- Worse-than-expected CPI data resulted in severe volatility for BTC.

- Toni Ghinea believes that BTC will enter into a mini-bull rally.

- BTC’s price is currently trading below $20 after a slight 24-hour drop.

Following the release of worse-than-expected CPI data, the price of the crypto market leader, Bitcoin (BTC), experienced severe volatility on 13 October. This has left prominent crypto strategists and analysts unable to confidently forecast what is in store for BTC’s price.

Some analysts are bullish on the crypto king and believe that BTC will enter into a short-term bullish rally again. One such analyst is Toni Ghinea, who has indicated that Bitcoin is ready to initiate a mini bull run before bottoming towards the end of this year.

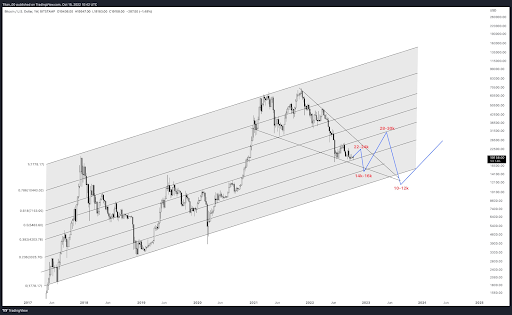

According to Ghinea’s recent tweet, BTC is forming a falling triangle pattern. This indicates a resistance level at a price range of $22k-$24k. Bitcoin is projected to reach this price range before the end of this month before starting its bearish journey.

The analyst added that this bullish trend will be short-lived as BTC’s price is expected to drop significantly to a price zone of $14k-$16k by the end of December. Thereafter, he believes that it will enter into a price recovery session in the beginning of 2023 that could take its price up to as high as $28k – $30k.

Approaching June 2023, Ghinea predicts that BTC may once again experience a significant price drop – resulting in it reaching the range between $10k-$12k. However, he is then bullish for the remainder of next year, sharing that BTC will have a smooth bull run which will stretch to 2024 and will elevate the coin’s price to $26.5k.

Currently, CoinMarketCap shows that BTC is trading at $19,131.09 after a slight 0.12% drop over the last 24 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.