.

On 1 August, Egorov made a third attempt to lower the utilization rate by encouraging liquidity toward the lending market, which could also lower the debt risk. He deployed a new Curve pool and gauge: a 2 pool consisting of crvUSD and Fraxlend’s CRV/FRAX LP token, seeded with 100k of $CRV rewards.

And after four hours of launch, the new pool attracted $2 million in liquidity and the utilization rate decreased to 89%.

Curve’s current situation is the aftermath of a glitch in the programming language that resulted in the exploitation of a number of stable pools. Curve Finance lost more than $47 million and its cryptocurrency fell.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.