- After the comments made by the FED, the BTC price dropped substantially.

- The S&P 500 dropped 2.2% in just one hour.

- There could be further downside in store for the cryptocurrency.

Bitcoin(BTC) and other stocks sold off yesterday after the Federal Reserve made comments suggesting that lowering the high inflation in the United States is still a top priority.

Over the last few days, things were going well for the king of crypto as its price jumped from $21,120 to $21,870 on August 26. Unfortunately, after the comments made by the FED, the BTC price dropped substantially to now trade at $20,193.74. This means that the BTC price saw a 5.81% drop in just over 24 hours.

BTC was not the only financial instrument that was negatively affected by the comments made by the FED. The U.S. stock market indexes also reacted badly as the S&P 500 dropped 2.2% in just one hour.

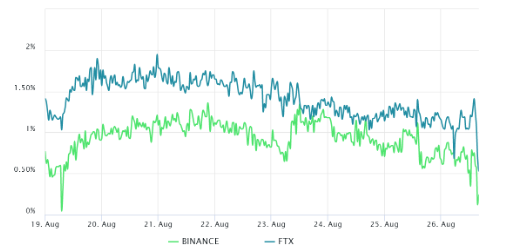

When looking at BTC’s 3-month futures chart, it seems like there could be further downside in store for the cryptocurrency. Usually, the indicator should trade at a 4% to 8% annualized premium to cover costs and associated risks. BTC’s futures premium remained below 1.8%.

This could suggest that traders are unwilling to add leveraged bull positions.

Another thing to take note of is BTC’s options markets.Usually in bear markets, options investors have higher odds of a price dump.This causes the skew indicator to rise above 12%. For BTC, the 30-day delta skew had been resting near the neutral-bearish threshold since about August 22.

This could indicate that traders are less inclined to offer downside protection.

All of the above mentioned information suggests that BTC’s jump on August 26 was just the crypto following the traditional stock market and that crypto traders are not expecting a positive move for BTC.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.