- Lido Finance’s staking deposits grew by 13% after Coinbase lost a major part of its share.

- LDO’s momentum remained bullish, however, a sell candle at $2 has pushed down the price.

- While the project’s revenue and TVL increased, LDO might retrace based on its volatility.

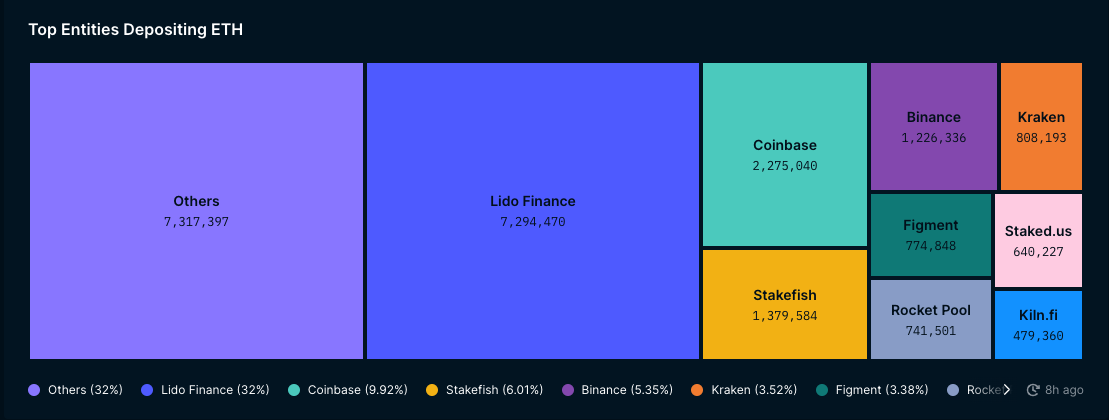

Decentralized staking protocol Lido Finance (LDO) witnessed a significant increase in its staking share as centralized exchanges face mounting challenges. According to data shared by a pseudonymous crypto analyst Emperor Osmo, Lido staking market share increased by 13%.

Lido Takes the Lead

This surge in Lido Finance’s staking share came at a time when centralized exchanges are grappling with user exit demands and regulatory pressure. Top of the list was Coinbase which tops the centralized entity cohort offering staking services to the community.

The decrease in staking on the centralized exchange means that validators consider decentralized platforms like Lido as a safer and alternative avenue to participate in staking.

Since Ethereum’s (ETH) Shapella upgrade which activated staked Ether (stETH) withdrawals, Lido has established itself as the go-to pool for staking. Although other projects like Rocket Pool (RPL) have also grabbed a significant share of stETH deposits, none was close to Lido’s percentage.

At press time, the total ETH staked deposits on Lido was over 7 million. As a result, Lido Finance’s share of deposits grew to 32%, according to Nansen data.

Meanwhile, the LDO token has increased by 19.18% in the last seven days following an all-round market recovery. But as of this writing, the token volume had decreased.

LDO Remains Bullish

In terms of the price action, the Moving Average Convergence Divergence (MACD) remained positive. When this indicator is above the zero mid-point, it suggests the short-term Moving Average (MA) is above the long-term Moving Average (MA).

This means that LDO is likely to continue its upward momentum. In turn, traders may want to refrain from opening short positions for the time being.

LDO had the tendency to halt its upward trajectory with a sell candle appearing around $2.02. Also, the price at press time touched the upper part of the Bollinger Band (BB). With increasing volatility, this could infer an overbought point. Therefore, a slight retracement might not be far away.

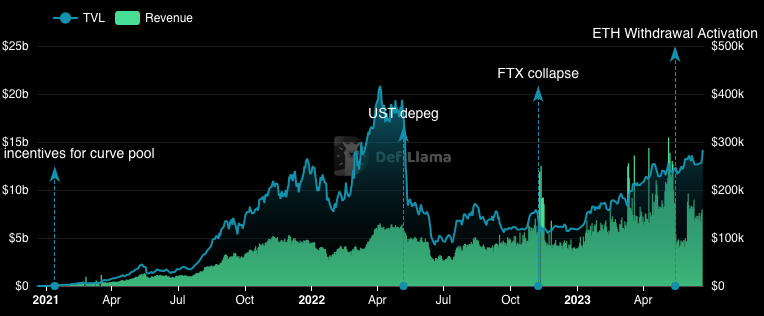

In addition to its price increase and staking share, Lido’s revenue crossed $1 million in the last seven days. This was because of the 11.93% hike in its Total Value Locked (TVL).

Typically, an increase in the TVL suggests that Lido has become more trustworthy and investors are willing to lock more assets in the DeFi protocol. If it was the other way around, then it would have inferred skepticism on the investor side.

In conclusion, Lido Finance’s overall ecosystem seems healthy. But on the technical side, gradual sell pressure could prompt a margin decrease in LDO’s value.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.