- Bullish OP price prediction ranges from $2.049 to $2.623.

- OP price might also reach $3.421 this 2023.

- OP’s bearish market price prediction for 2023 is $1.047.

Optimism has played a vital role in Ethereum’s development as an L2 blockchain layer. The OP Mainnet is considered as a fast, stable, and scalable solution built by “Ethereum developers, for Ethereum developers.” This Layer 2 architecture allows users to easily scale their Ethereum app within the network. Moreover, Optimism’s unique features and growth over time have caught the attention of potential investors towards OP.

If you are also interested in Optimism’s native token’s price sentiment and its forecast for the years 2023, 2024, 2025, 2026, 2027, until 2050. Read Coin Edition’s price prediction for OP as we conduct a detailed analysis of this altcoin.

Table of contents

- What is Optimism (OP)?

- Latest Developments on Optimism

- Optimism (OP) Current Market Status

- Optimism (OP) Price Prediction 2023

- Optimism (OP) Price Prediction 2024

- Optimism (OP) Price Prediction 2025

- Optimism (OP) Price Prediction 2026

- Optimism (OP) Price Prediction 2027

- Optimism (OP) Price Prediction 2028

- Optimism (OP) Price Prediction 2029

- Optimism (OP) Price Prediction 2030

- Optimism (OP) Price Prediction 2040

- Optimism (OP) Price Prediction 2050

- Conclusion

- FAQ

- More Crypto Price Predictions:

Optimism (OP) Market Overview

HTTP Request Failed... Error: file_get_contents(https://api.tokenncoin.com/coins/info?name=optimism): Failed to open stream: HTTP request failed! HTTP/1.1 404 Not FoundWhat is Optimism (OP)?

If you’re an Ethereum fan, you’ve probably heard of Optimism (OP), a layer-two blockchain that aids in the scaling of the Ethereum ecosystem. This innovative platform takes advantage of the Ethereum mainnet’s security while using optimistic rollups to record transactions easily.

If you want to get started with Optimism, simply add the chain to your Metamask and bridge tokens such as ETH to the L2. And, if you’re lucky, you might have taken part in Optimism’s highly anticipated airdrop of the OP token on May 31, 2022.

Overall, Optimism is a promising platform that has piqued the interest of many members of the Ethereum community. It’s no surprise that it’s become a significant player in the world of blockchain, given its unique approach to scalability and security.

Optimism is a layer-two blockchain solution that aims to simplify Ethereum scaling by reducing the number of moving parts. The architecture of optimism is based on four core tenets: simplicity, pragmatism, sustainability, and, of course, optimism. It achieves simplicity by employing tried-and-true Ethereum code and infrastructure wherever possible, and by keeping its codebase as simple as possible. Furthermore, pragmatism drives the team’s and users’ real-world needs, with features implemented iteratively.

The Optimism ecosystem is built for long-term sustainability, with no shortcuts to scalability. Optimism uses optimistic rollups and the Ethereum consensus mechanism to scale the network. Blocks are built and executed on the L2 (Optimism), whereas user transactions are batched and sent to the L1 (Ethereum). This guarantees a smooth user experience while ensuring security through the Ethereum consensus mechanism. Transactions are submitted to Ethereum without direct proof of validity and can be challenged for a certain period, after which a transaction is considered final.

Optimism’s simplicity, pragmatism, and sustainability have helped it become one of the most prominent scaling solutions for Ethereum. With over $500 million in TVL and hosting 97 protocols, Optimism has made it easy for users to begin their journey on the platform by bridging tokens like ETH to the L2. Furthermore, on May 31, 2022, Optimism conducted a highly anticipated airdrop of its OP token. The combination of simplicity, pragmatism, and sustainability has made Optimism a powerful solution for scaling Ethereum, with many more exciting developments expected in the future.

Latest Developments on Optimism

On July 25, 2023, Optimism made an announcement claiming that the OP Stack has been built. Announcing on Twitter, the team mentioned that the OP Stack would be the most forkable, modular scaling infrastructure.

The OP stack, explained by Optimism’s team, is the standardized, shared, and open-source development stack that powers Optimism, maintained by the Optimism Collective. It is clear from the documents that OP Stack and the Optimism Collection are recognized as the backbone of Optimism.

Furthermore, the team promised that OP Stack is an evolving concept and would grow along with Optimism’s development. Moreover, in the future, Optimism hopes that this new development will make it easy to plug in and configure different modules as well as maintain the simplicity of deploying new L2 Rollups. These latest updates and promises could be an indication that Optimism would continue to improve its network.

