Introduction

KuCoin Exchange, a powerhouse in the global digital asset trading arena, ranks among the top 5 cryptocurrency platforms worldwide. With an impressive reach, the exchange caters to one in every four crypto holders across the globe. Established in September 2017 and headquartered in Seychelles, KuCoin is renowned for its user-centric approach, inclusivity, and expansive community engagement.

The platform boasts a diverse offering of over 700 digital assets and provides a comprehensive suite of services to its 27 million users in 207 countries and regions. These services include spot trading, margin trading, P2P fiat trading, futures trading, staking, and lending.

In 2022, KuCoin successfully raised over $150 million through a pre-Series B funding round, amassing a total investment of $170 million when combined with the Series A round. This achievement propelled the exchange’s valuation to an astounding $10 billion. According to CoinMarketCap, KuCoin currently holds its position as No.4 crypto exchanges.

By 2023, KuCoin’s exceptional performance earned it the title of “Best Crypto Exchange” by Forbes and a “Highly Commended Global Exchange” recognition in Finder’s 2023 Global Cryptocurrency Trading Platform Awards.

Table of contents

KuCoin Exchange Details

| Website | www.kucoin.com |

| Available on mobile | Yes |

| Number of supported coins/tokens | 700+ |

| Number of supported trading pairs | 1,200+ |

| Native token | KCS |

| Supported fiat currency | 50+ |

| CEO | Johnny LYU |

| HQ Location | Seychelles |

History Overview

KuCoin Exchange, with its technical architecture initially designed in 2013, commenced full operations in 2017. Founded and headquartered in Seychelles, the crypto exchange is widely known as the “people’s exchange” due to its low trading fees and user-friendly interface catering to users of all levels.

Following its inception, KuCoin raised $20 million in Series A funding from prominent investors such as IDG Capital and Matrix Partners in 2018. In 2022, the exchange further bolstered its financial standing by securing $150 million from a group of investors led by Jump Crypto, Circle Ventures, IDG Capital, and Matrix Partner, elevating its valuation to an impressive $10 billion.

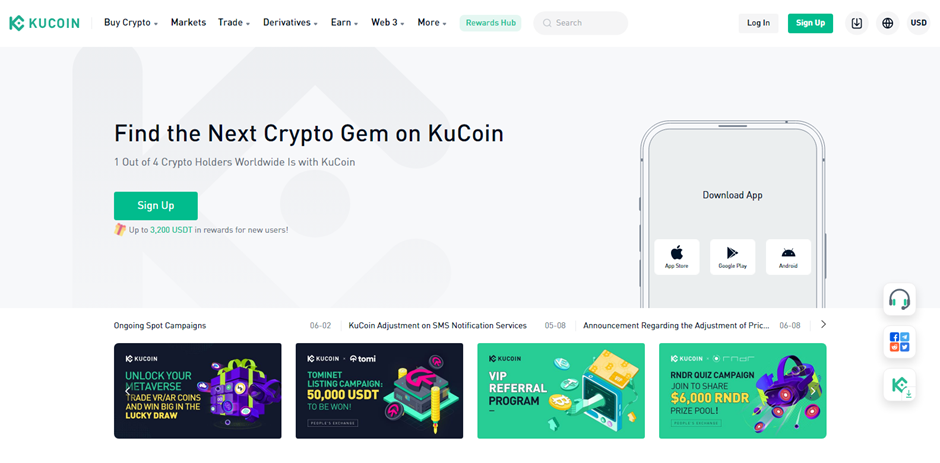

KuCoin Exchange Platform Homepage Interface

The KuCoin interface is designed with simplicity and elegance in mind. Featuring a smooth, sleek-looking homepage with calming light colors, the website elements are thoughtfully arranged across the page. The navigation pane and footer contain numerous links for easy access to various sections of the platform.

While the abundance of links on the KuCoin homepage may initially seem intimidating to beginners, the exchange thoughtfully includes a prominent “Beginner Zone” to alleviate any potential overwhelm. This dedicated area guides new users through their crypto journey by directing them to a separate page filled with unique rewards, events, and beginner-friendly guides on using KuCoin.

