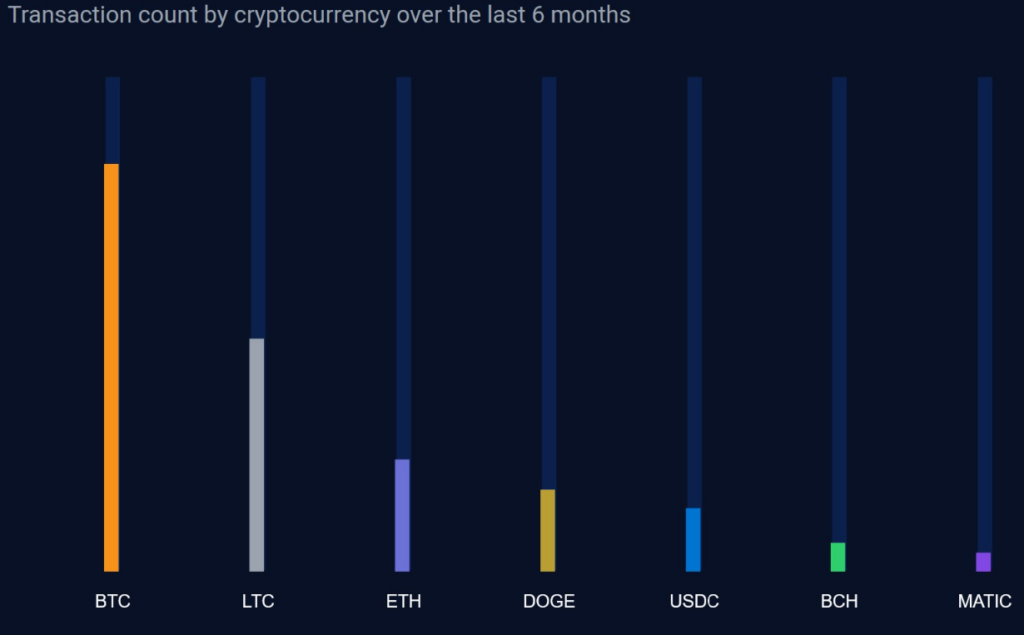

- Litecoin has outdone Dogecoin in terms of its transaction count over the past six months.

- Over the past 24 hours, the coin has exhibited a transaction count of 124,914 LTC.

- Bitcoin is the only cryptocurrency that overpowered Litecoin in transaction count.

Considering the latest reports, Litecoin, the peer-to-peer decentralized currency, has outdone the top cryptocurrencies including Dogecoin (DOGE), in terms of the transaction count on the network over the past six months.

Notably, Litecoin shared a Twitter thread on March 9, claiming that the transactions on the platform have “grown to make LTC by far one of the most consistently transacted crypto this month and every month”:

At the time of reporting, the number of Litecoins transacted over the past 24 hours is 124,914 with an average transaction of 5,205 LTC per hour.

As per the data provided by Litecoin, Bitcoin was the only cryptocurrency that ranked ahead of the LTC in terms of transaction count. All other popular coins including Ethereum (ETH), Dogecoin (DOGE), USDC, Bitcoin Cash (BCH), and Polygon (MATIC) have been exhibiting lesser transaction counts when compared to the six months history of Litecoin’s transaction count.

Interestingly, being designed as a payment protocol, LTC has played a major role in the transactions that took place in the largest payment processor, BitPay. LTC has been responsible for the 23% of the total transactions on BitPay, overpowering Dogecoin which constitutes 5.45%.

However, it is estimated that the current outlook of the coin’s performance in its transaction has no remarkable impact on its price. As such, LTC is currently trading at a price of $69.91, representing a decline of 16.36% at press time. In addition, the present value of the coin portrays more than 21% decline over the past week.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.