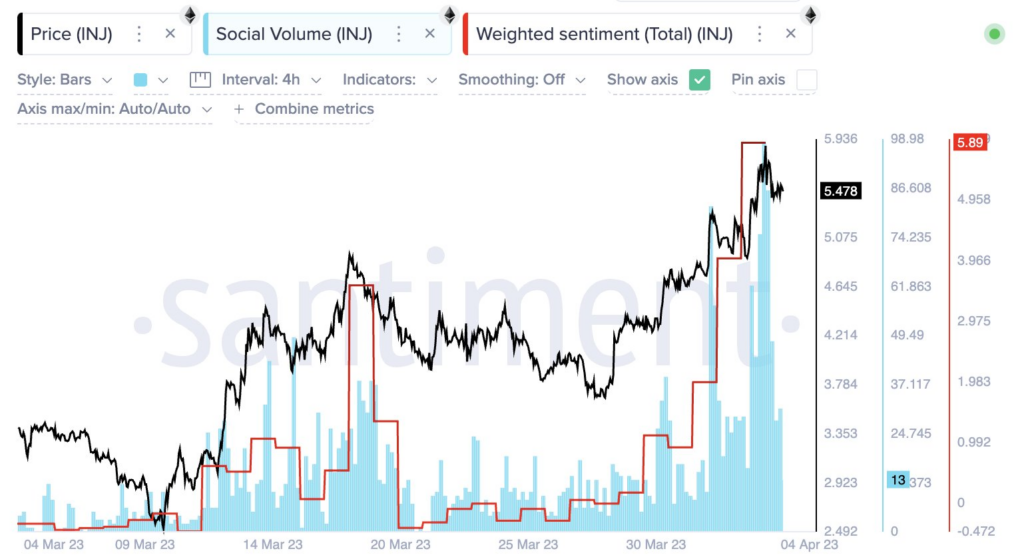

- Analyst Ali recently shared fundamental data from Santiment regarding Injective (INJ).

- The data showed that there is a lot of social activity and positive sentiment for INJ presently.

- Ali warned that INJ’s price has reached a peak and will retrace soon.

Crypto trader Ali (@ali_charts) shared recent data from the blockchain analytics firm, Santiment, in a tweet yesterday. According to the tweet, there has been a surge in positive sentiment and social media mentions for Injective (INJ) in recent days.

The trader concluded his tweet by cautioning investors and traders that the spike in INJ’s social volume and extreme positivity may be a signal of the altcoin’s price reaching a top.

At press time, CoinMarketCap shows that INJ’s price rose 0.73% over the last 24 hours. The altcoin was unable to replicate this performance against the two crypto market leaders, however. Currently, INJ is down 1.01% against Bitcoin (BTC) and 4.43% against Ethereum (ETH). As a result, INJ’s price is trading at $5.46.

A positive trend line has formed on INJ’s daily chart after the altcoin’s price printed higher lows over the last 3 weeks. Furthermore, INJ’s price has also broken above the key resistance level at $5.211 on Monday, and continues to trade above this major price level.

Despite the 9-day EMA line trading bullishly above the 20-day EMA line on INJ’s chart, the daily RSI indicator suggests that the crypto’s price will drop in the next 24-48 hours, supporting Ali’s bearish thesis.

Should the altcoin’s price drop in the next 2 days, its first target will be the key price level at $5.211. If this level collapses, then INJ’s price is at risk of dropping to the next support level at $4.457 as well in the coming days.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.