- Lido aims to become fully decentralized and outlined steps towards self-custody.

- No significant increase in LDO’s token value despite significant development.

- Lido updated on the unlocking and withdrawal process for staked ETH and resolved eight issues.

The most recent announcement from Lido addressed the platform’s move towards decentralization and self-custody, which was a response to previous concerns about its centralization. The update explained the steps that Lido must take in order to become a fully trustless protocol, with withdrawal key rotation being the initial step.

The update provides a breakdown of each step and its significance for the protocol’s trajectory. Despite this significant development, there doesn’t seem to be a notable increase in the token’s value.

The recent update from Lido included information about the unlocking and withdrawal process for ETH staked prior to July 2021. The update outlined the steps that will be taken to ensure that the process is seamless.

Additionally, the update stated that eight issues had been resolved, and there were no significant problems to report. Lido also mentioned that messages related to these changes would be shared after the Shapella hard fork.

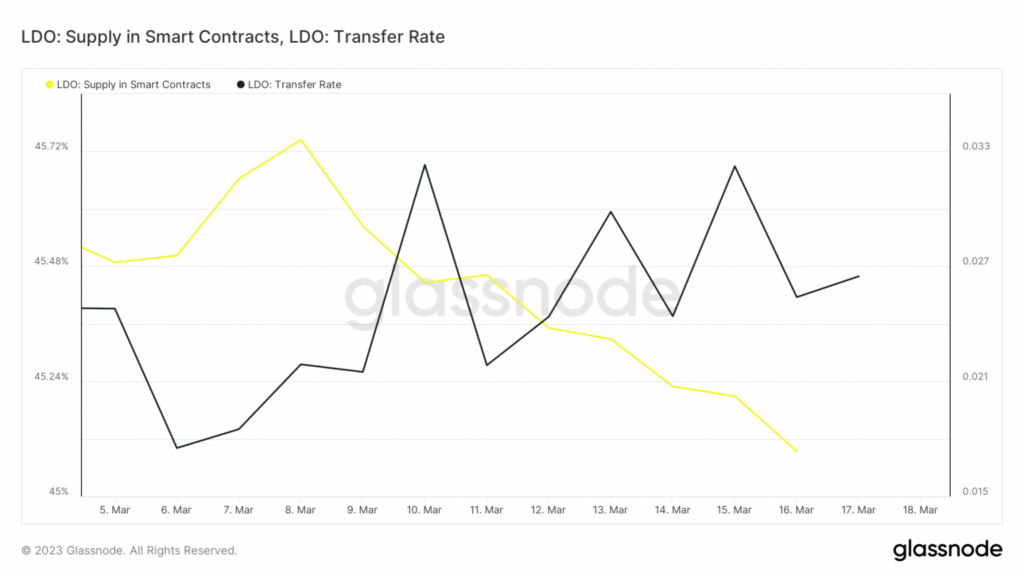

LDO’s smart contract supply dropped slightly from 45.74% to 45.09% in mid-March, while transfer rates increased slightly. Despite a bullish week in the cryptocurrency market, LDO’s price remained weak, trading at a discount to its weekly high.

The coin also struggled to stay above the 50-day moving average and lacked strong momentum due to low investor interest. Exchange inflows and outflows have decreased, but outflows still exceed inflows. Low trading volumes indicate low whale activity, and uncertainty surrounding staked funds being sold may discourage accumulation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.