- Bullish price prediction ranges of DASH are from $86.94 – $95.83.

- DASH price might also reach $90 this 2023.

- DASH’s bearish market price prediction for 2023 is $37.58.

Dash (DASH) is a decentralized blockchain project as a fork of Litecoin. Dash mined its first block on 18 January 2014. One of its goals is to become one of the most user-friendly and scalable cryptocurrencies focused on making its mark in the payments industry. Cryptocurrencies have already entered the payment industry allowing users to pay for goods and services with digital assets.

As the application of cryptocurrencies continues to grow in the payment industry, Dash could also experience a positive effect on its prices over time. DASH, currently, has over $4.48 billion in payment volume with almost 54,300 active addresses.

Let’s take a look at the intricacies of the Dash network. Furthermore, this price prediction article will help you comprehend DASH’s price analysis and forecast for 2023, 2024, 2025, 2026, and up to 2050.

Table of contents

- Dash (DASH) Market Overview

- What is Dash (DASH)?

- Analyst View on Dash (DASH)

- Dash Current Market Status

- Dash Price Analysis 2023

- Dash Price Prediction 2023-2030 Overview

- Dash (DASH) Price Prediction 2023

- Dash Price Prediction 2024

- Dash Price Prediction 2025

- Dash Price Prediction 2026

- Dash Price Prediction 2027

- Dash Price Prediction 2028

- Dash Price Prediction 2029

- Dash Price Prediction 2030

- Dash Price Prediction 2040

- Dash Price Prediction 2050

- Conclusion

- FAQ

- More Crypto Price Predictions:

Dash (DASH) Market Overview

| 🪙 Name | Dash |

| 💱 Symbol | DASH |

| 🏅 Rank | #183 |

| 💲 Price | $29.9930672986 |

| 📊 Price Change (1h) | 0.58 % |

| 📊 Price Change (24h) | -5.25 % |

| 📊 Price Change (7d) | 6.95 % |

| 💵 Market Cap | $353025614.75 |

| 💸 Circulating Supply | 11770240.4771 DASH |

| 💰 Total Supply | 11770240.4771 DASH |

Dash (DASH) is currently trading at $29.9930672986 and sits at number #183 on CoinMarketCap in terms of market capitalization. There are 11770240.4771 DASH coins currently in circulation, bringing the total market cap to $353025614.75.

Over the past 24 hours, Dash has decreased by 5.25%. Looking at the last week, the coin is up by 6.95%.

What is Dash (DASH)?

Dash (DASH) is a decentralized blockchain project as a fork of Litecoin. Dash mined its first block on 18 January 2014. Dash was co-founded by Evan Duffield and Kyle Hagan. The network’s goal is to become one of the most user-friendly and scalable cryptocurrencies focused on making its mark in the payments industry. Dash claimed that they offer users a form of money described as “portable, inexpensive, divisible, and fast.”

The Dash network secures its network by implementing a two-tier network to secure its transactions. The first tier conducts mining operations under the Proof-of-Work consensus protocol called “X11”, which is a custom hashing algorithm that uses 11 hashing algorithms. The second tier consists of master nodes, which overlook the networks.

Apart from earning a percentage of the block reward as an incentive, Masternodes users receive the right to vote on proposals. Masternode users can vote on proposals regarding the budget proposals or decisions that could affect the network.

Dash has started to offer various features over time. Some of those notable features include InstantSend, ChainLocks, and PrivateSend. InstantSend allows users to conduct transactions almost instantly without relying on the central government. ChainLocks is built to “protect” blockchain against 51% mining attacks. Moreover, the PrivateSend is optimized for allowing users additional privacy for their transactions. These are some of the features of the Dash network.

Furthermore, DASH, the native token of the Dash network, offers real-world applications as it plans to become a decentralized global payment network for businesses and individuals. The Dash network assures users that they can use DASH for various purposes such as shopping online, purchasing goods at a local store, paying for services, and making transfers to family and friends.

Analyst View on Dash (DASH)

Crypto analysts have keenly observed DASH’s price movement and has been under the investor’s radar for some time. One such Twitter crypto analyst account with the name “Technical Crypto Analyst” reported that DASH, similar to many potential altcoins, could witness an uptrend after BTC’s growth. Moreover, the crypto analyst predicted that DASH could continue to grow toward the $66 level.