KuCoin Exchange Key Features and Functions

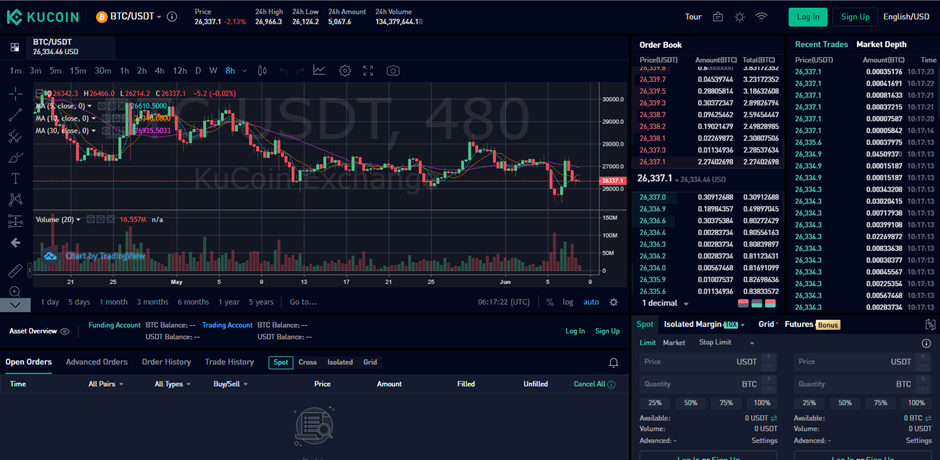

Spot trading

KuCoin Spot trading is a great option for investors of all levels, thanks to its user-friendly platform and wide range of markets and order types. The platform offers competitive trading fees, starting at just 0.1%, and users can enjoy even lower fees by holding KCS or increasing their trading volume.

With KuCoin, users have access to a variety of markets, including Stable Coins, Bitcoin, KuCoin Token, and numerous Altcoins such as ETH and TRX. The platform also supports different order types, including Limit Orders, Market Orders, Stop Limit Orders, Stop Market Orders, and OCO Orders. This range of options ensures that users can trade in a way that suits their individual needs and preferences.

One of the best things about KuCoin Spot trading is the ability to reduce trading fees further by enabling Pay Fee with KCS, which offers a 20% discount on fees. The minimum amount for each trade varies depending on the coin, making it accessible to investors with different budgets.

KuCoin Plus, is another specialized trading area within the KuCoin Spot trading were the platform features well-performing coins that meet specific criteria, such as being ranked in the Top 40 on major ranking sites, having a high trading volume on KuCoin, or maintaining a high rating in the KuCoin Review System. This feature is beneficial for users seeking promising investment opportunities. However, it is crucial to remember that trading cryptocurrencies involves inherent risks, and users should conduct their research and risk assessments before investing. KuCoin offers 24/7 customer support to assist users with any inquiries or concerns.

Trading Bot

KuCoin exchange also features the KuCoin trading bot, a free-to-use software for traders to automate their crypto trading. To begin using the bot, you only need to open your account, pick a trading strategy, invest your funds, and then let it do the work.

As of the time of writing, the KuCoin trading bot supports four strategies: Spot grid, DCA, Futures Grid, and Smart Rebalance.

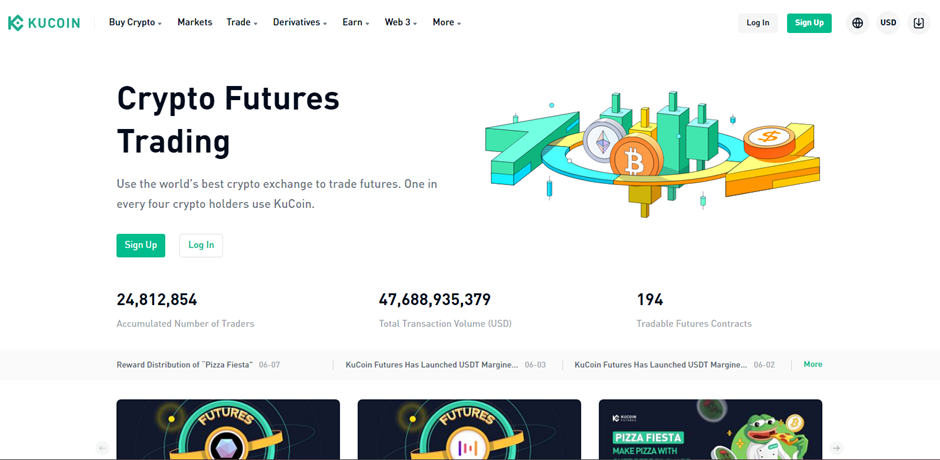

Futures Trading

KuCoin Futures is a trading platform that allows you to trade cryptocurrency futures with other users using Bitcoin/ETH. When trading futures, you need to have a minimum amount of funds in your account to open and maintain a position.If you don’t meet this requirement, your position will be liquidated, and you will lose your margin. KuCoin Futures uses a system called ADL to help protect users from losing more than their margin. The platform allows users to trade financial futures with other users, using Bitcoin, Ethereum, and USDT as the primary settlement currencies.

Key Features:

- Margin System: KuCoin Futures employs a margin system consisting of Initial Margin and Maintenance Margin. The initial margin is the minimum amount required to open a position, while the maintenance margin is the minimum amount needed to keep the position open.

