- Glassnode recently tweeted that Open Interest in BTC options has surpassed that held in options.

- According to the tweet, this is the first time that this has happened.

- The tweet added that this suggests traders are speculating higher prices for BTC.

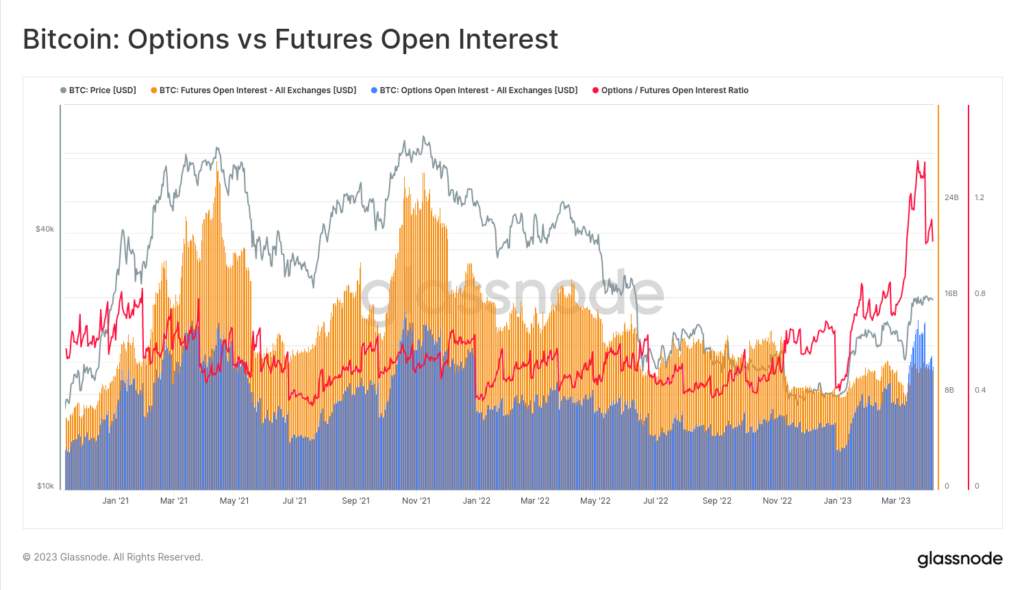

The blockchain tracking firm, Glassnode (@glassnode), tweeted this morning that the amount of Open Interest in Bitcoin (BTC) Options contracts has surpassed that held in Futures contracts for the first time.

According to the tweet, the total Open Interest in BTC Options contracts is estimated to be $10.3 billion, while the total Open Interest in Futures contracts is estimated to be $10 billion.

The tweet went on to add that Futures Open Interest has been relatively flat in 2023. This results from significant call option buys for BTC, which is an indication that investors are beginning to speculate higher prices for BTC.

At press time, CoinMarketCap shows that BTC’s price printed a gain over the last 24 hours. Currently, BTC’s price is trading at $28,101.27 after experiencing a 0.78% price increase. Although BTC’s price has risen in the last 24 hours, the market leader’s weekly price performance remains in the red at -1.15%.

The total crypto market cap has risen 0.69% over the last 24 hours as well. As a result, the combined capitalization of the global crypto market is estimated to be around $1.19 trillion. BTC’s dominance in the market increased slightly during this time period. At press time, BTC’s market dominance is at 45.88%, which is a 0.03% increase in the last day.

BTC was also able to outperform the leading altcoin in terms of market cap, Ethereum (ETH). At press time, BTC is up around 0.10% against ETH. Lastly, BTC is also trading near its daily high of $28,159.86. The crypto’s 24-hour low sits at $27,794.03 at press time.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.