Moreover, DASH has recently been the talk of the town after the US Securities and Exchange Commission (SEC) sued the Bittrex Exchange for operating as an unregistered securities exchange. Another crypto analyst, Coin Bureau, reported that the SEC offered unregistered securities such as DASH and ALGO. However, the crypto community remained resilient and viewed SEC claims as nebulous. The crypto community also pointed out that DASH is not a security as it fails the Howey Test, which is a legal test used to determine whether an investment qualifies as a security.

Dash Current Market Status

DASH is ranked in the 80 position based on its market capitalization, according to CoinMarketCap. The current circulating supply of Dash’s native token is at 11,244,083 DASH, while its maximum supply is 18,900,000.

Moreover, DASH is priced at $49.74, experiencing a 16.03% fall in seven days. With a market cap of $559,238,036, DASH also witnessed a 1.14% tumble in 24 hours. However, DASH is currently experiencing a rising demand as the trading volume, valued at $75,993,784, experienced a spike of 15.50%% in one day.

Some of the crypto exchanges for trading DASH are currently Binance, OKX, CoinBase, KuCoin, Kraken, and Huobi Global.

Now, let’s dive further and discuss the price analysis of Dash network’s native token, DASH, for 2023.

Dash Price Analysis 2023

Will the DASH blockchain’s most recent improvements, additions, and modifications help its price rise? Moreover, will the changes in the payment and crypto industry affect DASH’s sentiment over time? Read more to find out about DASH’s 2023 price analysis.

Dash Price Analysis – Bollinger Bands

The Bollinger Bands is a technical analysis tool that is used to analyze price movement and volatility. Bollinger Bands (BB) utilizes the time period and the stand deviation of the price. Normally, the default value of BB’s period is set at 20. The Bollinger Bands consists of upper and lower bands which can be used together, along with the middle line(simple moving average), to determine whether the price would rise or fall.

The upper band of the BB is calculated by adding 2 times the standard deviations to the middle line, while the lower band is calculated by subtracting 2 times the standard deviation from the middle line. Based on the empirical law of standard deviation, 95% of the data sets will fall within the two standard deviations of the mean. As such, the prices of the cryptocurrency, when the Bollinger bands are applied should stay within the upper and lower bands 95% of the time is the concept behind this.

The Bollinger Bands show that DASH has been trading below the lower band indicating that it is facing an oversold market condition. When the candlesticks fall below the lower band, it is expected that DASH could rise above soon, finally residing within the upper band and the lower band.

Moreover, the upper band and the lower band have expanded indicating that there could be a price reversal soon. If the trend reversal happens, DASH could be trading in the top half of the Bollinger Band, which is considered an uptrend. With the trend reversal, DASH could trade in the upper band for a long time. However, if the candlesticks trade beyond the upper band, then, DASH could face a slight fall.

Dash Price Analysis – Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator utilized to find out the current trend of the price movement and determine if it is in the oversold or overbought region. Traders often use this tool to make decisions about when to buy or sell the tokens. When the RSI is often valued below or at 30, it is considered an oversold region, and a price correction could happen soon. Moreover, when the RSI is valued above or at 70, it is considered as the overbought region, and traders expect the price could fall soon.

Looking at the chart, DASH’s RSI is trading below the SMA, indicating that the altcoin continues to fall. Moreover, the RSI is valued at 36.76, which confirms that DASH is facing a weak trend. The RSI is also pointed downwards, which signals that even if a trend reversal may happen, DASH could face a slight fall.

If the RSI falls below 30, then, DASH will remain in the oversold region. However, DASH could starts its climb upwards soon, when it reaches the oversold region. Ultimately, traders need to wait for confirmation regarding DASH’s market sentiment before trading.

Dash Price Analysis – Moving Averages (MA)

DASH is currently trading below the 50MA and the 200MA, which is a sign that the digital asset is facing a downtrend. Earlier, DASH was showing signs of consolidation, as it was trading in between the 50MA and the 200MA. However, after DASH fell below the MA indicators, the 50 MA is moving closer to the 200MA, which could form a death cross. The death cross will confirm that DASH could face a weak trend over time. Ultimately, traders need to wait for confirmation before expecting bearish behavior.