Optimism (OP) Current Market Status

Over the one-day period, OP was fluctuating between its intra-day low of $1.54 and intra-day high of $1.69 after a 6.06% surge. Optimism’s native token, currently priced at $1.69, has a circulating supply of 679,080,066 OP, according to CoinMarketCap.

At the reported time, OP’s market cap is valued at $1,145,119,593 after experiencing a surge of 8.03% in seven days. Observing the one-year chart, OP seems to have recovered and continues to trade within the green zone of the chart. However, OP needs to stay above the $1.05 to maintain its current green zone residence.

Let’s take a deeper look at OP’s price sentiment by utilizing various technical tools.

Optimism (OP) Price Analysis 2023

Ranking at 43, OP’s price could be affected over time caused by macro market conditions and the developments and operations within its network. However, would OP’s price move upwards or downwards? Would OP reach a new All-Time High as the years pass by? Read more to find out.

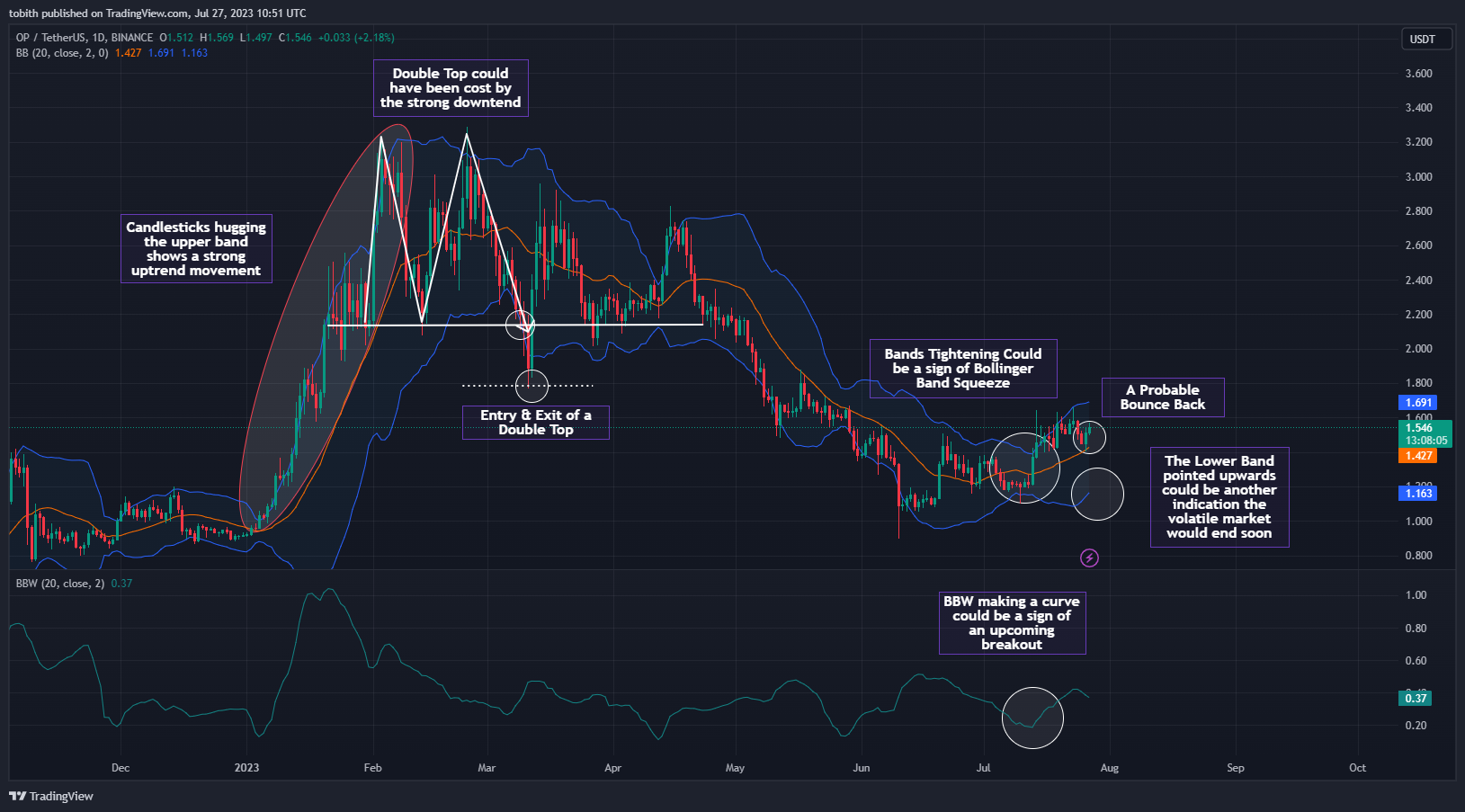

Optimism (OP) Price Analysis – Bollinger Bands

With Bollinger Bands, it is possible to determine and analyze the price movement and the volatility of an asset. Moreover, Bollinger Bands is used based on the empirical law of standard deviation as the upper band is calculated by adding 2 standard deviations from the middle line, and the lower band is calculated by subtracting 2 standard deviations from the middle line. Finally, the empirical law of standard deviation states that 95% of the data sets would be within the two standard deviations.

