- Mantle announced Ondo Finance’s $USDY token as a partner for RWAs.

- Ondo is leading the RWA space with a 50% share of the tokenized security market.

- Mantle anticipates using $USDY as collateral in lending protocols and “cash leg” in AMMs.

Earlier today, the Mantle Network published a blog announcing Ondo Finance’s USD Yield, $USDY as a showcase partner for Real World Assets (RWA). On Twitter, Mantle celebrated unlocking user access to U.S. Treasury yield directly via their Mantle wallets.

According to Mantle, RWAs offer the “greatest potential to bring significant benefits for users.” Hence, serves as a “fantastic choice” for the Mantle Showcase, enabling seamless user experience accompanied by investor protections. Furthermore, Mantle Chief Alchemist Jordi Alexander shared:

$USDY truly is a game changer for the world of DeFi. For the first time ever, users will be able to access U.S. Treasury yield straight from the tap and directly into their wallet, with a similar ease of access as stablecoins like USDT and USDC.

Moreover, Mantle’s announcement noted that secured by a combination of U.S. Treasuries and bank deposits, $USDY tokeholders receive a yield, currently standing at 5% APY, which is backed by the premium assets. Simultaneously, Mantle emphasized their efforts to protect investors and their capital. After analyzing the bankruptcy remoteness process in place, the blog confirmed that “$USDY’s investor protections are the best that exists in tokenized RWAs.”

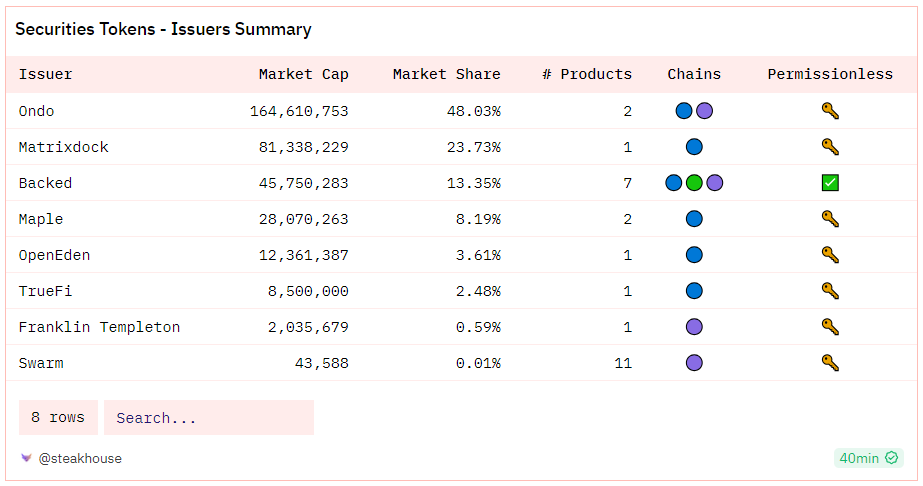

Mantle also acknowledged that Mantle users don’t have to switch to Ondo’s platform to acquire or trade $USDY as it is a tokenized bearer instrument in regards to legal structure. Additionally, Ondo is already a leader in the RWA landscape, holding a 50% market share in tokenized securities, as per data from Dune Analytics.

Mantle also discussed plans to use $USDY as collateral for derivatives and lending protocols, as well as a “cash leg” in an AMM. $USDY will remain pegged to $1, generating new token units to pay interest, thus, simplifying the token for payment use.

Lastly, the Founder & CEO of Ondo, Nathan Allman expressed his enthusiasm for the partnership and commended Mantle’s strategy of providing robust support for a carefully selected portfolio of top-tier protocols and products, aiming to create an integrated on-chain ecosystem.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.