Dash Price Analysis – Moving Averages Convergence Divergence

The Moving Average Convergence Divergence (MACD) indicator can be used to identify potential price trends, momentums, and reversals in markets. MACD will simplify the reading of a moving average cross easier. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Moving Average) indicator from the short-term EMA. Normally, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Moreover, MACD is considered a lagging indicator as it cannot provide trade signals without any past price data.

Traders have reported that occasionally the Moving Average could create false signals about the price momentum, however, MACD plays an important role as it can confirm the trends and identify the potential reversals.

Furthermore, there are two methods through which traders can speculate the price’s momentum: the crossover method and the histogram method. In the crossover method, when the MACD line crosses above the signal line, the trend could change from a downtrend to a long trend. However, if MACD crosses below the signal line, this could indicate the start of a downtrend.

In the Histogram method, the bars above the signal line indicate an uptrend. Meanwhile, the Histogram bars below the signal line indicate a bearish trend.

Looking at the charts, the MACD line is below the signal line, indicating a downward trend. Moreover, the gap between the MACD line and the signal line is increasing, indicating that the DASH could face the bears for some time. Moreover, the histogram shows the formations of bars below the signal, another confirmation that DASH is facing a bear run. However, traders should watch out for any trend reversals.

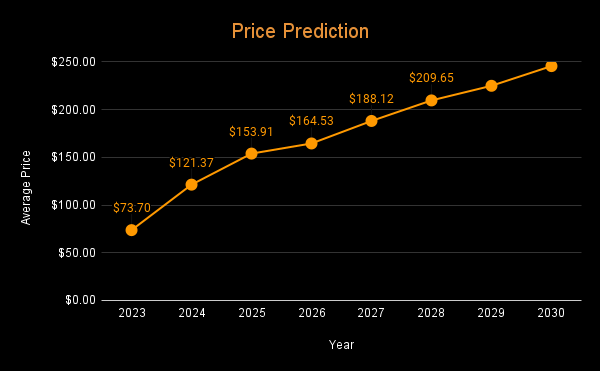

Dash Price Prediction 2023-2030 Overview

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $40.47 | $73.70 | $102.29 |

| 2024 | $99.87 | $121.37 | $140.87 |

| 2025 | $132.41 | $153.91 | $170.92 |

| 2026 | $155.08 | $164.53 | $193.72 |

| 2027 | $176.43 | $188.12 | $196.38 |

| 2028 | $183.39 | $209.65 | $215.84 |

| 2029 | $196.49 | $224.97 | $241.26 |

| 2030 | $216.87 | $245.62 | $262.78 |

| 2040 | $402.41 | $421.85 | $461.78 |

| 2050 | $503.59 | $531.36 | $562.49 |

Dash (DASH) Price Prediction 2023

The chart above shows the 1-day chart of DASH. Looking at the charts, the recent candlesticks have fallen below the 200MA, indicating the altcoin is facing a weak trend. If it continues to move in a bearish pattern, then, DASH could reach the weak low region at $43.18. However, if it falls to the support, then, there is a high possibility that DASH won’t fall below the Support region at $31.48.

Moreover, the MACD indicators also confirm that DASH is facing a bear run as the red bars have been formed in the histogram model. The MACD line is also below the signal line, which confirms that DASH will face a bearish sentiment for some time.

However, DASH could witness a trend reversal soon as the Bollinger Bands signals that the start of a bull season could happen soon. If DASH experiences a bullish sentiment, then it could reach the Weak High region at $74.17.

Meanwhile, the forecast for DASH remains to be bullish and is expected to reach beyond the level of $92.06. The bearish price prediction for DASH ranges from $31.48 to $37.59.

| Bullish Price Prediction | Bearish Price Prediction |

| $86.94 – $95.83 | $31.48-$37.59 |

Dash Price Prediction – Resistance and Support Levels

Looking at the chart, DASH is currently trading between the Weak Resistance and the Support. If DASH breakthrough the Weak Resistance, there is a high possibility that the altcoin could trade at $145.21. If 2023 proves to become extremely bullish, then, DASH could reach the Resistance 2 level at $196.81, which is the extremely bullish price level for the altcoin.

However, if DASH continues to face the bears’ attack, then, the altcoin trade at the Support level of $37.59 or even lower.

