- Sitharaman pointed out that G-20 or the World Bank, are assessing crypto assets.

- She said that no single country can effectively handle or regulate crypto assets.

- G20 countries have concerns related to misuse of cryptocurrencies.

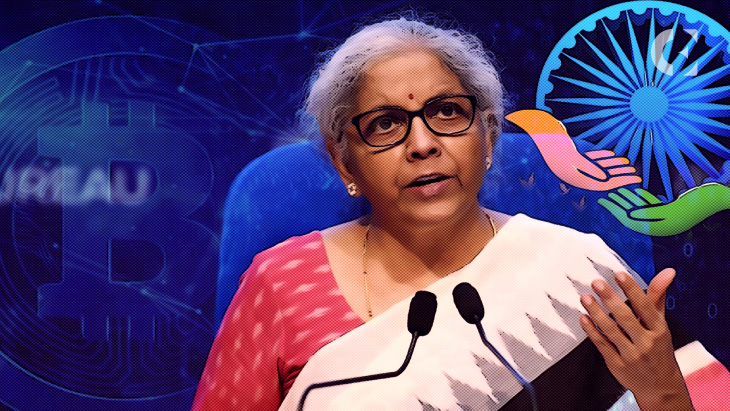

On Saturday, Finance Minister Nirmala Sitharaman announced that India will be developing a standard framework for cryptocurrency during its G20 presidency in 2023 as she emphasized on how every country wants the technology to thrive but not be misused.

Before attending the annual meetings of the International Monetary Fund and the World Bank, Sitharaman addressed a group of Indian reporters and said:

That (crypto) will also be part of India’s thing (agenda during G-20 presidency)

The minister pointed out that several institutions associated with the organisations like G-20 or the World Bank, are undertaking their own assessment and studies regarding cryptocurrencies or crypto assets.

She added that India would certainly want to study and combine all this to bring it on for G-20 members to discuss it and design a framework or SOP, so that countries can have a technology driven regulatory framework globally.

Sitharaman stressed upon the point that no single country can effectively handle or regulate crypto assets in any way. She added that this technology must survive and must also be in a position for the FinTech and other sectors to benefit from it.

Sitharaman asked if countries understand this kind of money trade and are in a position to establish a framework.

The minister elaborated that several members of the G20 have concerns like money laundering, drug misuse accompanied by the use of cryptocurrencies. Thus, there is a common understanding between the countries for the ‘pressing need’ for some kind of regulation.

Recently RBI disclosed its plans to launch a retail CBDC and a wholesale CBDC to simplify interbanking transactions. However, the report didn’t go well with the country’s crypto community.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.