- Santiment provided takes on the recent market condition.

- LDO is in the process of building the top and in the final stage of divergence.

- MVRV is below the dangerous ‘overbought’ level for a number of assets.

A report on the current status of Ethereum (ETH), Lido DAO Token (LDO), Marker (MKR), and SushiSwap (SUSHI) was just compiled by a company that provides analytics for the cryptocurrency markets, Santiment.

According to the firm, an investor may choose to put their money into a variety of assets, some of which may be sending out very optimistic signals while others seem to be much more negative.

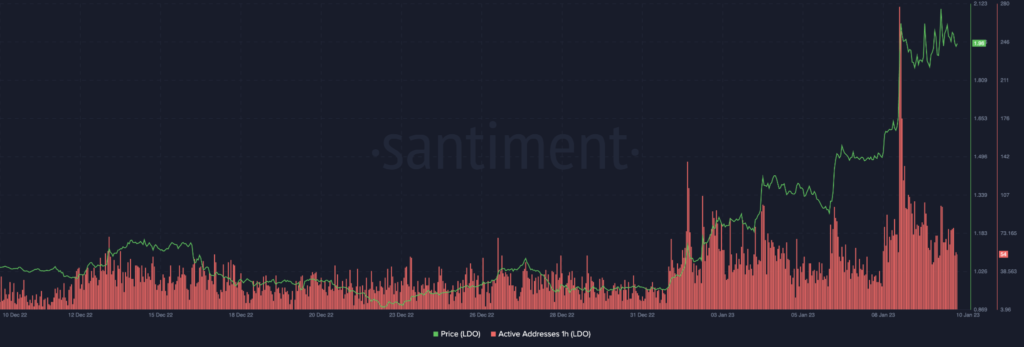

For instance, some patterns are emerging now on the liquid staking protocol, Lido DAO. According to the data, the token is in the process of building the top and in the final stage of divergence. The divergence is however on the network activity and in network growth.

Active addresses and network growth are both slowing down despite LIDO’s pricing continuing to be at the top. According to Santiment, this is often a sign that indicates an imminent bearish retracement.

Santiment adds: “Building a top can take time. You never know the timing of the top building. No one knows.”

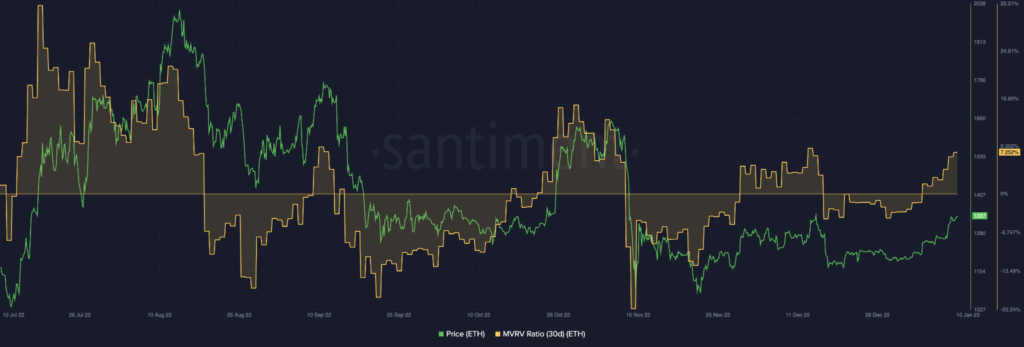

On the bullish end, MVRV is below the dangerous ‘overbought’ level for a number of assets following Santiment`s analysis. Ethereum is currently trading at around $1,334, which is significantly below the MVRV level of 7.25% traditionally associated with an ‘overbought’ condition.

On the other hand, the Maker token (MKR) is also currently trending below an “overbought” threshold, indicating that the current market sentiment is likely to turn bullish.

Ultimately, buying and selling decisions should be based on well-researched data, rather than simply relying on the MVRV ratio alone, according to experts.

For SushiSwap (SUSHI), the MVRV ratio currently stands at 10.20, significantly lower than the overbought threshold.

This suggests that the current market sentiment is bullish and that investors are feeling confident in the potential of SUSHI.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.