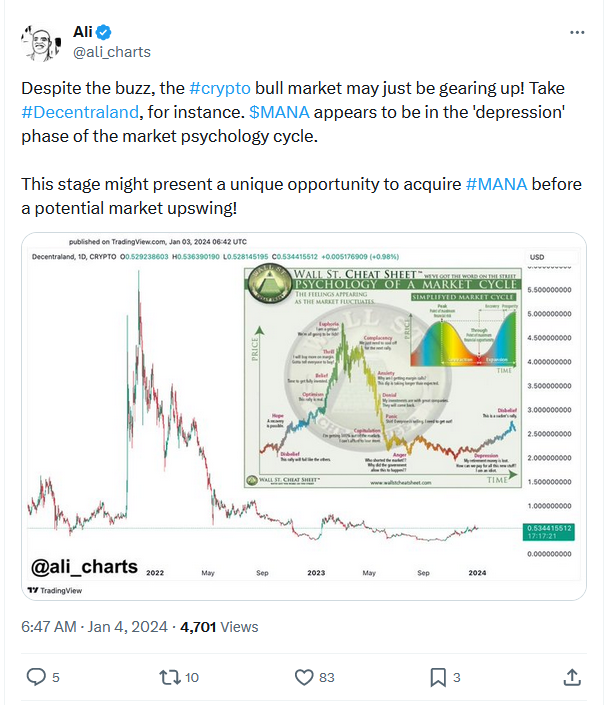

- MANA enters the “depression” phase of the market psychology cycle.

- At this phase, the market sees low volatility and trading volume.

- LDO appears poised to break out of an ascending triangle.

In a series of posts on X (formerly Twitter), analyst Ali Martinez noted that the metaverse-based token MANA and the governance token of the Lido DAO, LDO, are two assets primed for a rally in the short term.

MANA Might Have Something Else Planned

Martinez assessed MANA’s price movement and noted that the altcoin’s price is currently in the “depression” phase of the typical market psychology cycle.

An asset’s price is said to be in this phase when it has previously recorded highs and now experiences a decline. The phase is commonly marked by low investor sentiment, impacting trading activity and resulting in low trading volume.

Also, the asset’s price may fluctuate within a narrow range, reflecting the lack of strong buying or selling pressure in the market.

According to Martinez, “this stage might present a unique opportunity to acquire MANA before a potential market upswing!”

However, an assessment of MANA’s performance on a daily chart revealed that the steady decline in demand for the alt may put further downward pressure on its price.

At press time, MANA exchanged hands at $0.47, having witnessed a 12% value decline in the last seven days. The drop in price may be due to an uptick in token sell-offs and a dip in accumulation.

According to readings from its Money Flow Index (MFI) and On-Balance-Volume, MANA holders have increasingly distributed their tokens in the last week.

LDO Prepares to Soar

Regarding LDO, Martinez’s assessment of the token’s weekly performance showed that it has formed an ascending triangle.

When an asset’s price movements form an ascending triangle, it hints at the possibility of a potential bullish breakout. This is so because the structure is characterized by rising lows and flat highs, which indicate a gradual build-up of buying pressure.

According to Martinez, the $3.30 price level remains important. If LDO manages a sustained weekly close above this mark, it would confirm the bullish breakout. He added that it

trigger a surge of buying activity, which may push the token’s price toward the next target of $6.

At press time, LDO traded at $3.25. In the last week, its price has rallied by 15%, according to CoinMarketCap.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.