- Ripple CTO argues tokens can be securities if they include post-sale obligations.

- Watchdog Capital CEO said certain futures contracts could transition from securities to commodities.

- A lawyer emphasizes the constitutional requirement for such a transition.

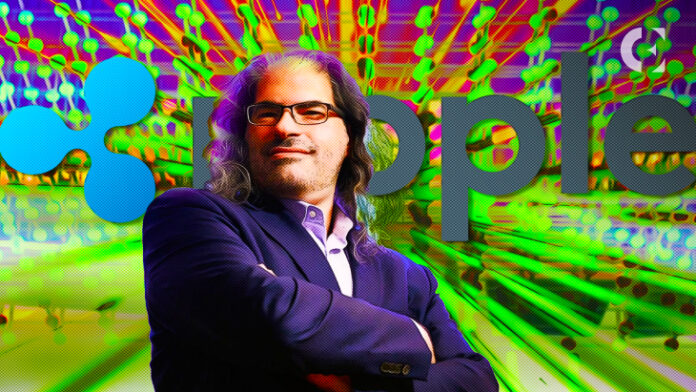

Recently, Ripple’s Chief Technology Officer (CTO), David Schwartz, joined a fiery debate within the crypto community regarding the classification of digital tokens as securities, challenging the notion that securities can transform into non-securities over time.

Schwartz shared his perspective on Twitter, highlighting the distinction between items that inherently fall under the securities category, such as stocks, and those that can be sold using investment contracts, like orange groves.

According to Schwartz, for a digital token to be considered a security, it must include post-sale obligations like redemption or profit sharing. He argued that without these legal obligations, it becomes difficult to classify tokens as securities.

Bruce Fenton, CEO of Watchdog Capital, argued that specific futures contracts initially function as securities but eventually transition into commodities. Fenton cited examples from the oil and gas industry, emphasizing that if something no longer meets the definition of security under the 33 Act, it should not be classified as one merely because it used to be.

Lawyer Boot Knocker added a constitutional perspective to the debate, emphasizing that only Congress can create or modify laws. Knocker argued that the transformation could only be recognized legally with explicit legislation or judicial opinions allowing securities to morph into non-securities.

The ongoing debate raises critical questions about the evolving nature of token offerings and the need for clear regulatory frameworks. While some industry experts believe that tokens can transition from securities to non-securities, others assert that such a transformation requires explicit legal provisions or judicial interpretations.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.