- A new Tweet by Glassnode suggested that there could be some volatility in store for BTC’s price.

- The analysis platform pointed out that the drawdowns experienced across BTC’s recent upswing in price action are smaller than in previous years.

- At press time, BTC was trading hands at $26,835.02, following a 0.90% price decrease.

The on-chain analysis platform, Glassnode, recently took to Twitter to share some new insights about the crypto market leader Bitcoin (BTC), and explained that some high volatility is likely on the horizon for the crypto. This conclusion was drawn based on BTC’s price movements over the past week.

According to the post, the 7-day price range that BTC has been consolidating within is the tightest seen in the past three years. Glassnode added that this consolidation for BTC can be compared to those from January of 2023 and July of 2020.

The analysis platform added that it is worth noting that these consolidation phases for BTC preceded large price moves. This may lead traders to assume that there could be some volatility in the cards for BTC in the near future.

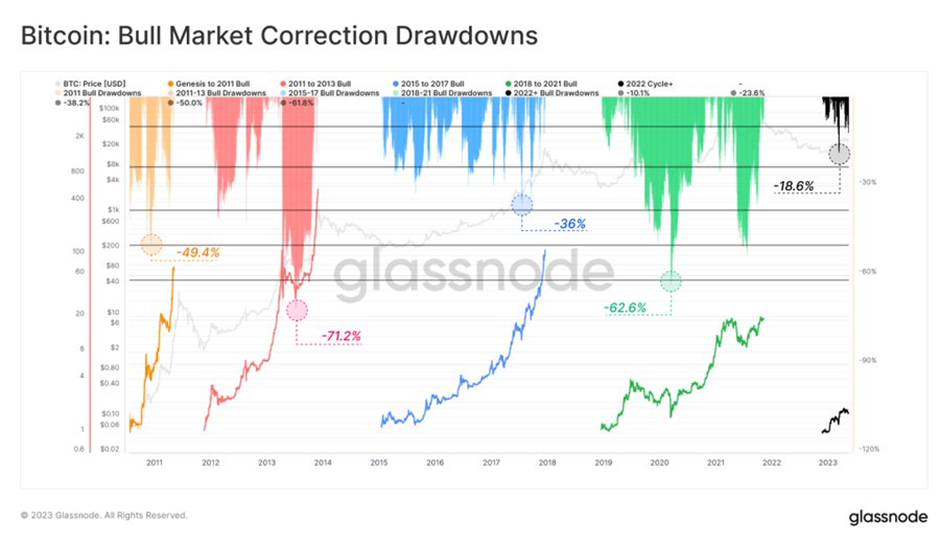

Although things might get rocky for BTC, Glassnode added in a separate Tweet that the magnitude of drawdowns experienced across BTC’s recent upswing in price action remains marginal when compared to other cycles. The bull peak drawdown for 2011-2013 stood at -71.2%.

In addition to this, the 2015-2017 and the 2018-2021 bull peak breakdowns stood at -36% and -62.6% respectively. To put this into perspective, the 2022+ bull peak breakdown stands at only -18.6%, according to Glassnode’s data.

Meanwhile, CoinMarketCap indicated that at press time, BTC was trading hands at $26,835.02 at press time. This followed a 0.90% price drop in BTC’s price over the past 24 hours. BTC was also down by more than 2% over the past week of trading.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.