Looking at the OP/USDT 1-Day Chart, the candlesticks observed a massive surge which could have been caused by traders’ bullish expectations. The uptrend was really strong as the candlesticks continued to hug the upper band while moving in an upward direction. However, after a few days, the downtrend started to regain strength as was observed through the formation of the first peak. Finally, the complete formation of the double-top pattern proved that the downtrend’s strength was really strong.

Currently, after a gradual fall, the candlesticks started to show certain signs of recovery. The first possible sign was through the bands tightened for a short while could have been an indication of a Bollinger squeeze, which break out in the future. However, it may seem that OP’s upward movement could end soon as the lower is pointed upward and the BBW indicates the volatility in the market may end soon. Looking at the BBPCT% indicator a red arrow signal has formed earlier, signaling a potential retracement.

Optimism (OP) Price Analysis – Relative Strength Index (RSI)

Similar to an oscillator, the Relative Strength Index (RSI) is usually valued between 0 and 100. The RSI helps traders and potential investors to understand the current trend of an asset. Ideally, most traders take advantage of RSI’s feature to create a signal on deciding when to buy or sell an asset. When RSI reaches or goes below 30, traders often see this as an ‘oversold region’. Meanwhile, if RSI crosses above or reaches 70, then, there is a high chance that a particular asset is trading in the overbought region. It is expected that whenever an asset reaches any of the extreme zones in the overbought region or the oversold region, there could be a reversal.

Looking at the RSI, the indication is valued at 59.33 and is moving closer to the 60 level, which could be an indication that there is a strong trend. Even though the RSI is below the SMA, the indicator could form a bullish crossover soon. This could be a good entry for a bullish trend. The Bull Bear Power is also positive showing that the bulls currently rule over the kingdom.

The Bull vs Bear Power indicator by DGT further confirms the theory that bulls have higher power compared to bears. Furthermore, the indicator states that the trend’s strength is strong as the ADX is valued at 25. However, it points out that ADX’s strong value may be over soon as it is falling. The buying volume is at 70.83%, while the selling volume is at 29.17%.

Optimism (OP) Price Analysis – Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) indicator helps the trader to easily identify the trend of an asset, and its current sentiment. Basically, MACD shows the difference between two Exponential Moving Average (EMA) and helps traders to see the crossover between them. By default, MACD has a set value of 12-day EMA, 26-EMA, and 9-day EMA. The MACD allows users to easily see the price trend through its line and histogram visualization.

The MACD claims that the short-term bullish period could be over as the green bars could reduce over time. Moreover, the MACD line is moving closer to the signal line. However, the MACD line, after making a fall, is moving exactly parallel to the signal line, indicating that the bull run has not yet ended. It’s best to wait for a few more bars to form to show the exact trend of the price.

