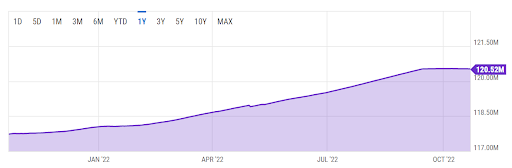

- ETH supply had been deflationary for the past 30 days.

- The supply had dropped from 3.79% to -0.1% with a current supply of 120.52 million.

- The deflationary pattern invites anticipation from investors of its positive impact on ETH price.

According to Ultra Sound Money, Ethereum’s on-trend supply had dropped from 3.79% to -0.1 % after the Ethereum Merge, with a current supply of 120.52 million, indicating a deflationary pattern. The reduction in the supply of the token anticipated a rise in its price.

The crypto analyst, Crypto Rover updated his Twitter post with the deflationary status of Ethereum, stating that “Ethereum has been deflationary for 14 days straight now”:

It is to be noted that the deflationary status of the token would impact the token price positively. With a low issuance rate and a less number of tokens produced, ETH could regain its former price momentum. Consequently, investors began anticipating the rise of its price.

Prior to the highly anticipated Ethereum Merge that marked the transition from PoW to PoS consensus mechanism, ETH supply was stable at 120,520,000. However, after the merge, there appeared to be a deflation in the supply of Ether.

Notably, Ethereum had been exhibiting a deflationary trend for the past 30 days, with an issue of not a single coin.

Arguably, the negative impact of the large number of ETH tokens being burned for the transaction fees resulted in the deflation in the supply of tokens.

Significantly, Ethereum’s transition from PoW to PoS mechanism had a considerable part in the reduction of the token supply. To be specific, when the transition was made, there was a significant reduction in the miner’s reward points.

While compensating for the reduced reward points, a large number of ETH were burnt, creating a scarcity in the tokens and leading to the deflation of its supply.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.