- Mark Price and Index Price: The mark price represents the fair price of the futures, influencing liquidation price and unrealized PNL, but not realized PNL. The index price is a weighted price derived from the spot prices of six major exchanges.

- Profit and Loss Calculation: Unrealized PNL is calculated based on the difference between the average entry price and mark price. Realized PNL is determined by the difference between the entry price and close price of a position, including trading fees and funding fees.

- Maintenance Margin Requirement: Traders must maintain a certain percentage of their position’s value, known as the Maintenance Margin percentage, to keep their positions open. Failure to meet this requirement results in liquidation and loss of the maintenance margin.

- ADL Mechanism: The Automatic Deleveraging (ADL) mechanism is in place to deleverage counterparty positions of liquidated positions at the bankruptcy price, prioritizing profit and leverage levels.

- Trading Process: To trade futures on KuCoin Futures, users need to open a position, obtain profit/loss from the position, and close the position. Profits and losses are settled only after the position is closed and reflected in the user’s balance.

To start trading, you need to open a position, which means buying or selling a cryptocurrency futures contract at a specific price. When you close your position, you either make a profit or a loss, which is reflected in your account balance. KuCoin Futures provides a helpful guide to get started with trading futures on their platform.

Spotlight

KuCoin Spotlight is the exchange’s token launch platform for early-stage crypto projects and initial token distributions. This feature enables you to engage in the early stages of these projects and earn a significant income with minimal thresholds.

Notably, KuCoin ensures that all listed projects and their tokens fit its standards by going through a listing procedure that follows three main stages: due diligence, agreement discussion, listing preparation and integration.

Furthermore, Spotlight allows you to earn better profits while actively supporting the further development of early-stage crypto projects with crowd-funding, market exposure, and industrial influence efforts.

KuCoin Earn

KuCoin savings allows you to deposit your assets and earn passive rewards. The savings feature allows you to subscribe and redeem your funds at any time.

KuCoin staking locks your digital assets on a proof-of-stake (PoS) blockchain for a certain period of time in exchange for staking rewards.

Finally, KuCoin promotions are products with a limited amount and a limited time for users to subscribe. These generally offer higher returns than savings and staking.

KuCoin Pool

KuCoin Pool is a mining pool that provides you with one of the lowest mining fees in the industry (2%), with optimized algorithms for higher mining efficiency. The KuCoin Pool aims to build the world’s largest PoW mining pool, contributing to a variety of public chains’ security.

It is a high-performance mining pool that supports PoW assets such as Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), and more coins in the future.

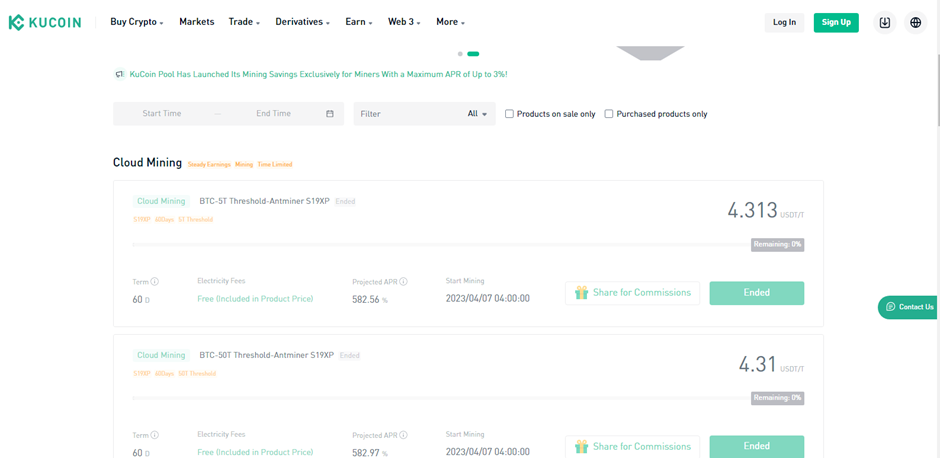

Cloud Mining

KuCoin’s Cloud Mining is a recruitment program in collaboration with Kucoin Pool. It aims to hunt for the most talented and driven individuals in the Bitcoin mining industry to join KuCoin’s exclusive club. It ventures to make contributions to the world of cryptocurrency mining by featuring low costs, ease of operation, and stable access to quality assets.

KuCoin exchange Advanced Trading Options

KuCoin exchange empowers users with advanced trading options, including margin trading, P2P fiat trading, futures trading, lending, and investing in new project tokens. While these features cater to experienced traders due to their complexity, they provide a comprehensive trading experience for those with industry knowledge.

Fractional NFTs

KuCoin allows you to trade Fractional NFTs via its fractionalization trading protocol for blue-chip NFTs. Fractional NFTs are a type of NFT that allows multiple investors to own a portion of a single token. The protocol offers a centralized experience and secondary market trading.