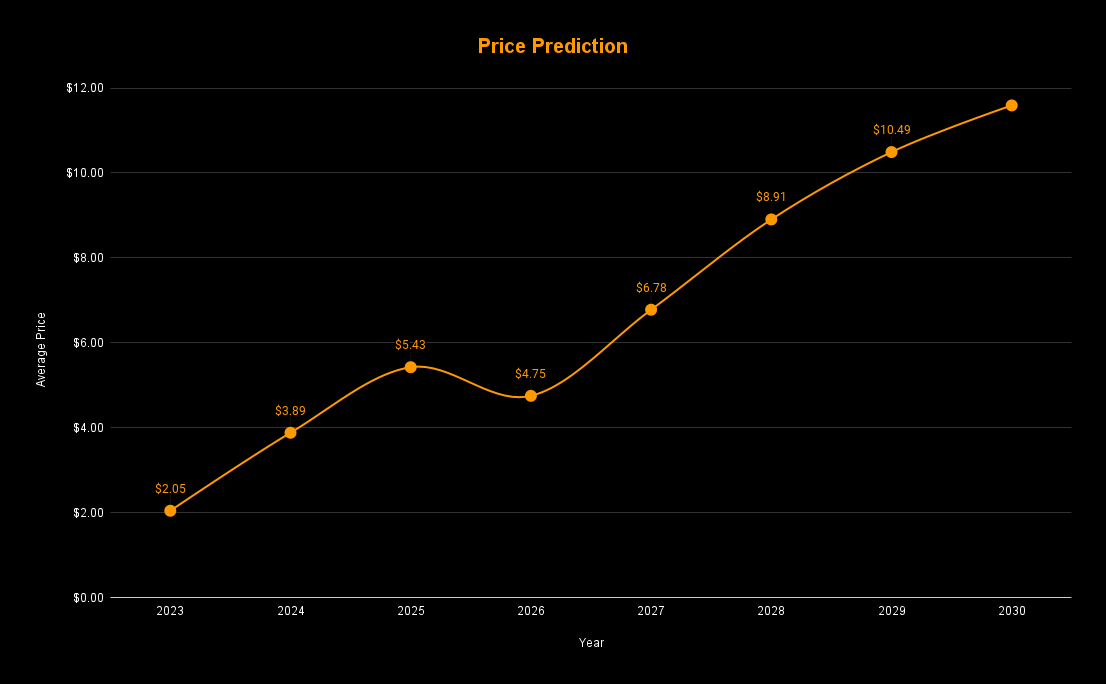

Optimism (OP) Price Prediction 2023 – 2030 Overview

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $1.047 | $2.049 | $3.421 |

| 2024 | $2.967 | $3.885 | $4.71 |

| 2025 | $3.399 | $5.428 | $6.562 |

| 2026 | $3.879 | $4.754 | $5.662 |

| 2027 | $4.977 | $6.781 | $7.349 |

| 2028 | $6.063 | $8.906 | $10.982 |

| 2029 | $8.617 | $10.492 | $13.753 |

| 2030 | $10.043 | $11.590 | $12.764 |

| 2040 | $29.87 | $31.56 | $32.13 |

| 2050 | $56.31 | $57.49 | $58.71 |

Optimism (OP) Price Prediction 2023

Looking at the OP/USDT 1-Day chart, the candlesticks are currently trading between $1.655 and $1.047 level. The current price sentiment of OP was achieved after the gradual downfall observed from the mid-week of April to June. The candlesticks are also currently staying afloat in the 50SMA which could confirm that the bulls still exist in the market. The 50SMA also acts as a support for the OP, hence, there is a chance that if the altcoin’s price falls then it bounces over that line. If the candlesticks cross the $1.655 level, then, the next target level would be at $2.049.

From the Ichimoku Could, it is clear that OP was experiencing a bullish trend as the green cloud is below the candlesticks. However, there are signs all around the cloud which could confirm that a reversal may happen soon. For instance, the lagging span is almost at the same level as the current candlestick showing that OP could move upwards or downwards. However, it will take some time before OP could reach the cloud which could be considered a proper signal for a reversal.

With an optimistic viewpoint and Optimism’s promise of always improving the network, we could expect that OP may experience a bullish price movement as time passes. The bullish price prediction for this year would be around the $2.049 to $2.623 level. However, if the bears make a raid, the bearish prediction for OP could be around $0.989 to $1.047. Finally, on the off chance, OP experiences a massive entry of bulls in the market, the altcoin could experience an extremely bullish trend and reach the $3.421 level

| Bullish Price Prediction | Bearish Price Prediction |

| $2.049 – $2.623 | $0.989 – $1.047 |

Optimism (OP) Price Prediction 2024

Even in 2023, traders speculate on the crypto market’s condition in 2024. The reason behind this is that potential investors and the crypto community are expecting BTC to experience a bull run after its BTC-halving event. Although few forecasted that the BTC-halving won’t trigger a bull run, many still remain optimistic about this highly anticipated event.

Earlier, when BTC experienced a previous bull run, it was observed that the altcoins showed a similar sentiment. Likewise, OP could also experience a bull run in 2024 caused by the BTC halving event. If OP experiences a bullish run, there is a chance that OP could reach the $4 level.

Optimism (OP) Price Prediction 2025

2025 could be the year when the bull market may gradually face a weakness in its strength, however, could still be experiencing an upward trend movement. In this scenario, traders may still expect a bull market with a slight fall in between caused mostly by buyers’ massive entry. Ultimately, 2025 could drive the altcoin’s price upwards and reach $6 as buyers speculate a slight uptrend this year.