Dash Price Prediction 2024

Traders are looking forward to this year as it could be a historic moment for cryptocurrencies, as the Bitcoin halving is expected to happen in 2024. Most of the time, whenever BTC rises, traders have observed a similar surge in the altcoins. DASH could also be affected by Bitcoin halving and could trade beyond the price of $120 by the end of 2024.

Dash Price Prediction 2025

DASH could still experience the after-effects of the Bitcoin halving and is expected to trade above its 2024 price. Many trade analysts speculate that BTC halving could create a huge impact on the crypto market. Moreover, similar to many altcoins, DASH will continue to rise in 2025 forming new resistance levels. It is expected that DASH would trade beyond the $150 level.

Dash Price Prediction 2026

It is expected that after a long period of bull run, the bears would come into power and start negatively impacting the cryptocurrencies. During this bearish sentiment, DASH could tumble into its support region of $140. Moreover, when DASH remains in the oversold region, there could be a price correction soon. DASH, by the end of 2026, could be trading beyond the $160 resistance level after experiencing the price correction.

Dash Price Prediction 2027

Naturally, traders expect a bullish market sentiment after the crypto industry was affected negatively by the bears’ claw. DASH is expected to rise after its slumber in the bear season. Moreover, DASH could even break more resistance levels as it continues to recover from the bearish run. Therefore, DASH is expected to trade at $180 by the end of 2027.

Dash Price Prediction 2028

Once again, the crypto community is looking forward to this year as there will be a Bitcoin halving. Alike many altcoins, DASH will continue to form new higher highs and is expected to move in an upward trajectory. Hence, DASH would be trading at $200 after experiencing a massive surge by the end of 2028.

Dash Price Prediction 2029

2029 is expected to be another bull run due to the aftermath of the BTC halving. However, traders speculate that the crypto market would gradually become stable by this year. In tandem with the stable market sentiment and the slight price surge expected after the aftermath, DASH could be trading at $220 by the end of 2029.

Dash Price Prediction 2030

After witnessing a bullish run in the market, DASH and many altcoins would show signs of consolidation and might trade sideways for some time while experiencing minor spikes. Therefore, by the end of 2030, DASH could be trading at $240.

Dash Price Prediction 2040

The long-term forecast for DASH indicates that this altcoin could reach a new all-time high(ATH). This would be one of the key moments as HODLERS may expect to sell some of their tokens at the ATH point. However, DASH may face a slight fall before starting its upward journey once again. It is expected that the average price of DASH could reach $400 by 2040.

Dash Price Prediction 2050

The community believes that there will be widespread adoption of cryptocurrencies, which could maintain gradual bullish gains. By the end of 2050, if the bullish momentum is maintained, DASH could surpass the resistance level of $500.

Conclusion

DASH has been part of the watch-out list for many investors as it aims to make its mark in the payment industry. If investors continue to show interest in DASH and these tokens in their portfolio, then, it could continue to rise up. DASH’s bullish price prediction shows that it could pass beyond the $92 level. Moreover, DASH could surpass the $400 level by the end of 2050.

FAQ

Dash (DASH) is a decentralized blockchain project as a fork of Litecoin. Dash mined its first block on 18 January 2014. One of its goals is to become one of the most user-friendly and scalable cryptocurrencies focused on making its mark in the payments industry.

DASH can be traded on many crypto exchanges such as Binance, OKX, CoinBase, KuCoin, Kraken, and Huobi Global.

DASH could break through the $100 Resistance level if it trades beyond the $92 region.

It was launched in 2014.

DASH achieved its All-Time High of $1,642.22 in November 2017.

DASH is expected to reach $92 by 2023.

DASH is expected to reach $120 by 2024.

DASH is expected to reach $150 by 2025.

DASH is expected to reach $160 by 2026.

DASH is expected to reach $180 by 2027.

DASH is expected to reach $200 by 2028.

DASH is expected to reach $220 by 2029.

DASH is expected to reach $240 by 2030.

DASH is expected to reach $400 by 2040.

DASH is expected to reach $500 by 2040.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

More Crypto Price Predictions:

- Solana (SOL) Price Prediction 2023-2030

- Compound (COMP) Price Prediction 2023-2030

- Render Token (RNDR) Price Prediction 2023-2030

- Bounce Finance Governance Token (AUCTION) Price Prediction

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.