- The analyst encouraged participants to buy the Bitcoin and altcoin dip.

- BTC’s dominance dropped, suggesting a potential altcoin rally.

- Bitcoin might keep trading sideways as bulls and bears stay on the sidelines.

Crypto analyst Michaël van de Poppe posted that the wider altcoin correction could be an opportunity to load up on the dips. van de Poppe said this in a post on January 24.

According to him, the negative sentiment currently experienced in the market should not be seen as a sign of losing faith. Instead, he opined that it could be the best time to accumulate before the next rally.

The analyst also talked about Bitcoin (BTC) in another post. According to him, BTC was in the final phase of its correction because volatility has been decreasing.

He, however, mentioned that the coin price could still drop as low as $36,000 but noted that a rally could happen before the halving.

On January 24, Coin Edition reported how another analyst noted that BTC might not hit $46,000 until after the halving.

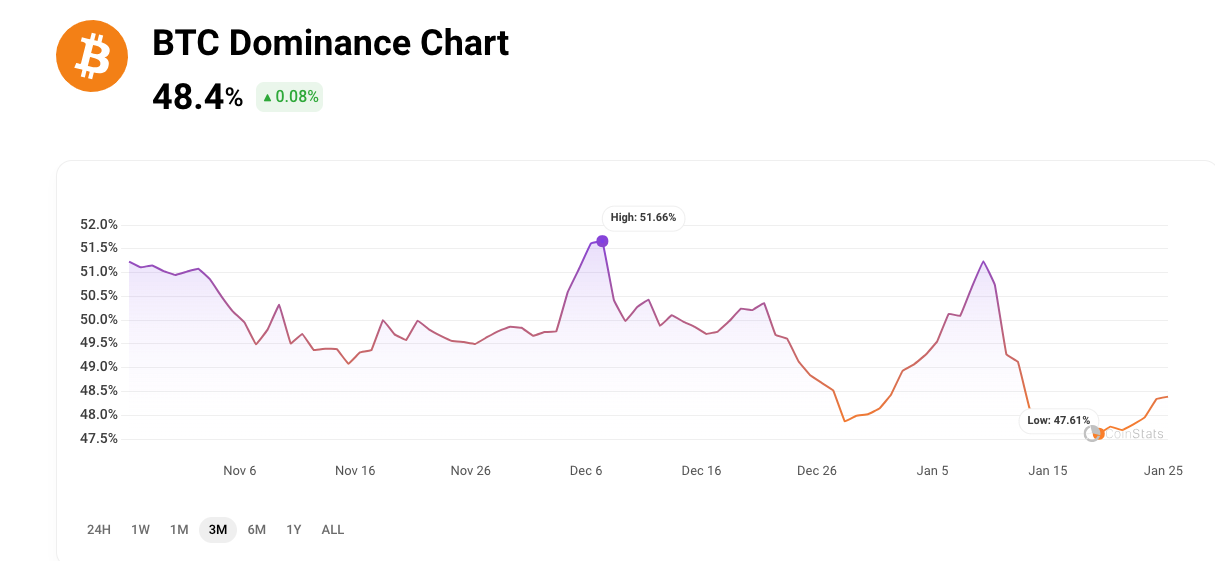

Recently, Bitcoin, alongside many top altcoins, has shredded a significant portion of its value. At press time, BTC’s price was $40,020. A look at the Bitcoin dominance chart showed that it was 48.4%, data from CoinStats showed.

The Bitcoin dominance chart is a key metric that indicates the strength of Bitcoin compared to the rest of the cryptocurrency market. When Bitcoin’s dominance is high, it means that Bitcoin is outperforming other altcoins in terms of market capitalization.

However, a lower dominance suggests that altcoins could be in line to outperform the coin. The value was one of the lowest BTC has seen in the past three months.

If it rises higher than this, then BTC’s price might increase. However, a further fall than this could result in the rotation of liquidity into altcoins, and push the prices higher.

For now, BTC might keep hovering around $39,000 and $40,000. This was according to the indication shown on the 4-hour chart.

At press time, the Accumulation/Distribution (A/D) indicator has stalled. A situation like this suggests that most market players are onlookers with bulls and bears hoping for a better time to show strength.

However, the RSI showed that bulls might have a better chance of influencing the price. As of this writing, the RSI was 45.88, suggesting that mild buying momentum had come into the market.

Should more buyers return, BTC could rise to $42,000. However, a dearth of bulls could cause the price to crash further while allowing altcoins to rally.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.