- The price of KNC has risen 0.24% over the last 24 hours.

- Whales have added 20% of KNC’s supply to their holdings since July 31.

- KNC’s price is currently attempting to challenge a resistance level on the 4-hour chart.

Kyber Network (KNC) has seen its price rise by 0.24% over the last 24 hours, according to CoinMarketCap, taking the price of the token up to $0.8535 at press time. Not only did KNC strengthen against the dollar, but the price of KNC was also able to strengthen against the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH) by 0.22% and 0.33%, respectively.

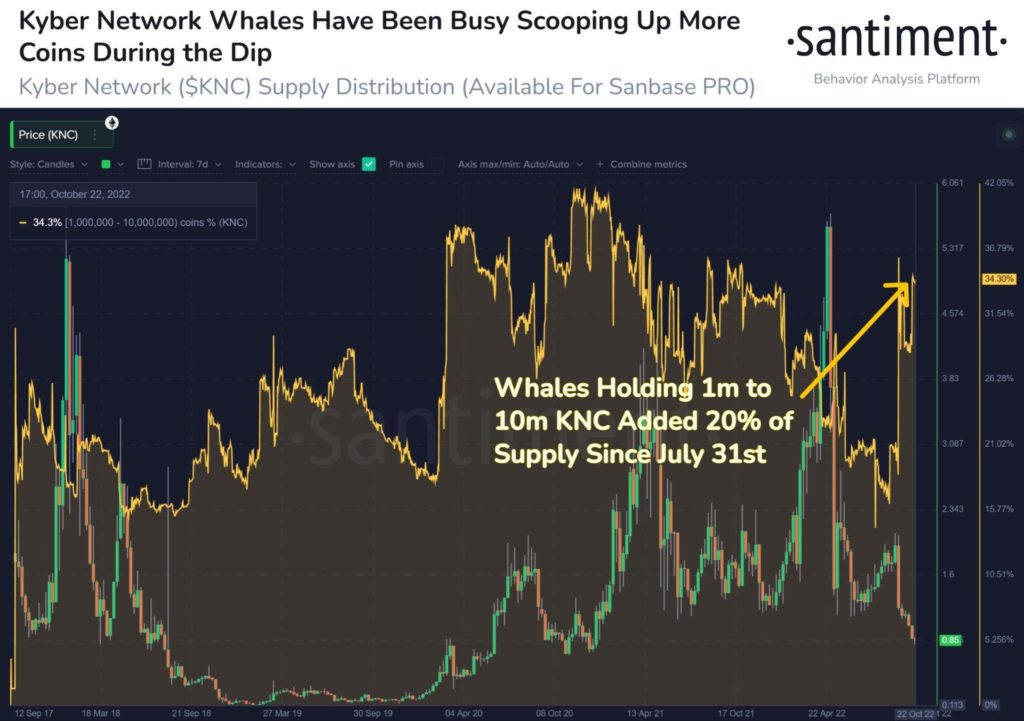

In addition to the slight price increase over the last 24 hours, data released by the blockchain analytics firm, Santiment, shows that whales have been accumulating the token for the past three months. The data also shows that KNC wallets holding between 1 million to 10 million tokens have added 20% of the supply to their holdings since July 31 of this year.

Also, last time this kind of accumulation was seen and the price of KNC grew more than 67% in the six months that followed.

The price of KNC finds itself at a strong resistance level of $0.86 at the moment, which has also been the upper limit of the parallel price channel that KNC’s price has been in for the last two days.

The 4-hour Relative Strength Index (RSI) line is positioned above the 4-hour RSI SMA line, which is a bullish sign. However, the RSI line is sloped towards the oversold territory, which is a bearish flag.

If KNC breaks above the current resistance level, then the 4-hour 9 EMA line will cross bullishly above the 4-hour 20 EMA line, which will signal a short-term bullish trend for KNC.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.