- Leonidas.io tweeted that the CEXs and mining pools control the rare sat market.

- The tweet was a response to Ord.io’s revelation that a cold storage wallet controlled by the Binance CEO holds 1.28% of all BTCs.

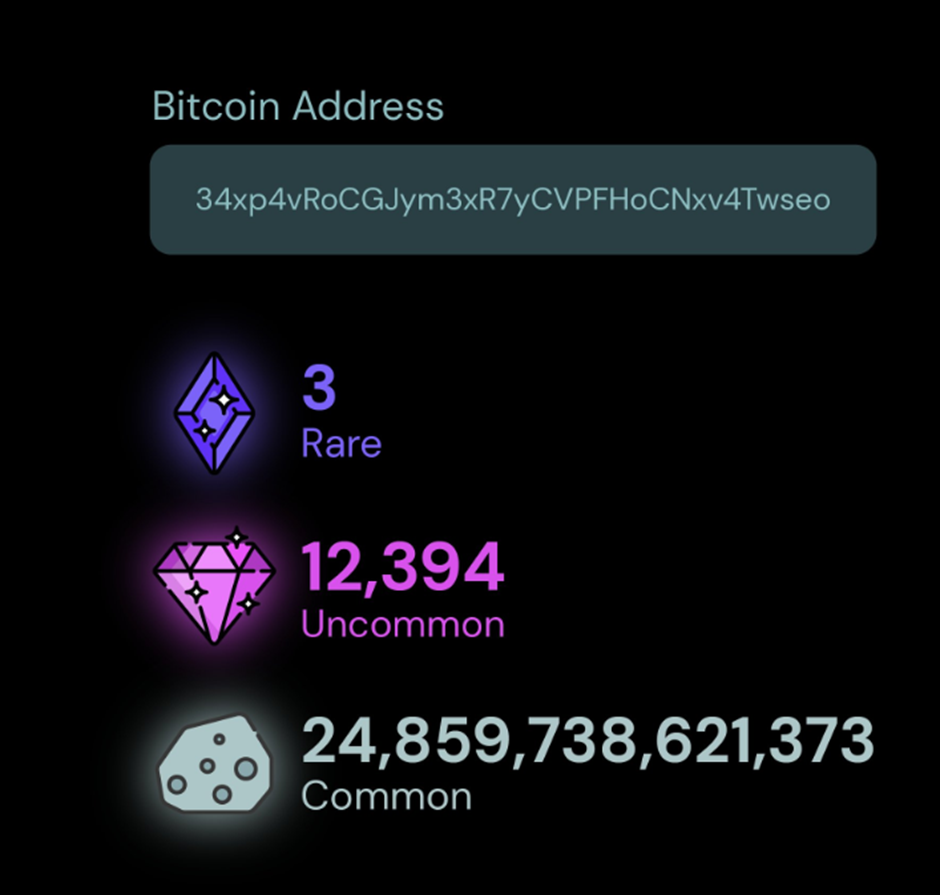

- The wallet holds 3 rare sats, 12,394 uncommon sats, and 24,859,738,621,373 common sats.

A renowned Ordinals member Leonidas.og shared a Twitter post today asserting that centralized exchanges (CEX) and mining pools control the rare sat market. Referring to a recent tweet by the Ordinals platform Ord.io that revealed a Bitcoin address holding 1.28% of all BTCs, the Ordfluencer commented that the “movement has only just begun”.

Leonidas.og took to Twitter to state that “one by one, CEXs and mining pools will wake up and realize that they control vast swaths of the rare sat market”:

The tweet came in response to Ord.io’s post that revealed that the largest Bitcoin address, 34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo, held a massive amount of uncommon Satoshis. The tweet stated that the address was the Binance cold storage wallet controlled by the Binance CEO Changpeng Zhao.

According to the revelations of Ord.io, the mentioned BTC address holds 3 rare sats, 12,394 uncommon sats, and 24,859,738,621,373 common sats, which in total forms an appreciative 1.28% of the whole Bitcoins. The tweet added that the 24.8 trillion sats held by the cold wallet amounts to over $6.7 billion.

In reaction to the tweet, Leonidas.og deduced that “0.81% of all Rare sats and 1.66% of all Uncommon sats” were under the control of the Binance CEO. Other replies quipped that Satoshi Nakamoto, the presumed pseudonymous founder of BTC, would be holding a still greater number of sats.

In related news, Binance has been troubled over the increasing regulations on the exchange as the Commodity Futures Trading Commission (CFTC) recently accused Binance and its CEO of trading unregistered crypto derivatives. Since then, Zhao has been facing criticism, including doubts about his trustworthiness as a crypto ambassador.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.