- ETH’s price has risen 1.62% over the last 24 hours.

- Santiment data shows that traders have shifted their focus to other coins.

- The altcoin’s price is trading above the daily 9 EMA line.

Ethereum (ETH), the altcoin with a market cap of $167,645,055,379 at press time, has seen its price rise by 1.62% over the last 24 hours according to the CoinMarketCap. This has taken its price to $1,374.15. Furthermore, the weekly performance for the altcoin is also in the green as ETH’s price finds itself 2.43% up over the last week as well.

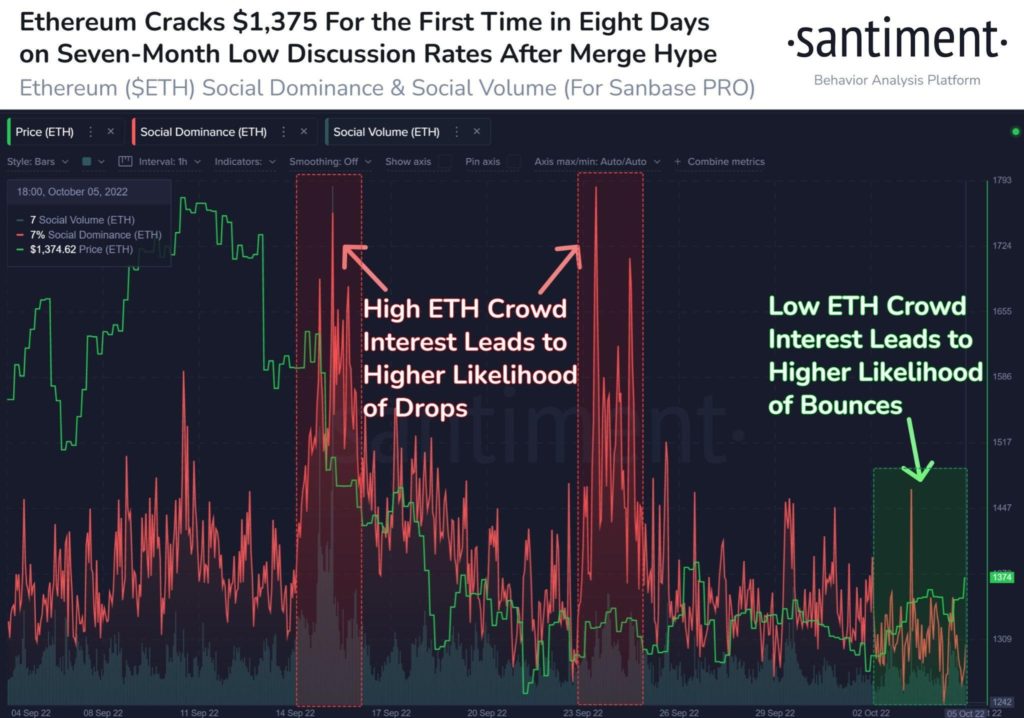

Data shared by Santiment in the early hours of this morning shows that ETH’s current levels were last visited on September 27 of this year, and that it appears that traders have turned their interest to other coins. As a result of this, ETH’s price has been left to gradually rise with reduced levels of resistance.

ETH’s trading volume has picked up 12.52% to take the daily volume to $11,215,030,623. Its price has also strengthened against the crypto market leader, Bitcoin (BTC) by 0.76%. Therefore, one ETH token is worth approximately 0.0676 BTC.

The altcoin’s price has also broken above the 9 Exponential Moving Average (EMA) line on ETH’s daily chart. This break has been accompanied by buy volume which suggests that the gradual upwards move will continue.

Technical indicators that support the bullish thesis are the MACD and RSI indicators. In terms of the MACD indicator, the MACD line has crossed bullishly above the MACD signal line. The MACD histogram’s gradient is also positive.

Meanwhile, the RSI indicator also crossed bullishly above the RSI SMA. There is still room for buyers to come in before ETH enters into overbought territory since the daily RSI is in neutral territory at 47.47 at press time.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.