KuCoin allows you to buy fractionalized NFTs with your trading account balance. As a result, you will not be able to make purchases using on-chain wallets.

Factionalized NFTs issued on KuCoin can also be traded on the spot market. This means that these NFTs will have access to KuCoin’s world-class liquidity and a plethora of trading pairs.

Halo Wallet

KuCoin is committed to providing a variety of services to meet the needs of users. With the development of Web3, more and more users are looking for a self-custodial wallet to store assets, and more than that they are looking for a gateway to Web3. To optimize the whole ecosystem, KuCoin incubated KuCoin Wallet, now rebranded as Halo Wallet, that has received its first round of financing from KuCoin Ventures, IDG, HashKey Capital, and other Web3 strategic partners around the world.

Halo Wallet is the first social crypto wallet that connects users to Web3 – from tracking the investment strategy of the pros to earning crypto and everything in between.

KuCoin Exchange Supported Currencies

Cryptocurrencies

KuCoin Exchange is well known for its wide library of altcoins. Accordingly, the exchange supports over 700 coins you can buy, sell, and trade. You can buy these coins with a credit card, bank transfers, Apple Pay, and other options. KuCoin also has a spotlight section to promote new currencies.

Fiat Currencies

KuCoin supports over 50 fiat currencies and over 70 payment methods, such as VISA, PayPal, Mastercard, and more. Additionally, it has recently partnered with Legend Trading to further support its fiat-to-crypto transaction services.

KuCoin Exchange Fees

Tiered Fee System

The KuCoin exchange has a tiered fee system that affects the fees you get for trading crypto. The exchange considers several factors to calculate your fees, including trading fee level (1-12), holding KCS, spot trading volume, futures trading volume, maker/taker, and crypto classes (A, B, or C).

As a result, KuCoin Exchange’s fees are more competitive than the rest of the market, especially if you are a regular KuCoin trader. This tiered fee system encourages the community to use the platform more to get more advantageous discounts.

No Deposit Fees

KuCoin’s deposit fees are completely free, regardless of your chosen cryptocurrency. However, it does have high fiat deposit charges. On the other hand, withdrawal fees depend only on the token’s market situation and still remain one of the lowest in the market.

Native Exchange Token

KuCoin Token (KCS) is the native token of the KuCoin Exchange and is regarded as one of its best ways to earn passive income.

KCS holders can use it as a utility token, used to pay for trading fees on the KuCoin Exchange with discounts up to 80%. Additionally, holding more than 6 KCS rewards you with daily dividends that come from 50% of KuCoin’s daily trading fee revenue.

Security

Although KuCoin is not licensed in the U.S., it offers standard security measures. The exchange features industry-standard encryption algorithms to protect all sensitive data and assets, multi-factor authentication for all user accounts which adds an extra layer of security, holds majority of client’s funds in cold wallets to secure funds, conducts regular audits and penetration tests, monthly Proof of Reserves and much more.

Furthermore, KuCoin has a partnership with cybersecurity company Hacken for a $1M bug bounty program. The bug bounty program rewarded researchers for discovering and responsibly disclosing vulnerabilities on the KuCoin platform, aiming to further strengthen the security of KuCoin and protect its users’ funds.

It’s worth noting that KuCoin prioritizes their user’s security above all. In 2020 when hackers breached KuCoin leaving it at a loss of $280M, $239.45M (84%) of the stolen funds were recovered. The remaining $45.55M (16%) was compensated from utilizing the insurance funds of the exchange, ensuring that customer deposits were unaffected by this incident. This also led to strengthening the security architecture of the exchange.

Pros and Cons

| Pros | Cons |

| Low trading and withdrawal fees User-friendly platform A wide variety of altcoins Offers advanced trading features Prioritises user’s security. | Not licensed in the U.S. Steep fiat deposit charges Not beginner-friendly |

Final Score

Services offered: 4/5

Cryptocurrency support: 4/5

Fees: 4/5

Security: 4/5

Review Score: 4/5

Conclusion

In summary, KuCoin stands out as a leading digital asset trading platform with a global footprint and an extensive array of services. With a user base exceeding 27 million and support for over 700 cryptocurrencies, the exchange caters to a diverse clientele. KuCoin’s platform is designed for ease of use, featuring a beginner zone to assist newcomers and a sleek, intuitive interface.

Moreover, KuCoin provides advanced trading features such as margin trading, P2P fiat trading, futures trading, lending, and access to new project tokens. The exchange also presents staking opportunities, a trading bot, and a cryptocurrency lending platform. Through its wealth management service, KuCoin Earn, users can generate passive income via savings, staking, and promotional events.

All in all, KuCoin serves as a comprehensive and adaptable platform, accommodating the needs of both novice and seasoned traders.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.