- The price of Dogecoin (DOGE) has risen to $0.08962 at press time.

- The meme coin has also strengthened against BTC and ETH.

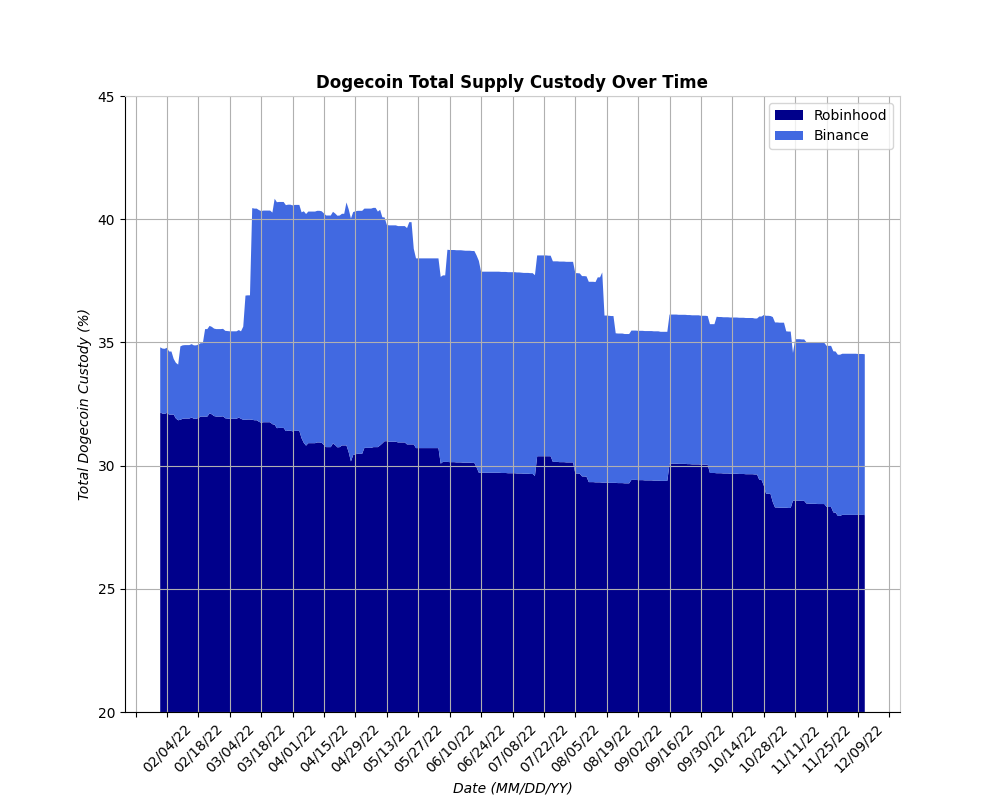

- Robinhood Dogecoin custody percentage has decreased in the last day.

Dogecoin (DOGE) is up 2.05% over the last 24 hours according to the crypto market tracking website, CoinMarketCap. As a result, DOGE is trading at $0.08962 at press time. Despite the 24-hour rise, the price of DOGE is still down 11.27% over the last 7 days.

DOGE has also strengthened against the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH), by 0.93% and 0.41% respectively. The one metric that is down for the meme coin, however, is the daily trading volume, which currently stands at $524,635,486. This is a 10.69% decrease compared to the day prior.

The Twitter user, WhaleGooBrr (@WhaleGooBrr), tweeted today that Robinhood Dogecoin custody percentage, 27.99%, has decreased 0.01% in the last day. On the other hand, Binance Dogecoin custody percentage, 6.53%, has not changed in the last day.

The price of DOGE attempted to break above the 4-hour 9 EMA line but was unable to successfully challenge the level, as bears stepped in to drag the meme coin’s price back down. The current 4-hour candle is slightly in the green which suggests that DOGE’s price will make another attempt at breaking above the 9 EMA line.

There is still bearish momentum present on DOGE’s 4-hour chart as the 9 EMA line is positioned below the 20 EMA line. In addition to this, the 4-hour MACD line is positioned below the MACD signal line. However, the narrowing gap between the MACD and MACD signal line suggests that a bullish reversal may be on the cards.

This bullish thesis will be confirmed when the price of DOGE closes above the 4-hour 9 EMA line.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.