Optimism (OP) Price Prediction 2026

Finally, this year, bulls may lose their strength and bears may reign over the market. Traders could expect a gradual fall in digital asset prices, including OP. During this year, few traders may see this as a buying opportunity, expecting profits in the long term period. Hence, OP could experience a downtrend and may reach a maximum level of $5.

Optimism (OP) Price Prediction 2027

After a long bear season, there may be a chance that the altcoin market experience a gradual bull market. Moreover, the optimistic behavior the traders may show this year could be related to the BTC halving event coming next year. Hence, 2027 may see a lot of traders’ activity movement this year as they get ready for the next bull season! For 2027, OP could reach the price of $7 at the end of this year.

Optimism (OP) Price Prediction 2028

The next expected BTC-halving event could, once again, trigger a bullish trend for the crypto market. During this period, traders may see the prices of Bitcoin rise up, which also causes a ripple effect of an uptrend in the altcoin market. Alike many altcoins, OP enthusiasts and traders could observe a similar behavior with this token. While the psychological behavior of investors could be optimistic, this may also support OP’s uptrend for this year, thus, reaching $10 by the end of 2028.

Optimism (OP) Price Prediction 2029

While the previous year experienced a strong bullish trend, 2029 could experience a weak uptrend as prices gradually rise. Even though there might be slight falls caused mostly due to the digital asset falling into the overbought region, the bulls may still have a significant strength compared to the bears. With these expectations, we could assume that OP may still have a weak upwards movement and cross beyond the $13 level.

Optimism (OP) Price Prediction 2030

After the bull’s strength may be drained out, the bears could enter the market, making the crypto market face a downtrend this year. During a bear market, one of the most common traders’ behavior noticed is that they would buy assets during its downfall. We could expect OP’s investors may do the same thing when the altcoin faces a downfall in its prices. Finally, after assuming a bear market for this year, OP may trade a maximum of $12.

Optimism (OP) Price Prediction 2040

After 10 years, there may be a higher chance that OP could have crossed various psychological resistance levels. Expecting that the traders and Optimism’s community might have grown in numbers, the altcoin could definitely have made significantly higher highs over the 10-year span. As a result, with optimistic expectations and evaluating various factors, OP could be trading at the $32 level by the end of 2040.

| Minimum Price | Average Price | Maximum Price |

| $29.87 | $31.56 | $32.13 |

Optimism (OP) Price Prediction 2050

By 2050, we could assume that cryptocurrencies would be recognized as global assets, thus, gaining a significant status in the market. As traders and investors continue to grow and expect the market to show favorable conditions, OP may experience a bullish trend and may create new All-Time Highs during these 10 years. Therefore, we may assume that OP could reach a new level of $58 if it crosses all its expected resistance levels.

| Minimum Price | Average Price | Maximum Price |

| $56.31 | $57.49 | $58.71 |

Conclusion

To conclude, we could expect OP to reach $2.623 in 2023 if it continues to experience a bullish market condition and investors show an optimistic behavior towards the altcoin. Meanwhile, Coin Edition’s price prediction article shows that OP may trade at a new level of $58 in 2050.

FAQ

Optimism is a layer-two blockchain solution that aims to simplify Ethereum scaling by reducing the number of moving parts. The architecture of optimism is based on four core tenets: simplicity, pragmatism, sustainability, and, of course, optimism. It achieves simplicity by employing tried-and-true Ethereum code and infrastructure wherever possible.

OP can be traded on many centralized and decentralized exchanges such as Binance, Coinbase, KuCoin, OKX, Bybit, UniSwap, and WooFi.

Expecting Optimism’s network to grow over the years, traders may have an optimistic view toward OP, which would further drive its price upwards. Therefore, after a few years, we could expect OP to cross its current All-Time High level.

OP achieved its All-Time High of $4.5692 on May 31, 2022.

The maximum supply of the OP is 4,294,967,296.

OP can be stored in a cold wallet, hot wallet, or exchange wallet.

OP is expected to reach $3.42 in 2023.

OP is expected to reach $4 in 2024.

OP is expected to reach $6 in 2025.

OP is expected to reach $5 in 2026.

OP is expected to reach $7 in 2027.

OP is expected to reach $10 in 2028.

OP is expected to reach $13 in 2029.

OP is expected to reach $12 in 2030.

OP is expected to reach $32 in 2040.

OP is expected to reach $58 in 2050.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

More Crypto Price Predictions:

- Verge (XVG) Price Prediction 2023-2030

- Aragon (ANT) Price Prediction 2023-2030

- Worldcoin (WLD) Price Prediction 2023-2030

- Alien Worlds (TLM) Price Prediction 2023-2030

- SingularityNET (AGIX) Price Prediction 2023-2030

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.