- Bull-bear clash wanders KAVA price between $1.17 and $1.27.

- Bearish pressure threatens KAVA’s upward trend.

- Investor sentiment wavers as KAVA’s price fluctuates.

At the start of the day, the bears had the upper hand in the Kava (KAVA) market, successfully lowering the price to a 24-hour low of $1.17 (support). After establishing support, the bulls swept the KAVA bears under the rug, sending the price to a 24-hour high of $1.27.

The bullish momentum was strong, with bulls maintaining market control as of press time, resulting in a 0.24% increase to $1.20.

KAVA’s market capitalization increased by 2.02% to $638,249,499 during the bull-bear battle, while 24-hour trading volume decreased by 9.57% to $178,190,221. This decrease in trading volume suggests that investors are cautious in the market, taking profits in anticipation of a reversal.

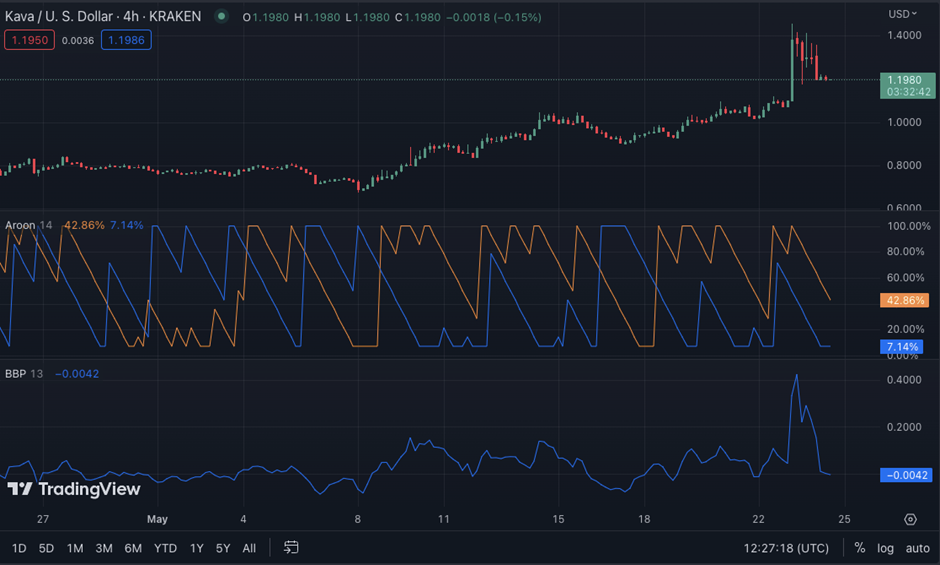

On the KAVA/USD price chart, the Aroon up reading is 50.00%, while the Aroon down reading is 7.14%, indicating that the bulls’ power is greater than the bears’, indicating a potential upward trend soon.

However, because the Aroon level is not above 50, there is still some uncertainty in the market, necessitating stop losses in the event of a pullback.

The bull-bear power has moved into the negative region with a reading of -0.0042, suggesting that the positive sentiment in the KAVA market is fading. This movement could indicate that the bears are gaining control and that a downward trend is coming.

The Relative Strength Index (RSI) rating of 56.78, which is moving downwards below its signal line, indicates that the current trend may be losing steam.

If this RSI trend continues and falls below the “50” level, it could signal a shift in market sentiment from bullish to bearish. This movement indicates that the bulls still have a chance of a rebound because buying momentum is still present in the market.

The Fisher Transform has also moved below its signal line, with a reading of 0.22, adding to the reversal forecast. This movement indicates that the bears are gaining ground and that a possible downtrend is on the horizon.

In conclusion, KAVA’s price faces uncertainty as bearish momentum looms, signaling a potential downtrend. Investors should stay cautious amid the fluctuating market sentiment.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.