- Santiment’s latest tweet shared that many large-cap alts are currently undervalued.

- XRP, DOGE, MATIC, SHIB, LINK, ADA, and UNI were all determined to be undervalued.

- Meanwhile, the firm classified BTC, ETH, and BNB as overvalued.

In a tweet published yesterday, Santiment, the blockchain intelligence firm, noted that many altcoins are currently undervalued and predicted that they may rally in the next few weeks. According to the post, several of the largest altcoins show signs of undervaluation when combining the “short, mid, and long realized market capitalizations.”

Some of the undervalued altcoins named in Santiment’s tweet included Ripple (XRP), Cardano (ADA), Dogecoin (DOGE), and Polygon (MATIC). Shiba Inu (SHIB), Uniswap (UNI) and Chainlink (LINK) were also determined to be undervalued by the firm’s MVRV Z-Score.

Meanwhile, the two crypto market leaders Bitcoin (BTC) and Ethereum (ETH) were classified as overvalued by Santiment. In addition, Binance’s native token Binance Coin (BNB) joined BTC and ETH and was also labeled as overvalued.

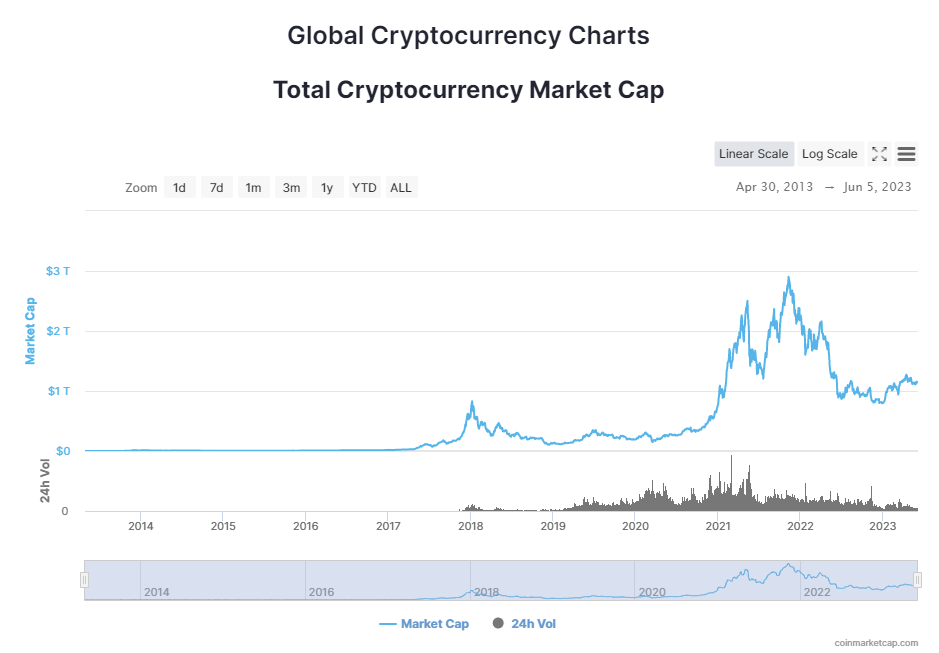

In related news, the global crypto market capitalization dropped 0.81% over the past 24 hours according to CoinMarketCap. As a result, it stood at $1.13 trillion at press time. During this period, both ETH and BTC experienced price drops.

ETH was trading at $1,869.65 after printing a 1.19% loss, while BTC was changing hands at $26,818.80 following its 0.83% drop in price over the past 24 hours. All of the altcoins named in Santiment’s tweet, except for XRP, were also trading in the red at press time.

XRP delivered a standout performance recently and printed a 2.72% gain. This elevated the remittance token’s price up to $0.5374. ADA, DOGE, and MATIC were unable to replicate XRP’s performance and were down 1.14%, 1.29%, and 1.58% respectively. Meanwhile, SHIB, UNI, and LINK saw their prices drop by 1.02%, 2.41%, and 0.96%.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.