- Coinbase analyst David Han believes USDe stablecoin is now a formidable rival to DAI.

- USDe gained market cap against DAI due to high yields and airdrop incentives.

- USDe added $500 million in two days while DAI stayed relatively stagnant.

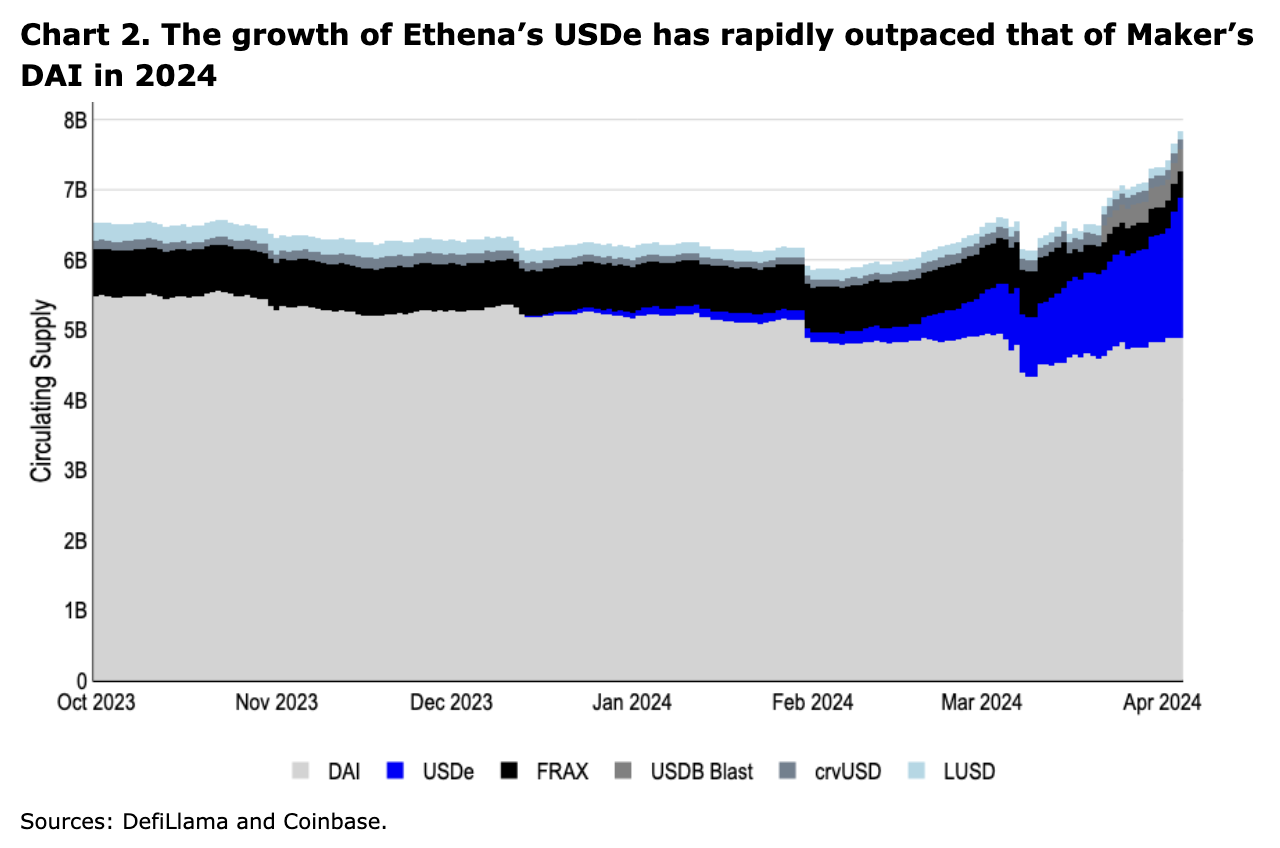

David Han, a research analyst at Coinbase, has highlighted Ethena’s newly launched USDe stablecoin as a formidable rival to MakerDAO’s DAI stablecoin. In Coinbase’s latest market trends report, research analyst David Han emphasized that USDe’s growth has significantly outpaced MakerDAO’s DAI in 2024 thus far.

According to the researcher, USDe has gained market share relative to DAI due to attractive yields and airdrop incentives. Moreover, he attributed the surge to the contentious governance alterations within MakerDAO and ongoing debates within the DeFi community regarding the potential removal of DAI as collateral from Aave markets.

At press time, the USDe stablecoin has a market cap of $2.05 billion, while DAI remains significantly ahead with $5.35 billion. Meanwhile, USDe attracted a considerable chunk of its market share within the last seven days.

As of April 2, USDe has a market cap of $1.58 billion. It saw a pronounced gain between April 3 and April 4, entering $2 billion for the first time, and has continued to defend the position. Interestingly, USDe had a cap of under $350 million in late February. Through these periods, DAI’s stablecoin market cap has stayed relatively stagnant.

While USDe is outperforming DAI, a more established player in the market, the Coinbase analyst has recognized similar constraints in both stablecoins. He pointed out that DAI and USDe encounter limitations on their issuance capacity. Specifically, DAI relies on over-collateralization, while USDe’s issuance capacity is constrained by the futures open interest market dynamics.

Furthermore, industry experts like Ki Young Ju, the CEO of data analytics platform CryptoQuant, have voiced apprehensions regarding the structure of USDe. Young Ju argues that Ethena’s decision to use Bitcoin as collateral echoes the situation with Terra Luna UST, where the Terra Luna team frequently sold BTC to maintain stability in UST’s peg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.