- On-chain data revealed that Ethereum whales have been taking Vitalik’s advice to keep assets off exchanges.

- ETH faced a tight trading range between $1,846 and $1,916, as short-term holders took profits.

- While the altcoin moved toward the oversold zone, long-term prospects remain bullish.

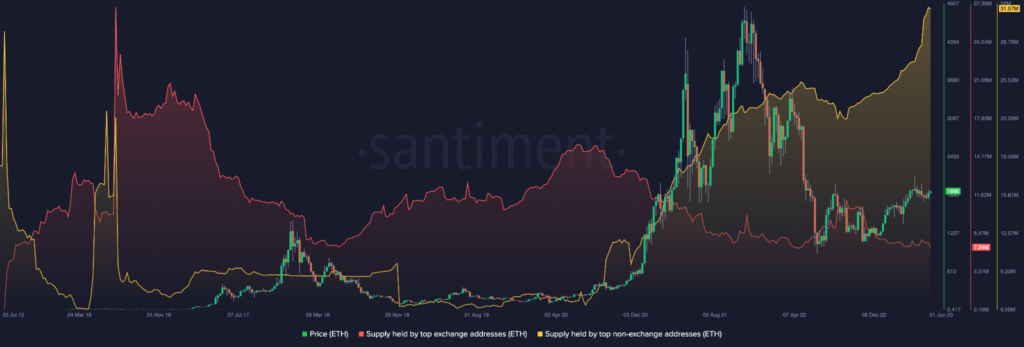

Whale addresses holding Ethereum (ETH) in self-custody have added more of the altcoins to their portfolio. The development, revealed by Santiment on 5 June, showed that the 10 biggest whales now have a combined holding worth $59.47 billion.

The on-chain analytic platform, via its official account, tweeted, “As more and more Ethereum has been moving into self custody & DeFi options, many of these coins have been absorbed by the largest whale addresses on the network. The 10 largest non-exchange addresses now hold an AllTimeHigh 31.8M $ETH worth $59.47B”

From the data shared by Santiment, the significant rise began last year. And this happened at the expense of the exchange supply held on exchanges (red) which have been on a rapid fall since September 2022.

Heeding the founder’s call

Interestingly, the move could be linked to Vitalik Buterin’s call for self-custody on two separate occasions.

In November 2022, the Ethereum co-founder urged the crypto community to move assets away from centralized platforms. This happened a few weeks after the FTX collapse, calling the exchanges “evil by default”.

On 17 March, he doubled down on his opinion. At that time, he suggested the adoption of multisig wallets. He also mentioned that ERC-4337 could address the concerns of custodial storage.

Multisig wallets, whose full meaning is multi-signature require different cryptographic keys to execute transactions. Thus, fostering improved security. On the other hand, ERC-4337 is an Ethereum standard that allows the biometric signing of transactions to aid the safety of assets.

Besides security, the move by these whales could serve as an indicator of long-term bullishness. If the supply on exchanges had increased this way, the ETH might face a possible decrease in value.

At the time of writing, the altcoin intra-day trading price was $1,869. This depicts a 1.68% decrease in the last seven days, according to CoinMarketCap.

ETH’s momentum is tilting toward the bearish area

Between May 29 and the time of writing, ETH’s trading range has been between $1,846 and $1,916, based on the 4-hour chart. The upswing on June 1, followed a resistance at $1,903 on June 3.

While it only flipped the market structure slightly from the period, ETH mostly retreated from the upper range. So, unless the bear succumbs to pressure or Bitcoin (BTC) blasts past the $26,000 range, bulls might find it difficult to bypass the downtrend.

Additionally, buyers have found it challenging to regain control, as indicated by the Relative Strength Index (RSI). At press time, the momentum indicator was 40.43.

This means it was closer to the oversold level of 30. This was caused by possible profit-taking around the $1,908-$1,904 region.

Therefore, ETH’s current trend supports a potential bearish movement. But in the long term, if whale accumulation continues, then the altcoin could rally.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

![Ethereum’s [ETH] Largest Non-Exchange Addresses Hit New Milestone As_more_and_more_Ethereum_has_been_moving_into_selfcustody_&_DeFi](https://coinedition.com/wp-content/uploads/2023/06/As_more_and_more_Ethereum_has_been_moving_into_selfcustody__DeFi.jpg)