- Singapore will feel consistent pressure from global financial concerns.

- MAS urged citizens to save money to weather these difficult times.

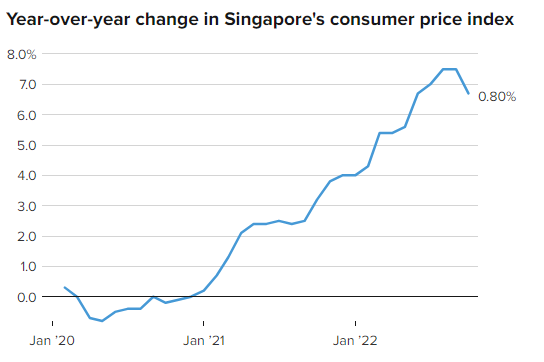

- Singapore’s core consumer price index is still at its 14-year highs.

Experts predict that even though Singapore’s core inflation eased a little around October, the nation will continue to feel consistent pressure from global financial concerns in the upcoming months.

In a recent report, the Monetary Authority of Singapore (MAS) warned the citizens about weakening demand and ongoing inflationary pressures. It stated that the country’s business, housing, and banking sectors are financially vulnerable.

In addition, the central bank added that “inflation is expected to remain elevated, underpinned by a strong labor market and continued pass-through from high imported inflation.”

This news comes as a blow to the Singaporean economy, which is already struggling with sluggish growth and high inflation.

The Monetary Authority of Singapore has been urging businesses and citizens to save more money to weather these difficult times. However, it seems that the pain will continue for a while.

Moreover, the Central Bank stated:

The most immediate risk is a potential dysfunction in core international funding markets and cascading liquidity strains on non-bank financial institutions that could quickly spill over to banks and corporates.

Singapore’s core consumer price index increased 5.1% in October compared to somewhat less than 5.3% in September, although it is still at 14-year highs.

MAS believes that “overall price stability” is often reflected by a core inflation rate of 2%, despite Singapore not having a specific inflation objective.

While core inflation levels are expected to remain high during the first quarter of 2023, according to JP Morgan analysts, the subsequent readings will show a further fall. This would allow the central bank to change its hawkish stance.

It is predicted that inflation will continue to be a major concern for Singapore, despite minor interest rate increases from global central banks like the Reserve Bank of Australia and the Bank of Korea.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.